Boardy, The AI Agent Created by Clearco Co-Founder, Raised a $8 Million Round All By Itself 🇨🇦

We're also covering Nubank's push to make stablecoins mainstream 🇧🇷, Trump's latest crypto money-grab 🇺🇸, Bench's bankruptcy filings revelations 🇨🇦, Freetrade's controversial exit 🇬🇧 & more.

Welcome to 2025, fintech peeps! Since this is my first issue of the year, I wanted to take the time to thank you for signing up to my newsletter! When I started it back in September, I was depressed, jobless, and I needed an outlet to feel relevant again. This newsletter allowed me to do just that, and now I have a great product management job and more than 1,300 of you guys reading me every week! Thanks for giving me a place in your inbox and, hopefully, in your heart!

P.S. : One of my goal for 2025 is to reach 10,000 subscribers by the end of the year, so feel free to share this newsletter with your friends and colleagues if you enjoy reading it.

🇨🇦 Boardy, The AI Agent Created by Clearco Co-Founder, Raised a $8 Million Round All By Itself

Boardy, an AI networking assistant created by Clearco co-founder Andrew D'Souza, announced on LinkedIn that it had raised 8 million USD "entirely on its own", though the legal paperwork was handled by humans, as Boardy itself admitted in the post.

The funding round was led by Creandum, known for early investments in fintech unicorn Klarna. Co-founded with Matt Stein and Andrew D'Souza, Boardy uses voice AI to facilitate business connections. Users share their phone number on LinkedIn, then receive a call from an AI with an Australian accent that aims to understand their needs and make relevant introductions.

I personally tested Boardy last Friday, discussing my background and my interest in covering fintech events in this newsletter. Boardy was summarizing what I was telling him to show understanding, and quickly ended the conversation at 9:59 when I mentioned having a call at 10:00. So it kind of works, but I'm still waiting for those fintech event organizer intros.

Writing on Creandum's blog, investor Simon Schmincke highlighted the financial services potential: "Boardy can streamline the procurement process, connecting companies more quickly with vendors that meet their requirements." The startup, which represents a new venture for D'Souza after leaving revenue-based financing pioneer Clearco, has already helped facilitate over 10 million USD in venture investments by making introductions between founders and investors.

Source: Global Fintech Insider

🇧🇷 Nubank To Make Stablecoins Go Mainstream With A 4% USDC Savings Account

Nubank, Latin America's largest digital bank serving over 85 million customers across Brazil, Mexico, and Colombia, has launched a fixed 4% annual return program for users holding USDC stablecoins in their crypto wallets. The initiative, which went live after a successful pilot program last year, requires a minimum balance of 10 USDC and offers daily returns with instant access to funds. The neobank's commitment to USDC seems well-founded as the stablecoin now represents 30% of its crypto users' portfolios. This could be one of the first major consumer use cases for stablecoins, as USD is widely used as a value refuge in countries like Brazil where the local currency is rapidly depreciating. I wouldn't be surprised to see similar accounts popping up in markets like Turkey, Venezuela, or Uzbekistan, where people often pay high fees to save in USD rather than risk their savings becoming worthless in local currency.

Source: Crypto.news

🇺🇸 Trump Memecoin Soars to $9B Market Cap Ahead of Inauguration Day

A cryptocurrency token called $TRUMP launched by President-elect Donald Trump in a Truth Social post on January 17th, 2025, has exploded to a $9 billion market capitalization in just days, with over $31 billion in trading volume in the last 24 hours as speculators pile in ahead of his inauguration today. The memecoin, of which Trump's company CIC Digital LLC owns 80%, has seen its fully diluted value surge above $45 billion. With 200 million tokens currently in circulation (set to expand to 1 billion over three years), Trump's stake could in theory be worth more than $36 billion on paper... but we all know it will crash way before that happens. Strangely enough, this new Trump coin has nothing to do with the other cryptocurrency company he launched with his sons last year.

