🇬🇧 UK FinTechs Wise & Cleo Ready To Snap Up H-1B Talent Priced Out by Trump's Visa Crackdown

We're also covering a Google-approved scam involving 2 fintechs 🇬🇧, Plaid bowing to JPMorgan open banking fees 🇺🇸, Coinbase taking a shot at Canadian banks 🇨🇦 & SumUp eying a $15B IPO 🇬🇧

🇬🇧 UK FinTechs Wise & Cleo Ready To Snap Up H-1B Talent Priced Out by Trump's Visa Crackdown

UK fintechs are snapping up top talent priced out of the US under Donald Trump’s immigration crackdown.

London-based Cleo, an AI powered personal finance assistant, immediately posted 100 open roles with full visa sponsorship and relocation support. CEO Barney Hussey-Yeo pitched the move directly to displaced candidates. “If that’s you, we want to help. Sometimes the best opportunities come from unexpected changes,’’ he wrote on a LinkedIn post.

Global payments platform Wise is making a similar play. In a LinkedIn post, senior analytics manager Ken L. said Wise believes “talent knows no borders” and posted that the company is seeking a Lead Product Analyst to be based in the UK. Andrew Chau, CEO of Canadian neobank Neo Financial, also posted on LinkedIn, hoping to convince impacted data scientists and engineers to join his company.

The Trump administration imposes a $100,000 fee on all new H-1B visa applications from September 21, which is a staggering increase from the previous fee of just $215. The H-1B visa programme, created in 1990, has long been the backbone of America’s tech labour force. Roughly 65% of approvals in 2023 went to computer-related roles, with Indian and Chinese workers making up more than 80% of beneficiaries.

