Alpaca Raises $52M to Bring Its Embedded Stock Trading Solution to Canada & Other Markets 🇺🇸

We're also covering the secret business model of a $7B super app 🇰🇷, Canada electing a fintech PM 🇨🇦, a16z turning into a media company 🇺🇸, UK crowdfunding market shrinking 60% 🇬🇧 & much more.

🇺🇸 Alpaca Raises $52M to Bring Its Embedded Stock Trading Solution to Canada & Other Markets

In an exclusive interview with Global Fintech Insider, Alpaca CEO Yoshi Yokokawa told me the US-based fintech plans to apply for a brokerage license in Canada following their $52 million Series C funding round. Alpaca functions as an API provider for financial services similar to what Plaid does for open banking enabling fintechs and platforms to offer stock trading capabilities without developing the technology or navigating regulatory hurdles themselves.

When I mentioned to Yokokawa that I had seen Alpaca is recruiting for a chief compliance officer in Canada on Linkedin, he confirmed they are indeed seeking a brokerage license in the country. He explained that the company aims to self clear in Canada as they do in the US, eliminating the need for a carrying broker partnership.

The participation of Montreal based Portage Ventures in the Series C round could help Alpaca expand their client base in Canada, Portage having invested in numerous Canadian fintechs including Wealthsimple, often called "the Robinhood of Canada”. The round also included Derayah Financial, 850 Management, National Investments Company Kuwait, and Unbound.

Alpaca faces a unique regulatory challenge in Canada. For their embedded stock trading model to work there, they need permission to offer trading on platforms that don't act as introducing brokers. Under existing Canadian Investment Regulatory Organization (CIRO) rules, apps offering stock trading historically had to become introducing brokers. Alpaca will need to convince regulators they can handle both introducing and carrying broker roles in a compliant way, even though their service is offered through third parties.

Beyond Canada, Alpaca plans to expand into other markets across the Middle East, Europe, and Asia, seeking additional brokerage licenses on top of the ones they already hold in the US, Japan, and the Bahamas.

Another competitive advantage Yokokawa mentioned is Alpaca's plan to offer European, Canadian, and Japanese stocks alongside US equities and enable US stock trading 24 hours a day. While HSBC and Interactive Brokers already provide international stocks at reasonable prices, most fintech trading apps don't, a gap Alpaca intends to fill.

The fresh capital brings Alpaca's total funding to $170 million as they expand beyond their current base of 5 million brokerage accounts across 40 countries.

Source: Global Fintech Insider

🇰🇷 Toss Founder Lee Seung-gun Reveals His $7B Super App Is Profitable Thanks To Ads & POS Systems

Toss, known primarily for its popular money transfer service used by 30 million South Koreans, has achieved its first-ever profit last year. Founder Lee Seung-gun, a former dentist turned fintech billionaire, revealed that despite the app's massive consumer adoption, its business model is mainly based on business customers. "Most of our revenue doesn't come from users, but instead from our business customers," Lee told Fortune, highlighting the company's focus on merchants through point-of-sale (POS) solutions and its internal ads network. This strategy helped Viva Republica, Toss's parent company valued at $7 billion, achieve its first annual profit of 21.3 billion Korean won ($15 million) in 2024 on a total revenue of 1.96 trillion won ($1.4 billion). The only service that actually charges consumers a fee is its online trading subsidiary, Toss Securities, which contributes roughly 20% of the platform's total revenue and acquired 2 million securities accounts in just five days. "For the next three to five years, it's going to mostly be a story around acquiring more business customers," Lee shared, signaling the company's continued focus on merchant services as it prepares for an IPO "in the near future."

Source: Fortune & Global Fintech Insider

🇨🇦 Mark Carney, Former Bloomberg Chairman and Stripe Board Member, Elected Prime Minister of Canada

Canada has a new fintech-connected leader. Mark Carney (right), who served on Stripe's board from 2021 to 2025 and was appointed as Bloomberg chair in 2023, has been elected Prime Minister of Canada with his Liberal Party set to win approximately 169 seats, just short of a majority government.

