Coinbase CEO Brian Armstrong Predicts Agentic Commerce Will Be a Big Deal in 2025 🇺🇸

We're also covering Bybit come-back after $1.5B hack 🇦🇪, Revolut keeping remote work despite new HQ 🇬🇧, JPMorgan's $175M fintech nightmare trial 🇺🇸 & Crunchbase's new AI crystal ball 🇺🇸

2,000 Thanks!

Thanks to you guys, this newsletter surpassed the 2,000 subscribers mark last week! We’re still far from my 10,000 goal for 2025, but we’ll get there!

Last week was doubly pivotal, as I also had the pleasure to send you my first standalone content project outside of the weekly fintech news round-up, the GFI's Top 40 Celebrity Fintech Investors ranking. It even became my most read content since starting the newsletter in August!

Finally, I've just launched a referral program. Once you refer a new subscriber to the newsletter, you'll receive a personalized social media shout-out from me to promote your work or professional profile. Just write to me at jrbrault@icloud.com once your referral is confirmed on our leaderboard and include your social media account(s) URL(s) and who you are.

🇺🇸 Coinbase CEO Brian Armstrong Predicts Agentic Commerce Will Be a Big Deal in 2025

Brian Armstrong, CEO of Coinbase, predicted that agentic commerce will be a major trend in 2025. In a post on X, Armstrong wrote that “Agentic Commerce is going to be a big deal this year”, and then went on to explain that merchants can now use Coinbase Commerce, its crypto payment provider, to make their shopping cart AI agent enabled, while its Developper platform could be used by AI agent makers to attribute crypto wallets to their agents.

This comes on the heels of a mind-blowing demo video shared by Justin Gainsley, a product manager at Coinbase, showcasing an agent booking appointments for him, making the payment for it using Ether and even adding the appointment (and the receipt) to his calendar.

AI chatbots are already changing the way people shop by making comparison sites like Nerdwallet, CNET or Kayak less relevant, as consumers can now use tools like Open AI’s Deep Research or Grok’s DeepSearch to scrape the web and instantly generate a custom report on the current prices and features of any product, from credit cards to TV sets. The next logical step is to allow AI agents to handle the comparison, selection, and purchasing on behalf of the user.

OpenAI's Operator, an AI agent that can perform tasks like building a meal plan and ordering ingredients to prepare those meals on Amazon, has the potential to be one of the first mainstream agentic shopper. Initially available only in the US, Operator became accessible to ChatGPT Pro subscribers in several countries, including Australia, Brazil, Canada, India, Japan, Singapore, and the UK, on February 21. While the premise of Operator sounds magical, the user still needs to manually check out whatever items Operator added to its user’s Amazon basket, an additional step that significantly reduces the time-saving potential of the agent.

In a recent blog post, Bain Capital Ventures partner Scott Friend declared that we are at the dawn of the "Agentic Commerce Era," where intelligent agents will operate on behalf of consumers. He believes this new paradigm will unlock substantial time and cost savings for shoppers. Friend is so bullish on agentic commerce that he is actively seeking to invest in founders who are working in the space.

The rise of agentic commerce will require both e-commerce platforms and payment providers to offer agentic interfaces. While Coinbase Commerce moving into this space could bring in some early adopters, the agentic commerce revolution has not yet encountered its iPhone moment, which would probably require a giant like Shopify, Amazon, PayPal or Stripe to offer agentic checkouts.

Source: Global Fintech Insider

🇦🇪 Bybit Makes All Customers Whole After Massive $1.5B Crypto Theft

Dubai-based crypto exchange Bybit has already restored full 1:1 backing for client Ethereum assets, just days after suffering the largest cryptocurrency hack in history. "Bybit has already fully closed the ETH gap, new audited POR report will be published very soon to show that Bybit is again Back to 100% 1:1 on client assets through merkle tree," CEO Ben Zhou announced in a X post on Monday. The news follows a $1.5 billion Ethereum theft that occurred during a routine wallet transfer, triggering over 350,000 withdrawal requests from the exchange's 60 million users. Zhou had immediately reassured users after the hack, posting on X that Bybit remained solvent and that the exchange had the financial capabilities to cover the loss. The exchange, which holds $20 billion in customer assets, continues to offer a 10% bounty ($140 million) for the recovery of the stolen funds.

