Airwallex CEO Jack Zhang Says He's Going To Pass on Stablecoins After Raising at a 6.2B valuation 🇸🇬

We're also covering Revolut's crypto derivatives push 🇬🇧, Klarna CEO's OpenAI windfall 🇸🇪, a fintech VC eyeing OnlyFans 🇺🇸, Deel trying to clean up 🇮🇱 & Tom Brady backing an AI-first bank 🇺🇸

This humble newsletter broke passed the 3,000 subscribers mark last week thanks to you!

If you appreciate my newsletter, keep sharing it with colleagues and business contacts (but only if you think they would enjoy it)!

I have more time right now, so I started to do a fintech battle infographic that you can find at the end of the newsletter. This week, I’m comparing Airwallex to Wise since Airwallex raised a big round (our first story).

I’m constantly trying to make this newsletter better, so feel free to reply to this email with your feedback or suggestions. If there is an infographic you would like to see next week, or some type of stories you think I’m overlooking, just hit the reply button!

🇸🇬 Airwallex CEO Jack Zhang Says He's Going To Pass on Stablecoins After Raising at a $6.2B Valuation

Airwallex has raised $150 million at a $6.2 billion valuation. But CEO Jack Zhang (pictured above) is going against the trend as major banks and fintechs embrace stablecoins for cross-border payments. The Singapore-based fintech, which combines Wise-style international transfers with Brex-like spend management and corporate cards, recently said he’s not jumping into the stablecoin bandwagon.

"Ultimately, if you are regulated in one jurisdiction and you wanted to send a stablecoin to another jurisdiction, where you are not regulated, I think there's still a lot of regulatory risk doing that," Zhang told Bloomberg. "That's why we have hesitation launching a stable product. We'd rather get more regulatory clarity before we go deep into it."

The stance marks a clear divergence from Stripe, which earlier this month started offering stablecoins accounts for businesses. Airwallex's platform, which serves 150,000 businesses and reached $720 million in annualized revenue, already supports traditional currencies including US dollars, Australian dollars, Singapore dollars, British pounds and euros.

Instead of betting on stablecoins, Airwallex is channeling its fresh capital from investors including Square Peg, DST Global, Salesforce Ventures and Visa Ventures into building its own large language model. "We need to build an application layer, AI layer or the ecosystem layer on top of our infrastructure to become a full, vertically integrated global business bank," Zhang said.

Source: Bloomberg & Global Fintech Insider

🇬🇧 Revolut to Launch Crypto Derivatives Business as Crypto Drive Double-Digit Profits

Revolut plans to launch crypto derivatives trading as the UK neobank looks to scale its already successful crypto business. "Next up: Building a crypto derivatives business, launching services for institutional clients, doubling down on global expansion," wrote on LinkedIn Emil Urmanshin (pictured above), Director of Crypto & New Bets at Revolut. The move into crypto derivatives would position Revolut to compete with major crypto exchanges, including Binance and Coinbase, which recently bought crypto derivatives exchange Deribit for $2.9B. Urmanshin expects each of the new initiatives he mentioned to at least double the crypto division's current revenue, which he claims already contributes double-digit percentage points to Revolut's P&L. The expansion would build on Revolut X, the company's crypto platform offering 210 cryptocurrencies that already operates across all 30 European Economic Area countries.

Source: Global Fintech Insider

🇸🇪 Klarna CEO Sebastian Siemiatkowski Increases His Stake in OpenAI

Sebastian Siemiatkowski's Flat Capital will receive more OpenAI shares after the AI giant announced its all-stocks $6.4 billion acquisition of Jony Ive's hardware startup io. "Excited that @FlatCapital was an investor in io and that we will now receive even more shares in openAI at a hefty return for an investment we did some 6 months ago. Even more excited what openAIs push into hardware will look like together with Jony!" the Klarna CEO wrote on X. The acquisition brings former Apple design chief Jony Ive as a consultant to Sam Altman’s OpenAI as the company aims to develop AI-powered alternatives to smartphones. Flat Capital, the investment firm founded by Siemiatkowski and his wife Nina, has been actively investing in AI startups including OpenAI, Perplexity and Lovablee. The OpenAI windfall provides a bright spot for Siemiatkowski as Klarna, the BNPL company he leads, recently reported its Q1 losses more than doubled to $99 million.