Bloomberg founder Michael Bloomberg (left), who collaborated with Carney on climate-related initiatives before naming him chairman, praised the new Prime Minister in a Linkedin post last night: "Mark's experience in government and business, his deep understanding of markets, and his forward-looking agenda — including his commitment to tackling challenges through international cooperation — will serve Canada well."

When asked about his experience with Carney, Stripe CEO Patrick Collison described the politician as "awesome" in a post on X last month. The former Bank of England governor also served as chair of Brookfield Asset Management.

Shopify CPO Craig Miller revealed in a Linkedin post that Carney was offered the role of President of Shopify in 2020, a position now held by Harley Finkelstein. While Carney ultimately declined the position to join Brookfield instead, Miller expressed his support for Carney's candidacy as prime minister. This put him at odds with Shopify CEO Tobi Lutke, who backed the Conservative Party. While Lutke congratulated Carney on X this morning, he had previously criticized his party in multiple posts on X, including one that made his position clear on April 19th : "Mark Carney is a great candidate, the Liberal Party is lucky to have him. But after the platform release today, it's clear the Party is still in control: it commits Canada to continued economic decline."

President Trump's annexation threats and trade war changed the game for the election, as Conservative leader Pierre Poilievre was set to win in a landslide when Justin Trudeau was still prime minister. Canadians seem to have seen in Carney the right man for facing Trump, as he capitalized during his campaign on having been governor of the Bank of England during Brexit and of the Bank of Canada during the 2008 financial crisis.

Source: Global Fintech Insider

🇩🇪 Thiel-Backed Neobank N26 To Launch Mobile Phone Service

German digital bank N26 is preparing to enter the telecommunications market by offering mobile phone contracts to customers starting in May. The Peter Thiel-backed neobank, which currently serves 5 million customers across 24 countries, will leverage one of Germany's top two mobile networks to provide the service. "Germany has some of the most expensive local plans among telecommunication markets in Europe," CEO Valentin Stalf (pictured above) told Bloomberg, noting that Germans spend an average of €50 ($57 USD) monthly on mobile plans compared to €10-20 ($11.40 to $22.80) to in other European markets. The move follows a similar strategy implemented by larger competitor Revolut last year and comes as N26 expects to break even or achieve slight profitability in 2025 for the first time. The neobank plans to delay an IPO for at least two years until it can triple revenue to approximately €1 billion ($1.14 billion USD). N26 is also exploring expansion into Eastern European markets like Romania and considering adding commodity trading to its platform.

Source: Bloomberg

🇺🇸 Podcast Network Founder Erik Torenberg Appointed as Andreessen Horowitz Partner To Marry VC & Media

Venture capital giant Andreessen Horowitz (also known as a16z) has acquired tech podcast network Turpentine and appointed its founder, Erik Torenberg, as general partner. The acquisition bolsters a16z's "going direct" media strategy while adding Turpentine's portfolio of 30 podcasts covering entrepreneurship, VC, and money. While not exclusively fintech focused, the network features substantial fintech content across shows like "Turpentine Finance" with Sasha Orloff, which includes interviews with Wealthfront CFO Alan Imberman and Mercury CEO Immad Akhund. Another popular show "1 to 1000" includes conversations with former Stripe COO Claire Hughes Johnson and Ramp CEO Eric Glyman. Torenberg will make investments and lead the firm's media initiatives, while keeping Turpentine's shows around. "When I told Marc my plans to marry investing, media, and networks, he said 'do it all here, but bigger' and crafted the right role to make it all work," Torenberg shared on LinkedIn about joining the firm. This move parallels Harry Stebbings' journey from podcaster to VC with 20VC, which recently closed a $400 million fund for European startups after starting with just $8.3 million in 2020.

