Chime CMO Says AI Tools Slashed Campaign Production Time by 60% and Eliminated Agency Retainer

We're also Moneybox's rebrand 🇬🇧, Optasia landing biggest South African IPO of the year 🇦🇪, Munich Re killing its profitable VC arm 🇩🇪 & Starling landing Scotiabank's Tangerine 🇬🇧.

🇺🇸 Digital Bank Chime Slashes Ad Costs by Millions, Replaces Agency With AI Tools

US-based Digital bank Chime has slashed ad production time by 60% and eliminated its creative agency retainer by leveraging AI tools, according its CMO Vineet Mehra.

The fintech reduced campaign turnaround from 10 weeks to four weeks by using AI tools such as Midjourney, Runway, and Veo3, with no additional headcount, saving millions in agency costs over the coming years.

“Our first AI-assisted brand campaign was storyboarded and edited using these tools, all in-house. It was probably the best storyboard as a CMO I’ve ever seen. It was almost like watching a movie,’’ Mehra told Business Insider in an interview.

He also explained that in a world where everyone has access to the same AI machines and algorithms, “the company that wins is going to be the company with a brand story that’s different.” he said in the same interview.

Beyond marketing, AI has transformed Chime’s operations with AI now handles 70% of customer support interactions (cutting costs 60% per interaction), powers a custom content GPT that reduced production costs 30%, and runs SPARKI, an internal research tool trained on years of consumer data that gives employees instant insights.

Source: Business Insider

🇺🇸 Need a Chief Risk Officer but Can’t Justify the Full-Time Hire? Matthew Komos Has the Solution

SPONSORED - When risk oversight starts stretching your bandwidth, OGMA Risk & Analytics steps in. Founded by Matthew Komos, former VP at TransUnion and 25-year risk management and analytic veteran, OGMA delivers fractional CRO expertise to fintechs and financial institutions.

Their Fractional Chief Risk Officer and Risk Department On Demand programs give immediate access to top-tier risk leadership, analytics, and compliance expertise without the full-time cost. Whether you’re scaling, facing regulatory scrutiny, or building your governance framework, OGMA embeds seamlessly with your team to bring structure, clarity, and control.

Because in a fast-moving market, managing risk shouldn’t slow your growth: it should drive it.