Source: Global Fintech Insider

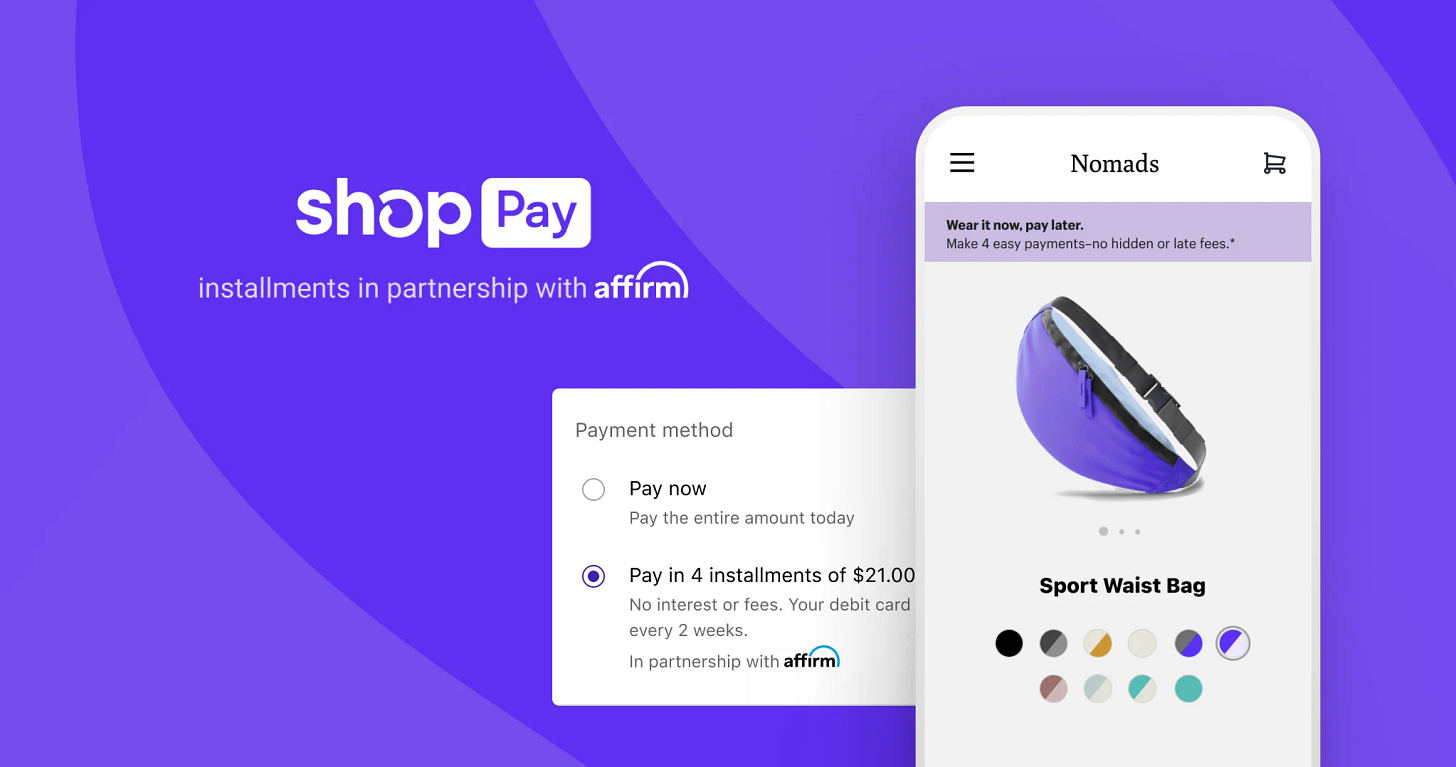

🇨🇦 Shopify Partners With Affirm For Canada & UK BNPL Launch

Shopify has extended its exclusive partnership with Affirm for Shop Pay Installments beyond the US market into Canada, with plans to enter the UK market next. The deal cements Affirm's position as Shopify's buy-now-pay-later provider in both North American markets. Shopify COO Kaz Nejatian emphasized the natural progression of the partnership, stating "Given the success of our long-standing partnership with Affirm in the US, bringing them to our merchants internationally is a no brainer." Under the expanded agreement, Canadian merchants will soon be able to offer Affirm-powered installment payments with terms up to 24 months and 0% APR options. The planned UK expansion will put Affirm in direct competition with European BNPL giant Klarna, which dominates the region's installment payments market and is preparing for a US IPO at a reported $15 billion valuation.

Source: Crowdfund Insider

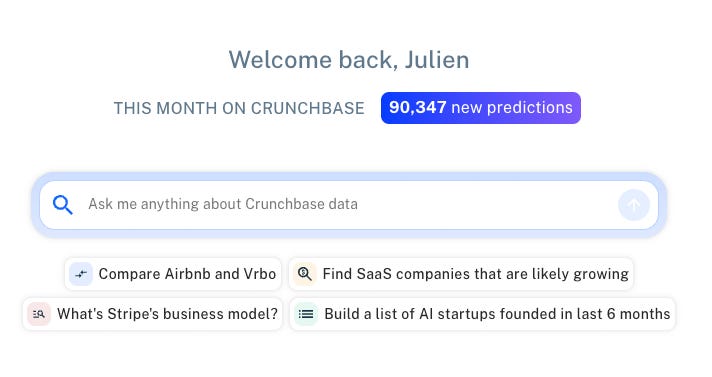

🇺🇸 Crunchbase Launches AI Engine To Predict Startup Exits & Funding Rounds

Crunchbase has launched an AI-powered prediction engine that forecasts startup funding rounds, acquisitions, and IPOs with up to 95% accuracy. CEO Jager McConnell revealed that the company pivoted to AI predictions after realizing that historical data companies could become obsolete in the age of ChatGPT. The platform leverages proprietary data from its 80 million users' behaviour, such as profile edits and investor interest patterns, to generate predictions. The system has already proven its worth by correctly predicting Anthropic's $2 billion raise in January and Coda's acquisition by Grammarly. McConnell, whose company generates about $50 million in revenue with 40% coming from access to user behavior data, also disclosed that Crunchbase's own AI predicts it will likely be acquired. The move puts Crunchbase in direct competition with PitchBook's VC Exit Predictor in the race to become the go-to AI-powered startup intelligence platform.