Source: Global Fintech Insider

🇨🇦 Bench Bankruptcy Filing Reveals $65M Debt Mountain

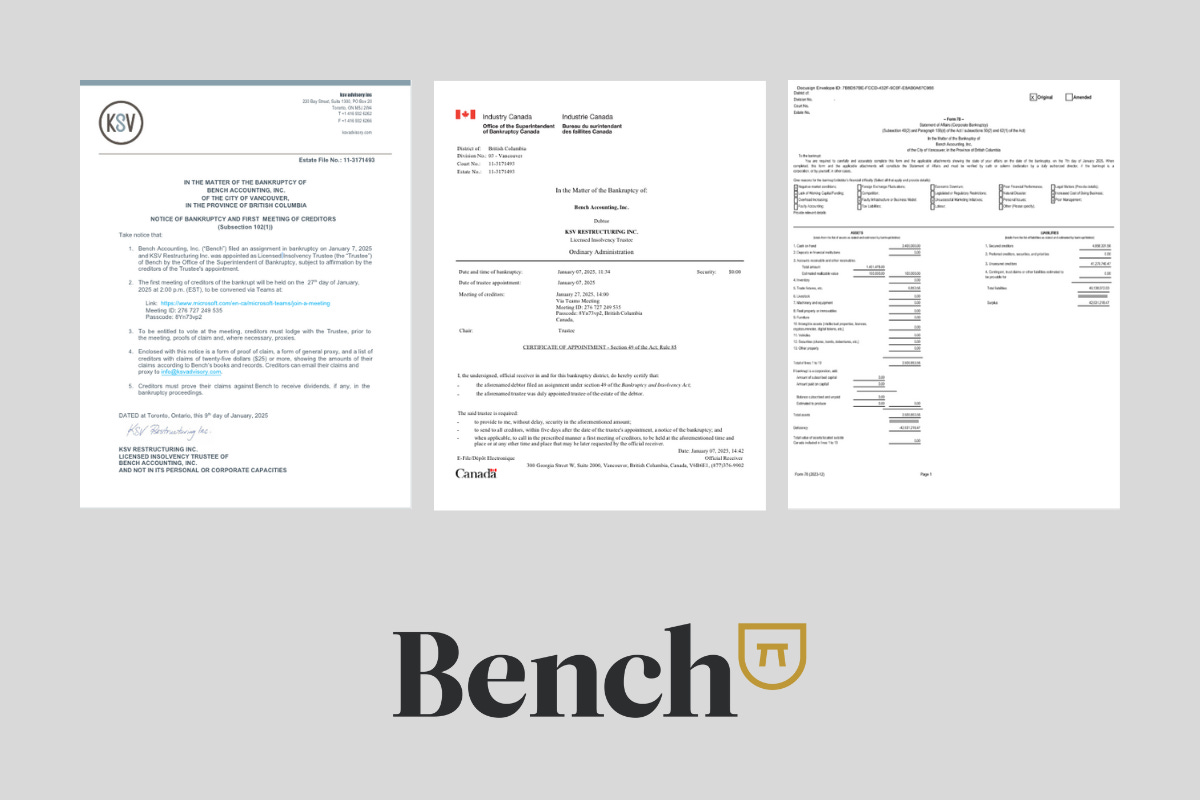

Bench, the Canadian accounting startup that suddenly shut down during the holidays (before Employer.com bought out its assets and brought the platform back online), officially filed for bankruptcy last week. The filings reveal the company was drowning in a 65 million USD (94 million CAD) debt despite having raised 113 million USD from investors including Shopify and Bain Capital Ventures. While trustees are not management consultants, it's interesting to note the causes of Bench's financial difficulties listed in the Bench filing, which included, among many others, "faulty business model". Yep, they were a bookkeeping firm masquerading as a tech company, and nope, AI has not yet replaced bookkeepers.

