A16Z’s David Haber Is Bullish on Plaid Despite US Open Banking Being Dead & Buried 🇺🇸

We're also covering N26 CEO exit 🇩🇪, Malaysia's new AI bank 🇲🇾, China's stablecoin pivot 🇨🇳, Brex planting flag in Brazil 🇧🇷, Turkish "Robinhood" raising $80M 🇹🇷 & more

🇺🇸 A16Z’s David Haber Is Bullish on Plaid Despite US Open Banking Being Deal & Buried

Venture Capital firm Andreessen Horowitz (a16z) general partner David Haber (pictured above) says he remains confident Plaid’s long-term value. “For the long tail of community regional banks, Plaid plays an even more important role in becoming this sort of data utility and enabling this ecosystem of companies to build interesting applications on top of those products,” Haber told Bloomberg in an interview shared on his LinkedIn.

This vote of confidence coincides with Visa closing its US open banking unit that was competing with Plaid, which allows many fintech applications to access their users’ banking data. This move by Visa follows US banks including JPMorgan and PNC Financial’s push to charge fintech firms for customer data access in response to the rollback of previously adopted open banking regulations.

While banks argue data restrictions are for consumer safety, Haber disagrees, saying infrastructure costs have plummeted and the underlying data account details and transaction history are not technology-intensive.

This comes after over 80 fintech CEOs and leaders signed an open letter urging US President Donald Trump to block new “account access” fees planned by America’s biggest banks.

Source: Global Fintech Insider

🇩🇪 Pressured by Investors, N26 Co-founder Stalf Cedes Co-CEO Role

Bowing to investor pressure amid fresh regulatory scrutiny, N26 co-founder Valentin Stalf (left) has step down from his Co-CEO position and transitioned to the neobank's Supervisory Board. His co-founder and co-CEO, Maximilian Tayenthal (right) remain in his leadership role, which Stalf confirmed in a LinkedIn post, announcing his move to the new role. While Tayenthal remain at the helm of N26 for now, a source told the Financial Times that “Tayenthal was likely to step down from his operational role at a later stage”. Meanwhile, the neobank’s chair, Marcus Mosen, should be appointed as interim co-CEO according to the paper.

Recently, Germany’s financial regulator BaFin, flagged weaknesses in N26’s internal controls and even proposed new sanctions. Stalf’s shift also comes amid reports that he and Tayenthal may waive special voting rights that grant them veto power over certain decisions. Together, the founders hold about 20% of the company.

Sources: Global Fintech Insider & Financial Times

🇲🇾 Ryt Bank to Debut With ChatGPT-Like Assistant, Calling It the World’s First AI Bank