Source: Wall Street Journal

🇵🇪 Peruvian Fintech Do Payment Plans US Launch After Getting SEC Green Light

Peruvian payment provider Do Payment has received SEC authorization to operate in the US market, with plans to be fully operational by mid-2025. Founded in 2022 by Cristian Valderrama to tackle the three-day wait times for fund access in sports betting and gaming, the fintech expanded into five Latin American countries in 2024 and plan to expand into Brazil next. The company, which offers pay-in and payout services through a single regional API, is investing $2 million in its 2025 expansion plans, with investment expected to rise to $5 million in 2026. Currently active in Peru, Chile, Colombia, Mexico, Ecuador, and Panama, Do Payment aims to process over $700 million in transactions by the end of 2025.

Source: Fintech Finance News

🇬🇧 Revolut CEO Says Employees Can Still Work From Home Despite Investing In New Massive London HQ

Revolut is bucking the traditional banking industry's return-to-office trend by maintaining its hybrid work policy even as it prepares to open a new 113,000-square-foot headquarters in London's Canary Wharf. CEO Nik Storonsky emphasized the company's commitment to flexibility in a LinkedIn post: "We care more about what you do than where you do it. The great work of our employees is what's made Revolut successful." The fintech, which employs over 10,000 people across 23 countries, allows staff to work entirely from home and spend up to 120 days per year working abroad. The move contrasts sharply with the recent return to office policies from traditional banks like JPMorgan Chase and Barclays. Revolut's new London headquarters is set to open in May.