Sources: Global Fintech Insider

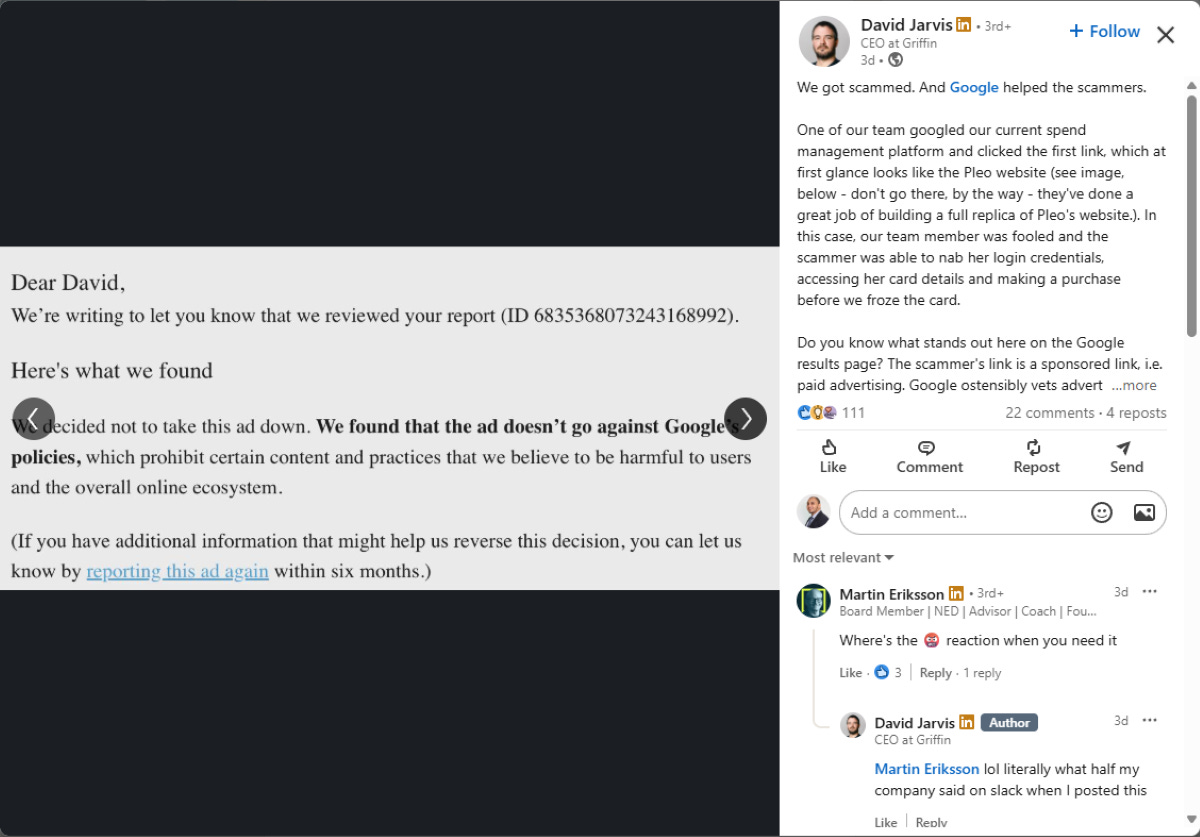

🇬🇧 Fintech CEO Says Google-Approved Scam Ad Shows Why UK Must Regulate Big Tech

The CEO of UK banking platform Griffin says his company’s run-in with a Google-approved scam ad shows why Britain’s fintech sector is demanding urgent regulation of big tech.

David Jarvis (pictured above) revealed that an employee fell victim to a phishing scam after clicking a paid Google ad impersonating spend management platform Pleo. The fraudsters captured login credentials and made a purchase before the card was froze.

“Google ostensibly vets advertisements before they go up, so they already reviewed this scam and decided to approve it. This is already really poor behaviour from Google, who should have caught it”, he wrote on a LinkedIn post

He added that when the fraud was reported, Google dismissed the complaint, saying the scam ad “did not violate its policies.”

Jarvis argues that this incident shows how tech giants shirk responsibility for their role in the fraud ecosystem, while profiting from sponsored ads that enable scams.

Not everyone agreed. John Graves, senior counsel at human risk management firm Nisos, commented under Jarvis’ LinkedIn post that scams like these are “whack-a-mole” and the real lesson lies in company practices. “DON’T SEARCH the login site. Bookmark it, have a company portal that has authorized sites, etc. It’s a human error/point of failure,” he said.

Source: Global Fintech Insider

🇺🇸 The Banks Have Won As Plaid Bends The Knee To JPMorgan Chase

Open banking mourning period in the US is officially over.

US data aggregator Plaid has agreed to pay JPMorgan Chase for customer data access in an undisclosed settlement, ending years of free data sharing that powered fintech innovation. The settlement keeps Chase customers connected to third-party apps, but at a cost that will almost certainly be passed down to consumers.

In a joint statement posted on JPMorgan's website, both companies committed to helping customers "safely and securely” access to their preferred financial products.

The statement was signed by Melissa Feldsher, Head of Consumer Payments at JPMorgan Chase, and Plaid's COO Eric Sager (pictured above). In another report by Payment Dive, the portal cited Plaid spokesperson Freya Petersen who stated that the agreement is "very custom" to Plaid and JPMorgan and extends a deal the companies have had since 2018.

The agreement comes nearly a year after the Biden-era Consumer Financial Protection Bureau (CFPB) introduced a rule last October, requiring banks and card issuers to provide free access to customer financial data and transfer it on request. Trump’s second administration has since frozen the CFPB’s work, halting new rules.

Last July however, JPMorgan Chase send pricing sheets to data aggregators, including Plaid and MX, outlining new charges for accessing customer bank account information. The pricing plans then sparked backlash, with over 80 fintech CEOs signing an open letter urging President Donald Trump to block the "account access" fees planned by America's biggest banks.