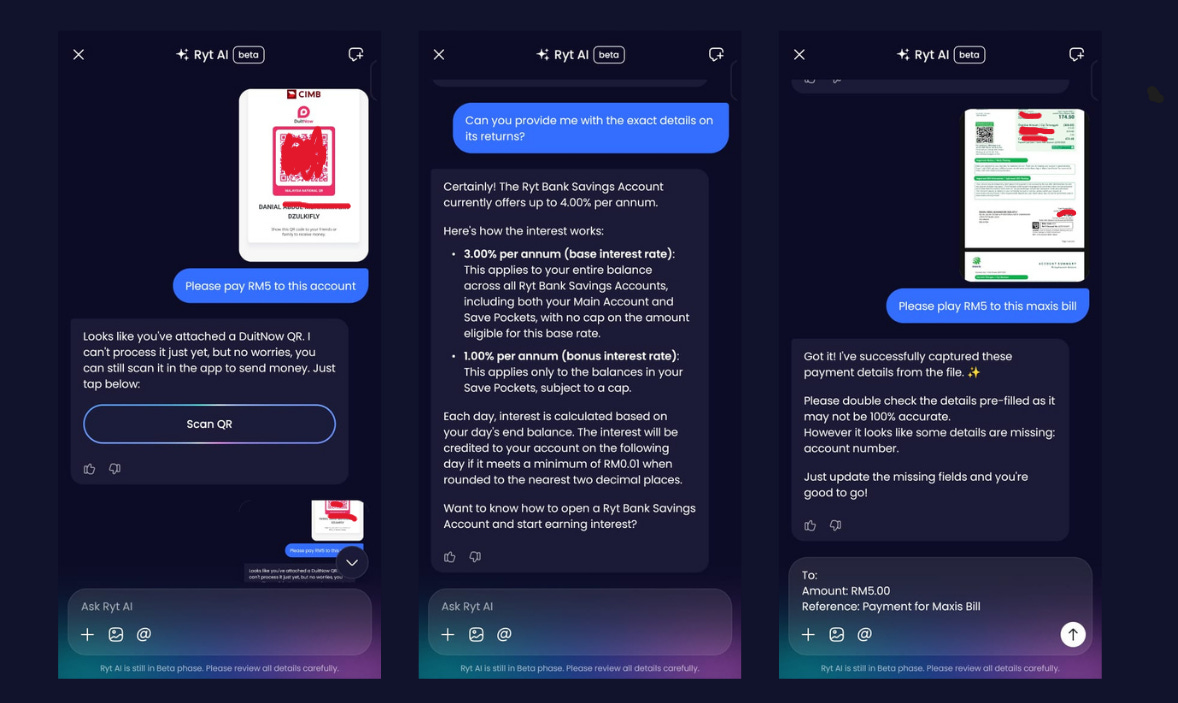

Malaysia-based Ryt Bank, which brands itself as the world’s first AI-powered bank, is set to launch on August 26. The bank is backed by Malaysian conglomerate YTL and Singapore’s Sea Limited, the tech giant behind e-commerce platform Shopee and often compared to China’s Alibaba Group. Its key differentiator is Ryt AI, a ChatGPT-style assistant powered by YTL’s proprietary large language model.

Currently in beta, the feature promises to handle fund transfers, bill payments, and commands based on text or screenshots. Early testing by Global Fintech Insider, however, revealed mixed results. While Ryt AI successfully processes DuitNow QR code payments (which is the most common means of digital payments for Malaysians), it only works when scanning with a phone camera. Uploading a QR image or PDF doesn’t work yet as an attempt to transfer RM5 ($1.18) using a PDF QR code failed. The assistant also struggles with e-bills longer than five pages; even after trimming a Maxis phone bill, it still required manual input of details.

Currently, access to Ryt Bank remains invite-only. Kevin Ong, the bank’s Head of Product, posted on LinkedIn to share an invite code and assured users the team is actively improving features. Beyond AI, Ryt Bank offers a 3% base interest rate (up to 4% with Save Pockets account), daily interest crediting, an instant virtual debit card, and a free Visa physical card until September. Domestic ATM fees are waived, and the bank absorbs foreign transaction charges, targeting both local and international users.

Source: Global Fintech Insider & RinggitPlus

🇹🇷 Midas, aka “Turkish Robinhood”, Secures $80M, Becomes Turkey’s Most-Funded Fintech

Istanbul-based stock trading app Midas has raised $80 million in a Series B funding round led by QED Investors, with participation from IFC, HSG, and QuantumLight, the fund founded by Revolut CEO Nik Storonsky. This marks the largest single funding round by a Turkish fintech. Founded in 2020 and led by CEO Egem Eraslan (pictured above), Midas serves 3.5 million users and plans to strengthen security, expand its product range, and introduce derivatives. Midas currently offers access to Turkish and U.S. stocks, mutual funds, and crypto, with U.S. options set to launch in September.