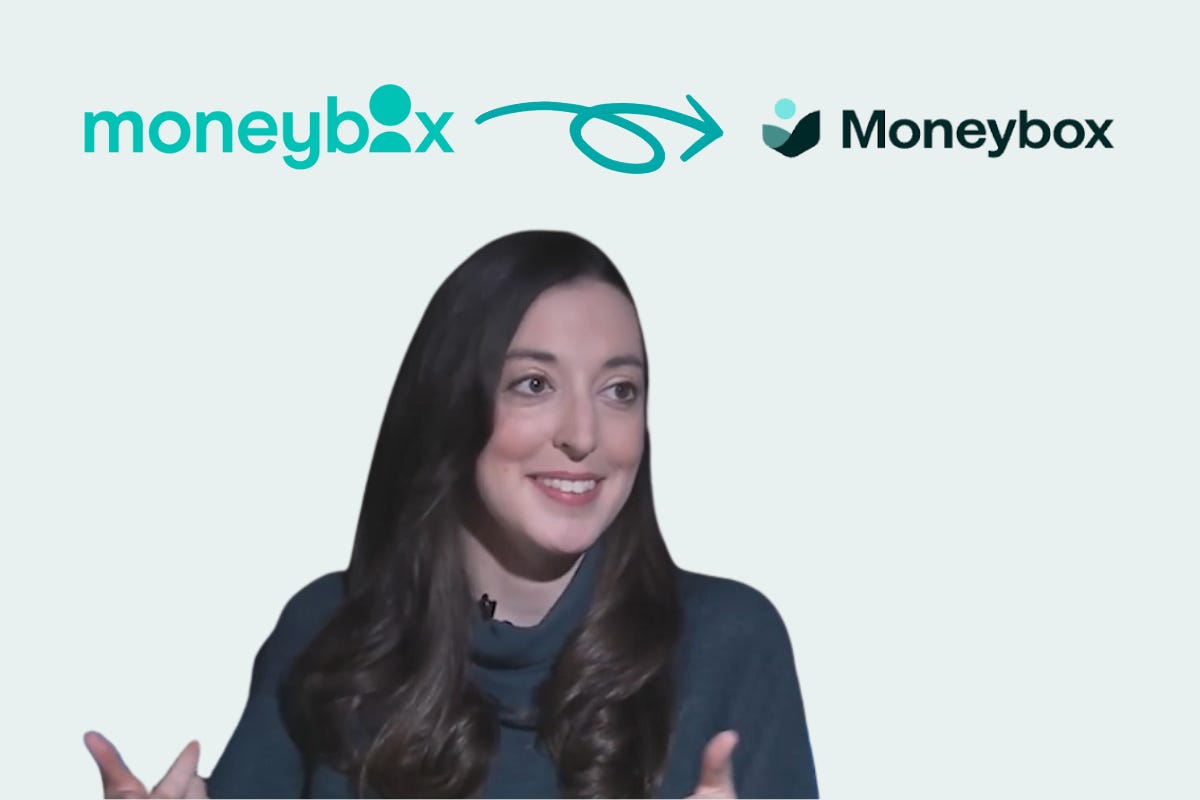

🇬🇧 British Savings App Moneybox Rebrand To Widen Its Mass Market Appeal

UK Savings app Moneybox rebranded to be seen as more than a savings app. The app, whose initial value proposition was to round up their customers purchases and invest the spare change (like Acorns does in the US), has moved into financial planning and wealth management over the years, and now serves 1.5 million customers and hold £16 billion ($21 billion) in assets.

The rebrand, which has been qualified as ”evolution, not revolution,” by Marketing VP Charlotte Oates, includes updated visuals and a TV campaign demonstrating how Moneybox serves users throughout their lives, from purchasing their first home to retirement.

“We now see ourselves breaking a binary between traditional wealth managers, who have established businesses for decades, and smaller fintechs and neobanks. We’re trying to do wealth building for the mass market,” Oates told MarketingWeek in an interview.

The company exploited early-mover advantage in performance marketing, building app-first when mobile ad space was much cheaper than desktop’s.

Source: MarketingWeek & Global Fintech Insider

🇺🇸 Neobank Current Hits 70% Revenue Growth With Its Home-Built Banking Core

US-based neobank Current has posted over 70% year-over-year revenue growth and crossed six million users. This is driven largely by its decision to build its own banking infrastructure rather than rely on third-party providers.

Founded in 2015 by Stuart Sopp and Trevor Marshall, Current’s custom banking system allows faster product launches, tighter feature integration, and stronger unit economics compared to competitors using off-the-shelf banking platforms, according a statement by the bank cited by Axios

Current’s strategy of focusing on the 67% of US workers living paycheck to paycheck according to a 2025 PNC survey, is paying off.

Current is now expanding its offering with three new products which is Current Max (a $10 per month plan with savings boosts and rewards), Pay Anyone (instant transfers to any phone number), and fee-free overdraft coverage on small purchases via the Build Card.

Source: Axios

🇦🇪 Dubai’s latest Billion Dollar Company Eyes Global Expansion After $1.4B Johannesburg IPO

Dubai-based AI embedded finance company Optasia Group is targeting expansion in Africa, Asia, and Latin America after debuting on the Johannesburg Stock Exchange at a $1.4 billion valuation.

CEO Salvador Anglada said the company will widen its credit offerings to include buy-now-pay-later options and virtual credit, while considering acquisitions in Asia or Latin America to accelerate growth.

“If we find the right company that helps us accelerate growth, we will consider it,” Anglada told Bloomberg in an interview.

Optasia closed its share sale at 19 rand per share with 1.24 billion shares issued, giving it a market value of 23.5 billion rand ($1.4 billion), the biggest South African IPO for the year.

Founded in 2012, Optasia operates in 38 countries across Africa, the Middle East, and Asia. The company assesses creditworthiness to offer microloans and cash advances to underbanked customers.

Source: Bloomberg

🇬🇧 UK’s Neobank Starling Wins First North American SaaS Client With 10-Year Deal with Canada’s Tangerine

UK neobank Starling has secured its largest Software-as-a-Service deal to date with Canadian digital bank Tangerine.

The 10-year agreement will see Starling provide its banking platform, Engine, to support over 2 million Tangerine customers as the bank embarks on a “new phase of growth”, Raman Bhatia, Starling Group CEO said in a LinkedIn post.

Tangerine is a wholly-owned subsidiary of Scotiabank, one of Canada’s “Big 5” banks.

Tangerine becomes Engine’s first North American client following the company’s expansion into the region earlier this year with new offices in New York and Toronto, and the appointment of Jody Bhagat as North American President, according to a Linkedin post by Starling accompanying the announcement of the deal.

Source: Global Fintech Insider

🇩🇪 German Insurance Giant Latest to Shutter Corporate VC Arm To Invest in In-House Innovation

German insurance giant Munich Re is shutting down its corporate venture capital unit, despite multiple unicorn investments, to invest more in innovation interanally.

Munich Re Ventures, led by Jacqueline LeSage, managed $1.2 billion in assets with over 40 staff and invested in nearly 100 companies. Its portfolio included reinsurer Hippo, machine health detection firm Augury, and Next Insurance, which Munich Re itself acquired for $2.6 billion earlier this year.

The venture activities will be absorbed by MEAG, Munich Re’s asset management arm, with a small team remaining in San Francisco to manage existing assets through Q2 2026.

The shift, according to Global Corporate Venturing, is likely linked to a leadership transition, with CFO Christoph Jurecka set to succeed Joachim Wenning as board chair in early 2026.