Source: Global Fintech Insider

🇨🇦 Two-Time Failed YC Founder Raises $79M for Canadian Corporate Card Startup Keep

Toronto-based Keep, a corporate card and spend management platform, has raised a total of 79 million USD ($108 million CAD) to scale its platform for Canadian SMBs. CEO Oliver Takach (pictured above), whi launched not one, but two YC-backed start-ups that failed, co-founded Keep with CTO Helson Taveras in 2021.

Takach wrote in a LinkedIn post that "thousands of Canadian businesses moving billions of dollars use Keep to manage local and global payments and FX, issue cards, control expenses, access credit, and unlock rewards." More precisely, Keep have attracted 3,000 Canadians customers since 2021, and reached $14 million in annualized revenue in 2024.

Keep enters an increasingly crowded Canadian market with Airwallex recently entering Canada, Venn raising $15 million in February, and Float Financial raising $48.5 million in January. However, Cambrian GP Rex Salisbury, an early investor in Keep, wrote on Linkedin that Canada is trailing the US when it comes to business banking : “In the US, business banking has improved dramatically in the last 10 years thanks to new entrants like Mercury, Brex, Ramp, BlueVine and others, he wrote. In Canada that revolution has just started and has a long way to run.”

The $79 million round was composed of $24 million in equity led by Tribe Capital, $52 million in credit facility from Treville, and $3 million in venture debt from SVB. Execs from Stripe, Ramp, Chime, and Qonto also invested in the round.

Source: Global Fintech Insider & TechCrunch

🇺🇸 Former Facebook VP of Product and Fintech VC Sam Lessin Wants to Buy OnlyFans

Former Facebook VP product Sam Lessin, a college buddy of Mark Zuckerberg, is considering a bid to acquire OnlyFans, announcing on X that he's seeking partners for what he calls "one of the best businesses on the internet and cheap!" The Slow Ventures general partner, whose firm has invested in notable fintech companies including Solana, Venmo, and Robinhood, outlined his investment thesis on X : "killer killer business financially today" while others "massively over-estimate AI business model erosion" and OnlyFans has "great angle on human in the loop AI business." Lessin's interest comes as OnlyFans owner Leonid Radvinsky quietly seeks to sell the platform that generated $485 million in profits last year, though adult content businesses typically trade at modest 3-5x EBITDA multiples, valuing OnlyFans between $1.46-$2.42 billion. OnlyFans operates similarly to Substack but for adult content, with a key advantage being payment arbitrage since processors typically charge up to 10% for adult transactions while OnlyFans negotiated better rates and charges creators 20%. Given the massive price tag, it remains unclear how serious Lessin's bid truly is.

Source: Global Fintech Insider

🇨🇦🇧🇷🇸🇬 Interest in Non-USD Stablecoins Grows as Canadian, Brazilian & Singaporean Projects Take Off

While the vast majority of the top stablecoins remain USD-backed, with some Euro and gold-backed ones here and there, investors are showing increased interest in stablecoins pegged to other national currencies.

Toronto-based Stablecorp raised $1.8 million USD ($2.5 million CAD) from Coinbase Ventures, Side Door Ventures, and others to enhance QCAD, its stablecoin pegged to the Canadian dollar. “The time to digitize all this commerce was yesterday and we’re thrilled to be working with a global leader like Coinbase to make this happen”, said Stablecorp CEO Alex McDougall. The funding will help build the necessary rails for CAD-denominated stablecoin use cases including cross-border payments and remittances.

In Brazil, BRLA Digital rebranded to Avenia after closing a 2.1 million USD (R$12 million) seed round co-led by Big Bets and Fluent Ventures. The company, which issues the Brazilian real-pegged BRLA Token, has already processed over 530 million USD (R$3 billion) in operations and reached breakeven in less than 12 months. "More than 90% of our revenue today comes from the cross-border payments platform," said Matheus Moura, co-founder and CEO of Avenia, as the company plans expansion across Latin America.

Meanwhile in Singapore, StraitsX launched its Singapore dollar-backed stablecoin XSGD on the XRP Ledger, marking the first phase of a collaboration with Ripple. The Monetary Authority of Singapore-licensed stablecoin is fully backed 1:1 by reserves held with DBS Bank and Standard Chartered. "As digital money becomes embedded in the global economy, regulated stablecoins like XSGD will serve as the foundation for borderless, real-time, and compliant-ready financial services," said Liu Tianwei, StraitsX co-founder.