Source: Global Fintech Insider & PitchBook

🇵🇭 Fintech Super App GCash May Delay $1.5B IPO Amid US-China Trade Tensions

Globe Telecom's newly appointed CEO Carl Cruz revealed that Mynt, the operator of GCash in which Globe holds a 36% stake, may postpone its anticipated $1 billion to $1.5 billion initial public offering due to market turbulence. "All the requirements are being prepared so that when the right time comes the IPO is going to happen," Cruz told Forbes, suggesting the listing could be delayed if US-China trade tensions continue to worsen. The fintech unicorn, valued at $5 billion after raising $800 million from AC Ventures and MUFG Bank last August, is the Philippines' most valuable fintech. GCash is used by 80% of Filipinos with over six million merchants on its platform offering payments, lending, insurance and investments. Beyond Globe Telecom, Mynt's ownership includes AC Ventures, China's Ant Financial, and Japan's MUFG Bank.

Source: Forbes

🇺🇸 Vocal Robinhood Critic Jason Wenk Raises $152M For RIA Platform Altruist At $1.9B Valuation

Fintech challenger Altruist has secured $152 million in Series F funding, valuing the registered investment advisory (RIA) custodial platform at $1.9 billion. Founded in 2018 by outspoken industry figure Jason Wenk, the Los Angeles-based fintech has positioned itself as a tech-forward alternative to established players Charles Schwab, Fidelity, and BNY Mellon's Pershing. Wenk has been particularly critical of Robinhood since they acquired RIA custodian TradePMR, putting them in direct competition with Altruist in the advisory space. In a Linkedin post, he mockingly questioned "Adding sports betting directly into your investing platform alongside your IRA seems like a really good idea, right?" and later posted "Prayers up for all the $HOOD traders in this market. May they find a solid RIA to help guide them away from leveraged Mag 7 portfolios and sh*t coins." The funding round was led by Singapore sovereign wealth fund GIC, with participation from Salesforce Ventures, Geodesic Capital, Baillie Gifford, Carson Family Office, and Iconiq Growth. The company now serves more than 4,700 advisors in the US.

Source: Global Fintech Insider & Barron’s

🇲🇽 Kavak's Valuation Plummets From $8.7B To $2.2B As Used Car Platform Raises $127M

Latin America's former most valuable privately held fintech has experienced a dramatic $6.5 billion drop in valuation. Online used car marketplace Kavak, which currently operates in Mexico, Brazil, Argentina, Chile, Turkey, Oman and the UAE, raised a $127 million funding round that valued the company at just $2.2 billion, down from its previous $8.7 billion valuation in 2021. The financing, co-led by existing investors SoftBank Group and General Atlantic, also helped secure two $200 million credit lines from Goldman Sachs and HSBC. "We wanted to continue strengthening our balance sheet to ensure we could get the working capital facilities needed to continue growing our lending business," explained founder Carlos García Ottati (pictured above) in his first interview since late 2023. The company's financial arm, Kuna Capital, has become one of its most profitable segments, having issued nearly $1 billion in loans over the past four years.

Source: Bloomberg Linea

🇦🇺 Financial Comparison App WeMoney Reaches $100M Valuation With Mastercard Backing

Australian financial comparison platform WeMoney has secured a $12 million Series A round with strategic investor Mastercard joining the cap table. Perth online casino entrepreneur Laurence Escalante led the funding through his family office, with participation from existing investors BetterLabs, Dorado Capital, and Eastcourt Capital. The transaction values the fintech at $100 million. WeMoney's app helps customers make better financial decisions by analyzing spending patterns, comparing credit cards, and identifying savings opportunities through provider switches. "Our BrightMatch platform is transforming how Australians manage finances and seamlessly switch to better financial products supported by partners and now our investor Mastercard," said Dan Jovevski (pictured above), founder and CEO of WeMoney, in a LinkedIn post announcing the round. The platform has attracted over 1 million Australian downloads in less than five years, with approximately 80,000 monthly active users. The company has a commercial partnership with Mastercard to leverage its Open Banking solution in Australia and plans to expand into Southeast Asia and New Zealand.