Source: Daily Sabah

🇺🇸 Wyoming Becomes First U.S. State to Launch Its Own Stablecoin

Wyoming has launched the Frontier Stable Token (FRNT), becoming the first US state to issue a state-backed stablecoin. FRNT is pegged 1:1 to the U.S. dollar and backed by dollars and short-term Treasuries. Developed in partnership with blockchain infrastructure firm LayerZero, the token will be available on major blockchains including Arbitrum, Avalanche, Base, Ethereum, Optimism, Polygon, and Solana.

Wyoming-based exchange Kraken will be among the first platforms to list FRNT on Solana. Kraken had recently announced it moved its global headquarters to Cheyenne, Wyoming last month. In a blog post, Kraken said the motivated by the state’s “forward-thinking policymakers” when it comes to crypto regulations. Governor Mark Gordon (pictured above), chair of the Wyoming Stable Token Commission, said the token will give citizens and businesses a superior “means of transacting in the digital age”.

Wyoming, still mostly known as the home of the Yellowstone National Park, is trying to diversify its economy away from mining and tourism thanks to its business friendly regulations. With 1.2 million companies incorporated in a state of 600,000 residents, the state is increasingly competing with Delaware for the title of top local domestic tax haven. Like Delaware, Wyoming have no corporate income tax, but it has stronger corporate privacy laws and lower incorporation fees.

Source: Global Fintech Insider & Bloomberg

🇧🇷 Brex Co-Founder Pedro Franceschi Brings Fintech Back Home By Opening São Paulo Office

Brex, the US-based expense management platform co-founded by Brazilian entrepreneur Pedro Franceschi (pictured above), has opened its first office in São Paulo. Franceschi called the move “personal’’ on LinkedIn, describing it as planting a flag in his home country. Nearly 200 of Brex’s 1,100 employees are already based in Brazil, and the new hub will serve as a centre for engineering, operations and leadership as the company builds its global footprint.

Recently, Brex has also secured a Payment Institution licence in the European Union, issued by Dutch regulators. The licence permits Brex to operate across all 30 EU states, enabling the direct issuance of commercial credit cards and payment services such as direct debits and credit transfers.

Sources: Global Fintech Insider & TechCrunch

🇺🇸 After Court Tosses Its Claims, Rippling Seeks ‘Non-Confidential Info’ From Ex-Deel Execs

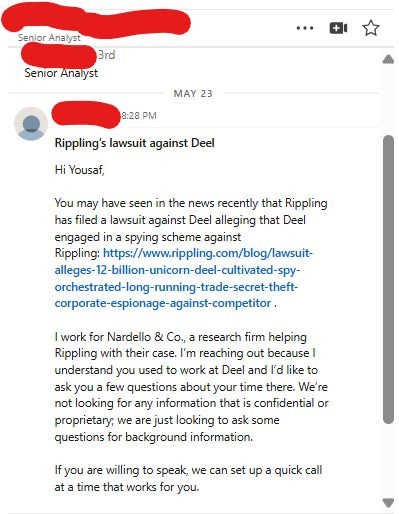

San Francisco-based HR and payroll solution platform Deel's former customer success manager Yousaf Shaukat, wrote on LinkedIn that investigators hired by Rippling reached out to him seeking “background information.” The outreach is tied to Rippling’s lawsuit accusing Deel of a corporate espionage scheme. “We’re not looking for any information that is confidential or proprietary; we are just looking to ask some questions for background information,” read the message from a representative of Nardello & Co., a business intelligence and investigative firm assisting Rippling in the case. The LinkedIn post came after a federal court in Florida dismissed fraud-based claims against Deel on August 20, including allegations under the Racketeer Influenced and Corrupt Organisations Act (RICO) brought by Rippling.

The broader lawsuit stems from allegations that San Francisco-based Deel planted a spy in Rippling’s Dublin office. Rippling claims the operative conducted more than 6,000 illicit searches and leaked competitive data, sales leads, and employee phone numbers for poaching. When served with a court order, the alleged mole reportedly locked himself in a bathroom, tried to flush his phone, and later fled.