Source: Global Corporate Venturing

🇺🇸 Direct-to-Investor Platform Raises $20M to Help Founders Tap Their Own Communities for Capital

US based fundraising platform DealMaker has raised $20 million in new financing to expand its infrastructure for direct-to-investor capital raising.

Co-founder Mat Goldstein framed the raise as validation of a broader shift in how founders are increasingly turning to their own customer communities rather than relying solely on venture capital.

“The data backs it up. Retail-first raises deliver faster closes, higher retention, and real distribution leverage. Companies that build investor communities early compound that advantage with every subsequent round,” he wrote in a Linkedin post.

According to an interview with Goldstein and CEO Rebecca Kacaba to Forbes, the co-founders said the new funding will accelerate its platform development, including AI tools to automate investor verification and streamline compliance.

DealMaker has processed over $2.4 billion across 1,000+ retail-driven raises, including campaigns for the Green Bay Packers and EnergyX. The round was led by Information Venture Partners, with participation from CIBC Innovation Banking.

Sources: Global Fintech Insider & Forbes

Upcoming Fintech Events

🇺🇸 Banking Transformation Summit will be held in Charlotte on November 17–18, 2025 ($2,280), with speakers such as Darius Wise (President & CEO, Red Rocks Credit Union), Priya Singh (Lead Data Scientist, Mastercard), and Rene Schuurman (Director – CashPro Product Manager, Bank of America).

🚨 GFI Exclusive Offer: Enjoy a 20% discount on tickets using the GFI20 promo code!

🇲🇾 Digital Finance Asia Summit – Malaysia will be held in Kuala Lumpur on November 18, 2025 (Price TBC), with speakers such as Sam Majid (CEO, National AI Office Malaysia), Nic Ngoo (CTO, Ryt Bank), and Farhan Ahmad (Group CEO, Payments Network Malaysia – PayNet).

🚨 GFI Exclusive Offer: Enjoy a 20% discount on tickets using the #GlobalFinDFA promo code!

🇩🇪 Banking 4.0 and Banking Innovation Conference will be held in Berlin on November 20–21, 2025 (€1,299–€4,999), with speakers such as Kamini Belday (Head of Global Payments & Transformation Executive, IBM), Sonja Marjanovic Vucic (Chief Data Officer, NLB Banka a.d. Banja Luka), and Nicole Onuta (AI Business Transformation Strategist, ING).

🚨 Save €100 on tickets using the promo code RQM8TEFV!

🇺🇸 RegTech Summit NYC will be held in New York City on November 20, 2025 ($995.50), with speakers such as Kenneth Lamar (Principal Partner, Lamar Associates LLC), Kristi Kunworee Baishya (AVP – Data and AI Product Management, Nomura Holding America), and Sepehr Irandoost (Head of Global Surveillance Calibration and Effectiveness, Bank of America).

🚨 GFI Exclusive Offer: Enjoy a 15% discount on tickets using the GFI15 promo code!

🇬🇧 Fintech Connect will be held in London on December 2–3, 2025 (£299), with speakers such as Aleksi Grym (Head of Fintech, Bank of Finland), Apoorv Kashyap (Head of AI, Santander UK), and Ben Brophy (Head of Institutional Growth, Europe, Solana).

🚨 GFI Exclusive Offer: Enjoy a 20% discount on tickets using the AAA-PTN20 promo code!

🇨🇳 Insurtech Insights Asia will be held in Hong Kong on December 3–4, 2025 ($299–$1,999), with speakers such as Huynh Thanh Phong (Group CEO, FWD), Edward Moncreiffe (CEO, Insurance, HSBC Life), and Masashi Namatame (Group Chief Digital Officer, Tokio Marine).

🚨 GFI Exclusive Offer: Enjoy a 25% discount on tickets using the GFI25 promo code!

Who Am I?

Hi, my name is Julien Brault.

From 2017 to 2024, I was the CEO of Hardbacon, a fintech I co-founded, which reached 400,000 unique visitors at its peak.

A Google update ultimately sealed the company’s fate, and I started this newsletter to keep myself busy in the aftermath.

I then launched an another fintech affiliate site called MooseMoney, but I still find the time to publish this newsletter weekly.

Why share this?

Because my goal is to use my experience as an economic journalist, fintech entrepreneur and product manager to present the most essential fintech news from around the world through the eyes of an insider.

If you like what I do, feel free to share this newsletter and follow me on LinkedIn, X, Reddit, YouTube & TikTok.

If you would like me to accompany you on your fintech entrepreneurship journey and provide you with ongoing feedback, feel free to hire me as coach on MentorCruise.

If all you need is to pick my brain on specific topic in the field of fintech marketing, product or strategy, feel free to book a one hour consulting call with me instead.

P.S : Once you refer a new subscriber to the newsletter using your unique share link, you'll receive a personalized social media shout-out from me to promote your work or professional profile. Just write to me at jrbrault@icloud.com once your referral is confirmed on our leaderboard and include your social media account(s) URL(s) and who you are.