Source: Finextra & Global Fintech Insider

🇨🇦 Shopify Is Looking For Developers To Launch Accounting & Print On Demand Apps In Its App Store

Shopify is actively recruiting developers to build new accounting and print-on-demand applications for its app store, according to a recent post on X highlighting Q1's trending app categories. Accounting leads with an impressive 140% increase in page views, while print-on-demand follows closely at 138%. The platform also identified significant growth in email marketing (+111%), product reviews (+96%), and workflow automation (+81%). For accounting apps, Shopify suggests features like cross-platform payment matching and automated dispute reconciliation, while print-on-demand developers are encouraged to incorporate AI-generated mockups and bulk design uploads. The recruitment push comes alongside changes to Shopify's revenue sharing model, which will sunset the annual $1 million exemption reset in favor of a one-time lifetime exemption, with 15% revenue share on amounts above that threshold starting June 16, 2025. Shopify noted that the company paid out more than $1 billion to developers last year across its ecosystem of over 16,000 apps.

Source: Global Fintech Insider

🇸🇪 Fintech Lender Froda Raises $23M With Backing From H&M Chairman & Klarna Co-Founder

Swedish embedded lending startup Froda has secured €20 million ($22.8 million USD) in Series B funding to fuel its European expansion. The round was led by first-time investor Incore Invest, with continued support from existing backers including H&M chairman Karl-Johan Persson and Klarna co-founder Victor Jacobsson. Founded in 2015, Froda operates as both a direct and embedded lender targeting SMEs across Sweden, Norway, Denmark, Finland, Germany, the UK, and Ireland. The company, which raised €10 million ($11.4 million USD) in 2023 at a valuation of approximately €170 million ($193.8 million USD), plans to use the fresh capital to onboard new embedded finance partners and enter additional European markets. "With Incore Invest's backing, we can accelerate our growth and scale our partnerships to continue supporting SMEs with the financing they need," said Olle Lundin (pictured above), co-founder and CEO at Froda.

Source: Tech.eu

🇺🇸 ChatGPT Joins Microsoft And Perplexity In AI Shopping Assistant Race

Code sleuths have discovered Shopify variable names embedded in ChatGPT's JavaScript, suggesting an imminent ecommerce integration between the AI platform and the leading commerce platform. First reported by Alexey Shabanov in TestingCatalog on April 20, the discovery points to a potential affiliate relationship, building on ChatGPT's existing commerce capabilities in its Operator research agent for booking travel and ordering groceries. This development comes amid an accelerating AI shopping landscape, with Microsoft announcing a merchant program for its Copilot AI on April 18 and Perplexity launching "Buy with Pro" Shopify integration in November 2024. The emerging AI shopping ecosystem presents both opportunities and challenges for merchants who may need to optimize product feeds for AI assistants, while potentially preparing for new paid inclusion models. For fintech companies, this trend signals an expanding frontier where payment processing, checkout experiences, and financial services will need to integrate seamlessly with conversational AI shopping interfaces.

Source: PracticalEcommerce

🇩🇪 Pliant CEO Malte Rau Secures $40M To Bring Corporate Cards Issuing Platform To US

Berlin-based B2B cards issuing platform Pliant has raised $40 million in Series B funding to fuel its US expansion. CEO Malte Rau (right) will use the fresh capital to establish local teams and infrastructure in the American market, bringing the company's total funding to over $100 million. "We have proven that our platform delivers real value at scale. With a strong foundation in Europe, we are ready to bring our solution to the U.S. market," said Rau, who co-founded the fintech in 2020 with current CPO Fabian Terner (left). The round was co-led by Illuminate Financial and Speedinvest, with participation from existing investors PayPal Ventures and Motive Ventures. Pliant's cards-as-a-service (CaaS) model allows businesses to launch their own branded credit card programs, enhancing customer retention while providing new revenue streams.