Sources: BetaKit, Portal do Bitcoin, The Asset & Global Fintech Insider

🇺🇸 Lead Bank CEO Jackie Reses Calls Debanking Claims 'Fiction'

Lead Bank CEO Jackie Reses (left) sparked controversy by dismissing debanking concerns as largely fictional during the Breaking the Bank fintech summit in San Francisco, stating "I think it didn't exist. I think it was a fiction, to some extent." Debanking refers to banks unilaterally closing accounts, which became a contentious political issue after conservatives alleged the Biden administration pressured banks to drop crypto and politically sensitive clients. Her comments drew immediate pushback from other fintech leaders, including AngelList CEO Avlok Kohli who countered "It was absolutely real," Bridge co-founder Zach Abrams who described going through five banking partners with some "just ghosting us," and Plaid co-founder William Hockey, who now runs developer-focused bank Column, offering a more nuanced view that regulators created "artificially high" barriers for crypto businesses.

Source: American Banker

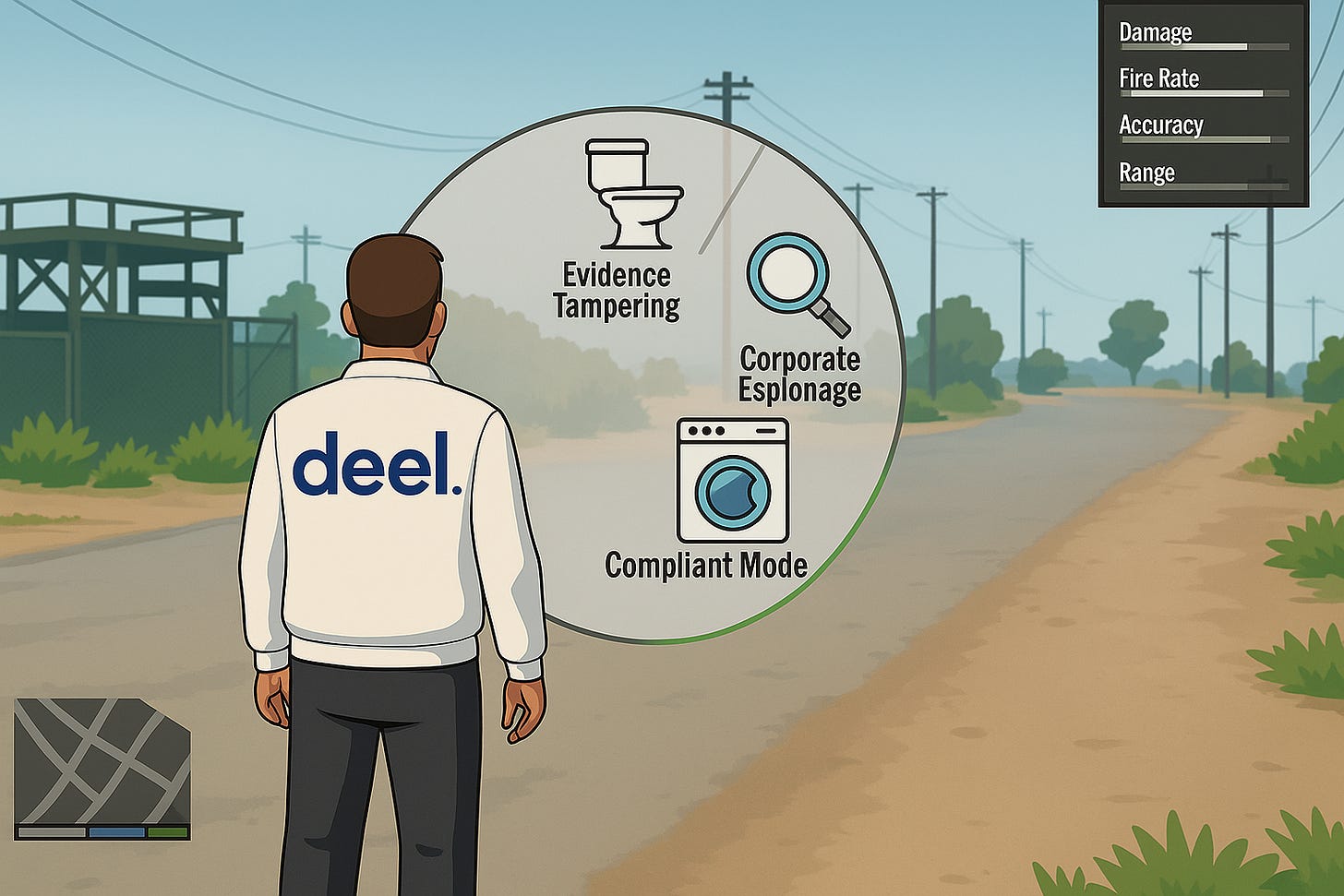

🇮🇱 Deel Is Trying to Clean Up Its Act by Severing Its Ties With a Sanctioned Russian Bank