Source: Global Fintech Insider

🇨🇦 Coinbase CEO Bet That Canadians Will Move Their Savings Over to His Crypto Exchange Thanks To Its 4.5% Yield Offer

US-based Crypto exchange platform Coinbase is taking on Canada’s big banks with a stablecoin savings account-like product that pays up to 4.5% on USDC balances. “The interest rate for most chequing accounts is 0% in Canada. That makes zero sense,” said Coinbase CEO Brian Armstrong in an X post, seemingly referring to the low digits interest indeed offered for chequing accounts held at Canada’s Top Six Banks, which account for over 90% of all banking assets in Canada.

From September 16, 2025, Coinbase will pay Canadians a 4.1% annual interest rate on all USDC holdings, paid weekly, with Coinbase One subscribers receiving 4.5%. Coinbase One is priced starts at 4.99 CAD (3.61 USD) per month for the basic plan, 29.99 CAD (21.70 USD) per month for the mid-tier, and 299.00 CAD (216.39 USD) per year for the premium plan, with the 4.5% rate applied up to $10,000, $30,000, and unlimited balances, respectively. Funds remain fully accessible with no lockups.

In a blog post, Coinbase framed the move as an alternative to GICs and savings accounts, which it argued are being eroded by inflation. The company also cited research from market research firm Angus Reid that shows 83% of Canadians want the global financial system overhauled, and 91% believe big banks prioritize profit over customer success.

Source: Global Fintech Insider

🇺🇸 Startup Founders Can Score Free Fundraising Advice From CEO By Switching to Bolt Payments

Startup founders can get free fundraising advice from Ryan Breslow (pictured above), CEO of US checkout and payments company Bolt, if they switch to his platform.

Breslow said founders who confirm they’ve moved their payments to Bolt will receive 30 minutes of personalized feedback on their fundraising deck and strategy. “Founders have given me significant advisory shares in exchange for my feedback on their deck/fundraising strategy. Today, I come to you with a special offer. If you switch your payments to Bolt, I’ll do it for free,” he wrote on a LinkedIn post.

"As a founder myself many times over, I can empathize with how important having a trusted partner is for payments/checkout with fair rates, reliable support, and high conversion," Breslow wrote in another LinkedIn post.

Source: Global Fintech Insider

🇺🇸 African Diaspora Remittance App Bags $22M To Grow In Canada, UK and Europe

US-based fintech Kredete has raised $22 million in new funding to expand its credit-building platform for African immigrants residing in Canada, the UK, and Europe. Founded in 2023 by Adeola Adedewe (pictured above), the startup combines remittances with a credit-building product, enabling transfers to over 30 African countries. It also helps users build credit histories in host nations by reporting their remittance activity to credit bureaus.

The fresh capital will fund both geographic expansion and new products, including rent reporting, credit-linked savings plans, and goal-based loans aimed at thin-file or no-file immigrants. The company is also preparing to launch Africa’s first stablecoin-backed credit card across 41+ countries, alongside USD and EUR interest-bearing accounts. Since launch, Kredete has reached 700,000 monthly users, processed $500 million in remittances, and lifted users’ U.S. credit scores by an average of 58 points.

The Series A funding round was led by AfricInvest (via the Cathay AfricInvest Innovation Fund and Financial Inclusion Vehicle), with participation from Partech and Polymorphic Capital, bringing total funding to $24.75m. Kredete is carving out a niche serving Africa’s diaspora, a space also targeted by South Africa’s Mukuru and UK-based LemFi.

Sources: Global Fintech Insider & Nairametrics

🇬🇧 SumUp Eyes $15B IPO As It Plots Expansion Across Europe

UK payments firm SumUp is preparing an IPO that could value the company between $10 billion and $15 billion, according to the Financial Times.

The report cited sources who indicated that the company is in talks with banks and may list within the next year, considering both London and New York as options. According to another source familiar with SumUp’s operations, they believed the IPO could fund acquisitions of competitors and their expansion in new European markets.

SumUp last raised €590 million ($693 million) in 2022, achieving an €8 billion ($9.3 billion) valuation in a round led by Bain Capital. Founded in 2012 by CEO Daniel Klein (pictured above) and co-founder Marc-Alexander Christ, SumUp serves over 4 million customers across 36 countries. The company provides point-of-sale terminals, business accounts, and invoicing tools for small and medium-sized businesses.