Source: Global Fintech Insider

🇲🇽 Senior Role Openings Signal R2’s Expansion Into Brazil and Argentina

Mexico-based embedded finance start-up R2 appears to be expanding into Brazil and Argentina after posting senior role openings in São Paulo and Buenos Aires. These additions come on top of an ongoing hiring spree in Mexico City, Santiago, and Bogotá, where R2 already has offices. The new roles include key positions in credit risk, capital markets, and financial planning. In a LinkedIn post, CEO Roger Larach briefly stated that they are expending to “new geographies” but did not elaborate. Backed by Google’s Gradient Ventures and Y-Combinator, R2 is expanding aggressively following its $59 million raise in December 2024, which included $9 million in equity (led by Hi Ventures and Cometa) and a $50 million credit facility from Community Investment Management.

Sources: Global Fintech Insider

🇨🇳 China Is Thinking About Launching a Yuan-Backed Stablecoin

China is considering allowing yuan-backed stablecoins for the first time to accelerate the currency’s global adoption, sources told Reuters. The plan, expected to be reviewed by China’s State Council later this month, would set targets for international yuan use, assign roles to regulators, including China’s central bank, headquartered in Beijing (pictured above), and outline risk controls for cross-border payment applications.

Despite being the world’s second most traded currency, the yuan’s share in global payments fell to 2.88% in July versus the U.S. dollar’s 47.94%, according to SWIFT. If approved, the move would reverse Beijing’s 2021 crypto ban. It comes as U.S. dollar-backed stablecoins dominate 99% of the market, with Washington backing regulation to legitimise them. The global stablecoin market is currently worth $247B by estimates of crypto data provider CoinGecko and could hit $2T by 2028, according to Standard Chartered estimates.

🇨🇳 HSBC Invests in Dowsure, A Fintech Providing Loans to Amazon & Walmart Sellers

London-based bank HSBC Holdings has invested an undisclosed amount in Shenzhen-based cross-border embedded lender Dowsure. The bank, which led its Series C funding round, first backed the company in 2023. Last year, HSBC announced its partnership with Dowsure to expand financing solutions for SMEs using real-time commercial data. Essentially, Dowsure helps global e-commerce SMEs by providing fast and easy financial solutions like loans and credit. “As an SME business customer on a large marketplace platform, like Amazon, Alibaba or XYZ.com, you can secure financing. You can click at the point of purchase to pay now or after 30 days,’’ said Vivek Ramachandran, HSBC head of Global Trade Solutions. Dowsure was founded by IBM alumnus Byron Pei (pictured above).

Sources: Bloomberg & Global Finance

🇺🇸 Fintech Sector Unscathed as Trump Tariffs Inflict $6.7B Hit on Auto and Tech

President Donald Trump's new tariffs have battered traditional industries, but fintech players remain virtually untouched, according to AI-powered analytics firm Marvin Labs. The firm’s Tariff Impact Tracker reports that major fintechs such as Intuit, Block, MercadoLibre, Automatic Data Processing (ADP) and Fiserv saw no impact recorded on 2025 second-quarter earnings from the trade policies. The contrast is stark. The tracker, which monitors 179 companies, shows that the top 10 most-affected firms, largely in auto and hardware, absorbed a combined $6.7 billion hit. Volkswagen took the biggest blow at €1.3 billion ($1.51B), while GM lost $1.1B, Ford $800M, and Tesla $300M as rising material and import costs rippled through the industry.

Tech giants weren’t spared either. Apple and chipmaker AMD each booked $800M hits, the latter tied to U.S. export restrictions on AI chips to China. Industrial players such as Caterpillar ($350M) and John Deere ($200M) also flagged higher costs, while Rio Tinto ($321M) cited both headwinds and opportunities. Marvin Labs offers real-time tariff impact tracking and ChatGPT-like insights derived from earnings calls, filings, and CEO commentary.