The Deel-Rippling corporate espionage drama is the fintech story that keeps on giving… Israeli HR platform Deel now scrambling to clean up unusual business practices, according to The Information. The $12 billion company has been operating with its registered corporate address listed as a luxury two-bedroom apartment on the 15th floor of a San Francisco residential tower, which it now says it will change, and has stopped allowing customers to sign up Russia-based contractors after revelations its Russian subsidiary listed an account with Russia-based sanctioned T-Bank. The saga started with the revelation that Deel was paying Ripppling employee Keith O'Brien $6,000 per month to get confidential information about his employer. The legal battle has escalated beyond civil courts, with Rippling reporting Deel's alleged conduct to U.S. federal authorities and claiming there's "an active criminal investigation". Globalization Partners, a $4.2B Boston-based competitor, has also reported that Deel spied on them to US authorities.

Source: The Information, Axios & Global Fintech Insider

🇺🇸 Mercury CEO Is Allegedly Playing Fast and Loose With Banking Compliance

Mercury CEO Immad Akhund (pictured above) is treating compliance as an obstacle to overcome rather than a requirement, according to an investigation by

from Fintech Business Weekly. Mikula claims that the neobank for businesses onboarded risky clients like Moscow-incubated Flipper Devices (which has alleged ties to sanctioned Russian entities), and personally sought exceptions to bring OnlyFans onto the platform despite its own policy banning adult content provider. Mercury's lax practices contributed to enforcement actions against all three of its banking partners (Choice Bank, Evolve Bank, and Patriot Bank), forcing the company to close thousands of accounts from high-risk jurisdictions including Ukraine, Nigeria, and Pakistan. The company's willingness to prioritize "frictionless" customer experience over compliance included shipping payment cards anywhere regardless of listed addresses, allowing a transaction in sanctioned Cuba, and building its own transaction monitoring system after deactivating a commercial vendor that generated "too many alerts."Source: Fintech Business Weekly

🇸🇪 🇦🇺 Sweden and Australia To Force Stores to Keep Accepting Cash

Sweden's central bank is pushing for mandatory cash acceptance at essential businesses despite being one of the world's most cashless countries, with only one in 10 payments made with physical money in the country. Riksbank governor Erik Thedéen argued that "people should always be able to pay for food, healthcare and medicines both digitally and with cash," citing concerns about power outages, cyber attacks, and network disruptions that can render digital payments useless. The central bank wants legislation requiring supermarkets and health centers to accept cash, forcing major banks to provide overnight deposit and petty cash services to businesses, and mandating that banks allow individuals to deposit banknotes into accounts. Australia is following a similar path, with the government working on legislation to force essential services to accept cash payments while providing exemptions for small businesses.

Source: Yahoo Australia

🇺🇸 Monarch Hits $850M Valuation After Capitalizing on Mint Shutdown

Personal finance startup Monarch has raised $75 million in Series B funding at an $850 million valuation, capitalizing on the surge in users after Intuit shut down budgeting pioneer Mint in early 2024. The San Francisco-based budgeting app, founded in 2018 by former Mint product manager Val Agostino (right), saw its subscriber base surge by 20 times in the year after Intuit announced Mint's closure as users sought alternatives. Unlike the free Mint model that relied on advertising from credit card issuers and data sales, Monarch operates on a subscription basis to provide an all-in-one mobile app for tracking spending, investments, and money goals without compromising user privacy. The funding round was led by Forerunner Ventures and FPV Ventures

Source: CNBC

🇺🇸 Circle Co-Founder Sean Neville Raises $18M From a16z crypto & Tom Brady to Build AI-Native Bank

Circle co-founder Sean Neville has raised $18 million in seed funding for Catena Labs to build an artificial intelligence-native bank designed to serve the emerging AI economy. Neville, who co-founded Circle, the company behind the world's largest stablecoin USDC that is preparing for a $5 billion IPO, envisions a future where AI agents conduct most economic transactions, requiring "a completely new financial infrastructure designed from the ground up to accommodate this reality" rather than traditional brick-and-mortar credit card models adapted for e-commerce. The startup has released an open-source agent commerce kit that outlines protocols for "agentic commerce" and includes "know your agent" identity mechanisms to verify AI agents acting on behalf of companies. The funding round was led by a16z crypto with participation from Breyer Capital, Circle Ventures, Coinbase Ventures, and retired american football player Tom Brady.