Source: Tech.eu

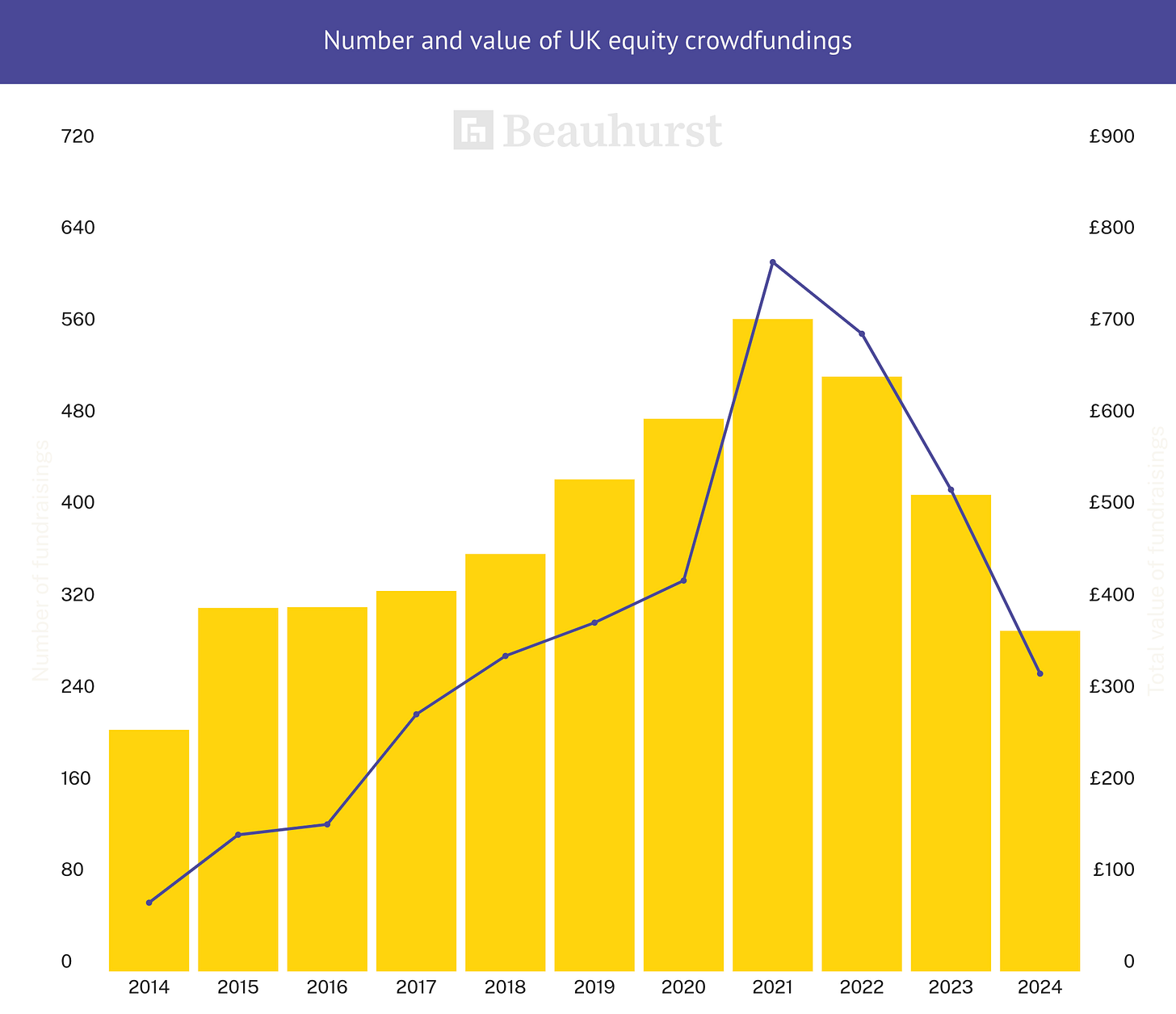

🇬🇧 UK Equity Crowdfunding Market Shrinks 60% in Early 2025 as Investor Appetite Wanes