Source: Global Fintech Insider

🇺🇸 Frank Founder Says JPMorgan Had Buyers Remorse After Spending 175M To Buy Millions of Fake Users

The criminal trial of Charlie Javice, founder of college financial aid platform Frank, began Thursday with her lawyer arguing JPMorgan Chase's fraud allegations were just "buyer's remorse." Frank, founded in 2017, was acquired by JPMorgan for $175 million in 2021. Prosecutors allege the 32-year-old founder deceived the bank by claiming Frank had 4.25 million customers when it only had about 300,000. Javice's lawyer Jose Baez pleaded that JPMorgan conducted thorough due diligence and only claimed fraud a year later when financial aid regulations changed. The prosecution claims Javice and her chief growth officer Olivier Amar purchased fake student data to inflate user numbers. JPMorgan CEO Jamie Dimon has since called the acquisition a "huge mistake."

Source: Reuters

🇨🇦 Fintech Seed Fund Holt Xchange Takes Unusual Path By Embracing Equity Crowdfunding

In an uncommon move for a VC fund, micro fintech seed fund Holt Xchange has turned to Canadian equity crowdfunding platform FrontFundr to raise capital, securing $7.5 million out of a $10 million target, with a $20,000 minimum investment. The decision to go after smaller tickets comes amid a challenging fundraising environment in Canada, where new VC funds often struggle to access traditional institutional capital. The fintech-focused fund, which has invested in 30 companies across 10 countries, has seen its portfolio companies, such as islamic finance platform Manzil and insurance claims monitoring platform Owl.co, raise a total of $250 million. In a January LinkedIn article, founding partner Jan Christopher Arp (the guy with the bow tie on the front right of the picture) explained how the fund generates additional revenue through corporate partnerships and extra equity stakes obtained in return for services provided to portfolio companies.

Source: Global Fintech Insider

Upcoming Fintech Events

🇬🇧 Finovate Europe will be held in London on February 25-25, 2025 (2,399 USD), with speakers such as Joris Hensen, co-lead of co-lead Deutsche Bank API Program & Joanne Phillips, managing director for Aviva Direct Wealth.

🇺🇸 The Bank Automation Summit will be held in Austin on March 3-4, 2025 (633 USD), with speakers such as Michael Lehmbeck, CTO at BankUnited and Koren Picariello, head of generative AI strategy for Morgan Stanley Wealth Management.

🇯🇵 The GFTN Forum Japan will take poace in Tokyo from March 3-7, 2025 (350 USD), with speakers such as Doug Feagin, President of Ant International & Kenneth Gay, Chief Fintech Officer of the Monetary Authority of Singapore.

🇺🇸 Fintech Meetup will take place in Las Vegas on March 10-14, 2025 (2,800 USD), with speakers such as Leif Abraham, co-CEO of Public.com & Misha Esipov, CEO of Nova Credit.

🇨🇦 The Canadian Fintech Summit will be held in Toronto on April 8th, 2025 (221 USD), with speakers such as Darcy Tuer, CEO of ZayZoon and David Nault, GP at Luge Capital.

🇩🇪 FIBE Fintech Berlin will be held in Berlin on April 9-10, 2025 (1,204 USD), with speakers such as Dan Schulman, former CEO of PayPal & Hélène Falchier, partner at Portage Ventures.

🇺🇸 Stablecon will take place in New York on May 29, 2025 (1,295 USD), with speakers such as Cuy Sheffield, Head of Crypto at Visa and Edward Woodford, CEO & Co-Founder of Zero Hash.

Who Am I?

Hi, my name is Julien Brault.

From 2017 to 2024, I was the CEO of Hardbacon, a fintech I co-founded, which reached 400,000 unique visitors at its peak.

A Google update ultimately sealed the company’s faith and I started this newsletter to keep myself busy in the aftermath.

I’m now product manager for Beeye, an AccountingTech SaaS.

Why share this?

Because my goal is to use my experience as an economic journalist, fintech entrepreneur and product manager to present the most essential fintech news from around the world through the eyes of an insider.

If you like what I do, feel free to share this newsletter and follow me on Linkedin.