Source: Banking Dive

🇺🇸 Gilgamesh Ventures Raises $20M Fund to Invest in Fintechs That Leverage AI to Scale

Gilgamesh Ventures, the fintech VC firm co-founded by fintech podcaster Miguel Armaza (pictured above) and Andrew Endicott, has raised a $20 million Fund II. Known for his Fintech Leaders podcast where he has interviewed various fintech execs such as Credit Karma co-founder Ryan Graciano, and Wealthfront CEO David Fortunato, Armaza has invested in 44 startups across 10 global markets, with a focus on Latin America. Originally from Bolivia, the long-time New Yorker recently became a US citizen.

Gilgamesh Ventures plans to focus on companies that leverage AI-native approaches to scale more efficiently, with Armaza noting that about a third of Fund II startups have grown from zero to more than $5 million ARR within 18 months "fueled by AI tooling and a mentality of austerity." The firm specializes in early-stage fintech startups and typically co-invests alongside larger funds rather than leading rounds, with plans to increase check sizes to $400,000-$600,000 from the previous $150,000-$250,000 range. Notable portfolio companies include business identity verification startup Baselayer, Mexican auto POS provider Nexu, and Brazilian restaurant procurement platform Cayena.

Source: Axios & Global Fintech Insider

Fintech Battle of the Week: Airwallex vs Wise

Airwallex represents a unique hybrid in fintech, combining Stripe's API-first payment infrastructure with Brex-style spend management and Wise's cross-border capabilities. With $720M in revenue from 150,000 business customers, it faces off against Wise's broader approach serving 12.8 million customers (including 630,000 businesses) with $1.42B in revenue. Despite Airwallex's comprehensive B2B platform, Wise's mass-market efficiency has driven it to a £11 billion ($14.9B) public valuation versus Airwallex's $6.2B private valuation.

Upcoming Fintech Events

🇺🇸 Stablecon will take place in New York on May 29, 2025 (1,295 USD), with speakers such as Cuy Sheffield, Head of Crypto at Visa and Edward Woodford, CEO & co-founder of Zero Hash.

🇳🇱 Money20/20 Europe will be held in Amsterdam on June 3-5, 2025 (3,395 USD), with speakers such as Steven van Rijswijk, CEO of ING & Yoni Assia, CEO of eToro.

🇬🇧 The Future of FinTech Conference 2025 will be held in London on June 12, 2025 (527 USD), with speakers such as Kirsty Rutter, Strategic Investment Director at Lloyds Banking Group & Chris Waring, Head of Digital Customer Journeys at NatWest.

🇮🇱 Money Tel Aviv will be held in Tel Aviv on June 18-19, 2025 ($83), with speakers such as Ido Shamash, head of payments at Wix & Ran Cohen, CEO at BridgerPay.

🇺🇸 Fintech South will be held in Atlanta on August 19-20,2025 ($600), with speakers such as Joshua Silver, CEO of Rainforest & Kristin Slink, fintech strategist at FIS.

🇨🇦 The Customer Experience for Financial Services Summit will be held in Toronto on September 18–19, 2025 ($995), with speakers such as Amit Mondal, VP & Head of Digital Analytics & Experimentation at Amex & Angela Crapsi, AVP of Operations at Flexiti/Questrade.

Who Am I?

Hi, my name is Julien Brault.

From 2017 to 2024, I was the CEO of Hardbacon, a fintech I co-founded, which reached 400,000 unique visitors at its peak.

A Google update ultimately sealed the company’s faith and I started this newsletter to keep myself busy in the aftermath.

Why share this?

Because my goal is to use my experience as an economic journalist, fintech entrepreneur and product manager to present the most essential fintech news from around the world through the eyes of an insider.

If you like what I do, feel free to share this newsletter and follow me on Linkedin, YouTube, TikTok, Instagram & X.

P.-S. : Once you refer a new subscriber to the newsletter using your unique share link, you'll receive a personalized social media shout-out from me to promote your work or professional profile. Just write to me at jrbrault@icloud.com once your referral is confirmed on our leaderboard and include your social media account(s) URL(s) and who you are.