Companies in the UK raised just £324 million ($430M) across 297 rounds on crowdfunding platforms in 2024, marking a 48% fall in deal volume and 58% drop in total funding since the industry's 2021 peak, according to data provider Beauhurst. The slide has continued, with total funding raised in the first quarter of 2025 down nearly 60% from a year earlier. The decline mirrors broader venture capital trends, with fintech startups securing $29.5 billion in 2024, a 13% decline year-over-year according to PitchBook. Despite these challenges, platforms are adapting. Crowdcube grew revenue 33% year-on-year to £10.1 million ($13.5M) in 2024 and achieved profitability by expanding into secondary share sales. Richard Theo, founder of Zero, a banking app focused on environmental sustainability, secured £400,000 ($536,280) via crowdfunding in February and remains optimistic about the approach: "Our motivation was absolutely to raise money using the process, but it was also a good customer acquisition tool, so it was kind of win-win really."

Source: Bloomberg

🇬🇧 Coinbase Partners With Founders Factory To Launch A Crypto & AI Accelerator in the UK

Cryptocurrency exchange giant Coinbase is teaming up with venture studio Founders Factory to create a new 16-week accelerator program in the UK focused on blockchain and AI startups. The initiative includes crypto investors Animoca Brands and Fabric Ventures as additional partners. Selected startups will receive £250,000 ($335,175 USD) in investment for approximately 5% equity stakes, alongside business strategy, product development, and fundraising support. "The UK government is really excited about pushing forward crypto regulation in the UK and crypto delivering growth for the UK economy," Coinbase's UK Country Director Keith Grose told Sifted. The accelerator comes at a critical time for UK crypto, following industry concerns after Andreessen Horowitz closed its UK offices in January to focus on the US market after Donald Trump's re-election. Applications are expected to open in June, with the first cohort beginning in September.

Source: Sifted

Upcoming Fintech Events

🇬🇧 The Innovate Finance Global Summit will be held in London on April 29, 2025 (450 USD), with speakers such as Justin Basini, co-founder & CEO of ClearScore & Diana Avila, Global Head of Banking and Expansion at Wise.

🇨🇦 The AI Agent Montreal meetup will be held in Montreal on May 1, from 6:00 PM to 8:00 PM, with speakers such as Deck co-founder and president Frédérick Lavoie.

🇺🇸 FinovateSpring will be held in San Diego on May 7-9, 2025 (1,299 USD), with speakers such as Vishal Garg, founder & CEO at Better.com & Lauren McCollom, Head of Embedded Finance at Grasshopper Bank.

🇦🇪 Dubai FinTech Summit will take place in Dubai on May 12-13, 2025 (899 USD), with speakers such as Arik Shtilman, co-founder and CEO of Rapyd & John Caplan, CEO of Payoneer.

🇺🇸 Stablecon will take place in New York on May 29, 2025 (1,295 USD), with speakers such as Cuy Sheffield, Head of Crypto at Visa and Edward Woodford, CEO & co-founder of Zero Hash.

🇳🇱 Money20/20 Europe will be held in Amsterdam on June 3-5, 2025 (3,395 USD), with speakers such as Steven van Rijswijk, CEO of ING & Yoni Assia, CEO of eToro.

Who Am I?

Hi, my name is Julien Brault.

From 2017 to 2024, I was the CEO of Hardbacon, a fintech I co-founded, which reached 400,000 unique visitors at its peak.

A Google update ultimately sealed the company’s faith and I started this newsletter to keep myself busy in the aftermath.

Why share this?

Because my goal is to use my experience as an economic journalist, fintech entrepreneur and product manager to present the most essential fintech news from around the world through the eyes of an insider.

If you like what I do, feel free to share this newsletter and follow me on Linkedin, YouTube, TikTok, Instagram & X.

P.-S. : Once you refer a new subscriber to the newsletter using your unique share link, you'll receive a personalized social media shout-out from me to promote your work or professional profile. Just write to me at jrbrault@icloud.com once your referral is confirmed on our leaderboard and include your social media account(s) URL(s) and who you are.