The documents also show that National Bank of Canada is owed 50 million USD, with 85% of that debt being unsecured. The fintech also owes 1.3 million USD to Bain Capital Ventures, 1.2 million USD to Inovia Capital, and 1.8 million USD in severance pay to former employees, including executives CEO Jean-Philippe Durrios, CRO Todd Daum, and CFO Mor Lakritz.

Source: TechCrunch & Global Fintech Insider

🇬🇧 Revolut Founder Nik Storonsky Takes $430M Off The Table

Revolut founder Nik Storonsky has sold 430 million USD (£350 million) worth of shares in a secondary sale that values the fintech at $45 billion. The sale, initially open only to current employees, was expanded to early investors with total sales now exceeding 1 billion USD. While Revolut is performing strongly with 40 million customers and recently secured its UK banking license after years of regulatory delays, I wouldn't be surprised if this massive cash-out by Storonsky reduces the pressure to go public anytime soon. That said, Nik Storonsky still holds a stake worth approximately $8 billion in the digital bank.

Source: Sky News

🇮🇱 eToro Targets $5B+ Valuation in Its U.S. IPO Filing

eToro, a retail trading platform, has confidentially filed for a U.S. IPO that could value the company at over $5 billion. The Israelian company, whose largest market is the UK, is the latest to avoid listing in London. CEO Yoni Assia believes a U.S. listing will give eToro access to a broader range of investors compared to a UK listing. eToro allows customers to trade assets like stocks and cryptocurrencies, managing $11.3 billion in customer assets across 3 million accounts. The company previously attempted to go public in 2021 through a $10.4 billion SPAC deal, but ended that effort in 2022 as the SPAC market imploded. eToro's latest valuation was $3.5 billion in a 2023 funding round that raised $250 million from investors including SoftBank and Ion Group.

Source: Financial Times

🇬🇧 Freetrade's $191M Fire Sale to IG Group Burns Crowdfunding Investors

UK trading app Freetrade has been acquired by IG Group for £160 million ($191 million USD), a significant discount from its £650 million valuation in a 2021 fundraising round. The deal, set to close in mid-2025, has left many of Freetrade's crowdfunding investors angry. CEO Viktor Nebehaj (on the picture above) acknowledged the disappointing outcome for recent backers in a forum post, stating, "I appreciate that for many of you who backed us after our Series B this means that your investment is being realised at a loss."

Source: City AM & This Is Money

🇺🇸 Deepfake Passports Pose New Challenges for Fintech Fraud Prevention

The increasing sophistication of AI-generated ID photos is raising alarms for fintech companies that rely on legitimate customer ID images to identify their customers. In a viral LinkedIn post with over 20,000 likes, Konstantin Simonchik, Chief Scientific Officer of New York-based digital identity provider ID R&D Inc., showcased a fully AI-generated passport photo (the picture above) with astonishingly realistic details, including smartphone shadows on the document and table. Simonchik warns that emerging Dark Web services are creating opportunities for fraudsters, as these tools can produce multiple deepfake images from a simple list of personally identifiable information, potentially enabling fraud on an unprecedented scale. This poses significant challenges for fintech compliance departments in distinguishing genuine documents from fake ones.

Source: Global Fintech Insider

🇮🇳 Amazon to Buy Indian BNPL Startup Axio in $150M+ Deal

Amazon has agreed to acquire Axio, an Indian buy-now, pay-later (BNPL) startup, in a deal valued at over 150 million USD, according to sources familiar with the matter. The acquisition, which is pending approval from the Indian central bank, deepens Amazon's push into financial services in one of its fastest-growing markets. Co-founded in 2013 by Gaurav Hinduja and Sashank Rishyasringa (on the picture above), Axio has raised 135 million USD from investors such as Peak XV Partners, Ribbit Capital, and Elevation Capital. The startup, which specializes in providing credit to self-employed individuals at the point of sale on major e-commerce platforms, claims to serve more than 10 million customers with a loan book worth over $260 million.