Source: Global Fintech Insider

🇺🇸 Insurance Giant Allianz Life Data Breach Exposes 1.1M Customers’ Personal Info

A July cyberattack on U.S. insurance giant Allianz Life compromised the personal data of 1.1 million customers, according to breach notification site Have I Been Pwned. The stolen data includes names, dates of birth, gender, email and home addresses, and phone numbers from a Salesforce-hosted CRM database. Allianz Life, a US subsidiary of Munich-based Allianz SE, later confirmed to regulators in Texas and Massachusetts that Social Security numbers were also taken. The company disclosed the breach in late July but has not confirmed the exact number of affected customers. Brett Weinberg, an Allianz Life spokesperson, declined further comment when asked by TechCrunch, citing an ongoing investigation. The attack is linked to ShinyHunters, a hacking group known for social engineering tactics. The group has also targeted companies like Google, Cisco, Qantas, Pandora, and Workday, all of which reported Salesforce-related data thefts. ShinyHunters is reportedly preparing a data leak site to pressure victims into paying for data deletion, a common extortion tactic.

Source: TechCrunch

🇺🇸 Bankrupt Linqto to Sell $500M in Private Stocks Including Ripple & Circle

Collapsed retail investment platform Linqto has received court approval to sell more than $500 million worth of private company stocks. The sale would include a $399 million position in blockchain company Ripple and a $106.6 million stake in USDC issuer Circle, according to court filings cited by Bloomberg. F. Daniel Siciliano (pictured above) had taken up the role as CEO since January 2025 and is currently helming Linqto throughout this process. Linqto marketed these investments as exclusive pre-IPO access for retail investors, but later admitted the securities could not be transferred to customers due to regulatory restrictions. The company shut down while under an SEC investigation into whether it failed to verify investor accreditation.

Source: Bloomberg

Upcoming Fintech Events

🇺🇸 FinovateFall will be held in New York on will be held on September 8-10, 2025 ($3,998), with speakers such as Norah Coelho, Managing Director, Embedded Finance at J.P.Morgan & Lindsey Downing, VP Interactive at TransUnion.

🇨🇦 The Customer Experience for Financial Services Summit will be held in Toronto on September 18–19, 2025 ($995), with speakers such as Amit Mondal, VP & Head of Digital Analytics & Experimentation at Amex & Angela Crapsi, AVP of Operations at Flexiti/Questrade.

🇩🇪 Sibos will take place in Frankfurt from Sept. 29 to October 2 ($1,180.90 for fintechs), with speakers such as Victoria Cleland, Director of Payments at the Bank of England & Sophie Gilder, Managing Director, Blockchain & Digital Assets at Commonwealth Bank.

🇺🇸 Money 20/20 USA will be held in Las Vegas on Oct. 26-29, 2025 ($3,849), with speakers such as May Zabaneh, VP of Digital Currencies at PayPal & Dietrich Kuhlman, CEO of Navy Federal Credit Union

Who Am I?

Hi, my name is Julien Brault.

From 2017 to 2024, I was the CEO of Hardbacon, a fintech I co-founded, which reached 400,000 unique visitors at its peak.

A Google update ultimately sealed the company’s fate, and I started this newsletter to keep myself busy in the aftermath.

Why share this?

Because my goal is to use my experience as an economic journalist, fintech entrepreneur and product manager to present the most essential fintech news from around the world through the eyes of an insider.

If you like what I do, feel free to share this newsletter and follow me on Linkedin, X, Reddit, YouTube & TikTok.

If you are raising for your fintech and would like to be featured in Global Fintech Insider for free, fill this form.

P.-S. : Once you refer a new subscriber to the newsletter using your unique share link, you'll receive a personalized social media shout-out from me to promote your work or professional profile. Just write to me at jrbrault@icloud.com once your referral is confirmed on our leaderboard and include your social media account(s) URL(s) and who you are.