Source: TechCrunch

🇺🇸 NYC Fintech Community Mourns as Barclays Shutters Rise Accelerator and Coworking Spaces

Barclays has confirmed that it will be closing its Rise fintech accelerator and coworking spaces in London and New York by mid-2025. The nearly decade-old program has been home to notable fintech startups such as Chainalysis and Alloy. The decision to close Rise has sparked an outpouring of memories and gratitude from the New-York fintech community. Nicole Casperson, founder of Fintech Is Femme, shared in a LinkedIn post that Rise played a critical role in helping her build build Fintech is Femme into the media brand it is today by hosting several of its events. Kristina Fan, CEO of 7 Chord, a market data firm in NYC, also shared on Linkedin her company's origin story tied to Rise. However, she noted, "The truth is ... RISE never fully recovered post-pandemic."

Source: Axios & Global Fintech Insider

🇨🇦 Wealthsimple Backer Sagard Makes Private Equity Available to Mass Affluent Investors

Sagard, a key player in Canada's fintech ecosystem through its backing of Wealthsimple and other fintechs, is launching a private equity fund targeting accredited investors with a dramatically lower minimum investment of 25,000 USD, down from their usual 10 million CAD threshold. "We're looking to democratize access to what we think is the most important part of the investment industry for the next decade," CEO Paul Desmarais III told Bloomberg. The move builds on Sagard's existing relationship with Wealthsimple, for which it manages a 430 million CAD (300 million USD) credit fund. The new fund follows Sagard's retail private credit fund launched last year. With this launch, Sagard joins BlackRock and Brookfield in the race to make alternative investments more accessible to retail investors.

Source: Bloomberg

Upcoming Fintech Events

🇮🇳 The Bharat Fintech Summit will take place in Bombay on February 5-6, 2025 (94 USD), with speakers such as Balaji Rajagopalan, CTO of the State Bank of India & Anup Agarwal, CEO of Mintifi.

🇳🇱 Banking Renaissance will take place in Amsterdam on February 19-20, 2025 (1,263 USD), with speakers such as Giorgi Shagidze, CEO of maib & Ivar Lammers, Global Head of Financial Crime at ING Bank.

🇬🇧 Finovate Europe will be held in London on February 25-25, 2025 (2,399 USD), with speakers such as Joris Hensen, co-lead of co-lead Deutsche Bank API Program & Joanne Phillips, managing director for Aviva Direct Wealth.

🇺🇸 The Bank Automation Summit will be held in Austin on March 3-4, 2025 (632.50 USD), with speakers such as Michael Lehmbeck, CTO at BankUnited and Koren Picariello, head of generative AI strategy for Morgan Stanley Wealth Management.

🇺🇸 Fintech Meetup will take place in Las Vegas on March 10-14, 2025 (2 800 USD), with speakers such as Leif Abraham, co-CEO of Public.com & Misha Esipov, CEO of Nova Credit.

🇨🇦 The Canadian Fintech Summit will be held in Toronto on April 8th, 2025 (221 USD), with speakers such as Darcy Tuer, CEO of ZayZoon and David Nault, GP at Luge Capital.

Who Am I?

Hi, my name is Julien Brault.

From 2017 to 2024, I was the CEO of Hardbacon, a fintech I co-founded, which reached 400,000 unique visitors at its peak.

A Google update ultimately sealed the company’s faith and I started this newsletter to keep myself busy in the aftermath.

I’m now product manager for Beeye, an AccountingTech SaaS.

Why share this?

Because my goal is to use my experience as an economic journalist, fintech entrepreneur and product manager to present the most essential fintech news from around the world through the eyes of an insider.

If you like what I do, feel free to share this newsletter and follow me on Linkedin.

Did you ever get the intro's? I've just come across Boardy, and wondering how helpful it can be for me and Blue Earth