Source: Financial Times

🇫🇷 PayPal + YC Backed French Startup's Plan to Build Europe's Answer to Modern Wealth Management

Paris-based all-in-one investment platform Finary has closed a €25 million ($29 million) Series B led by PayPal Ventures to scale its AI-driven wealth platform across Europe.

The funding will support new features including brokerage, savings, and retirement accounts, as well as an expansion of its premium Finary One service for clients with over €500,000 ($589,600) in assets. The startup also plans to add more than 50 hires to accelerate growth.

Finary is betting that AI can open up wealth tools once reserved for the ultra-rich. The push comes as €13.9 trillion ($16.39 trillion) in Europe sits in accounts earning below inflation. “In France alone, more than €2 trillion ($2.36 trillion), nearly a third of financial assets, are stuck in products that earn less than inflation,’’CEO Mounir Laggoune wrote on a LinkedIn post. The company has already moved into crypto investing and rolled out Finary Life, an insurance product built with BlackRock and Generali.

Founded in 2021 by Laggoune and Julien Blancher, Finary has built a 600,000-strong user base in France with its investment app. The Series B round also drew participation from Y Combinator, Speedinvest, LocalGlobe, Kima Ventures, and Hedosophia.

Source: Global Fintech Insider & EU-Startups

Upcoming Fintech Events

🇬🇧 Buy AND Build: The Future of Capital Markets Technology will be held in London on October 2, 2025 (£360), with speakers such as David Marcos, CIO & Head of AI, IO Capital Group, Richard Bell, Head of Engineering at CoinShares, and Jon Butler, Co-Founder & CEO at Velox.

🚨 GFI Exclusive Offer: Enjoy a 15% discount on tickets using the GFI15 promo code!

🇩🇪 Sibos will take place in Frankfurt from September 29 to October 2 ($1,180.90 for fintechs), with speakers such as Victoria Cleland, Director of Payments at the Bank of England & Sophie Gilder, Managing Director, Blockchain & Digital Assets at Commonwealth Bank.

🇸🇬 TOKEN2049 Singapore will be held in Singapore on October 1–2, 2025 ($499–$4,999), with speakers such as Vlad Tenev (Chairman and CEO, Robinhood), Bryan Johnson (Founder and CEO, Blueprint / Don’t Die), and Donald Trump Jr. (Co-Founder, World Liberty Financial).

🇬🇧 Buy AND Build: The Future of Capital Markets Technology will be held in London on October 2, 2025 (£360), with speakers such as Jon Butler (Co-Founder & CEO, Velox), Dan Schleifer (President & Co-Founder, Interop.io), and Steve Grob (Founder, Vision57).

🚨 GFI Exclusive Offer: Enjoy a 15% discount on tickets using the GFI15 promo code!

🇺🇸 LEND360 will be held in Dallas on October 6–8, 2025 ($2,599–$2,999), with speakers such as Andrew Duke (CEO, Online Lenders Alliance), Chris Furlow (CEO & President, Texas Bankers Association), and Geoff Brown (CEO & Founder, Highline Technologies Inc.).

🇮🇳 Global Fintech Fest will be held in Mumbai on October 7–9, 2025 ($120–$240), with speakers such as Narendra Modi (Prime Minister of India), Nirmala Sitharaman (India’s Minister of Finance & Corporate Affairs), and Sanjay Malhotra (Governor, Reserve Bank of India).

Who Am I?

Hi, my name is Julien Brault.

From 2017 to 2024, I was the CEO of Hardbacon, a fintech I co-founded, which reached 400,000 unique visitors at its peak.

A Google update ultimately sealed the company’s fate, and I started this newsletter to keep myself busy in the aftermath.

Why share this?

Because my goal is to use my experience as an economic journalist, fintech entrepreneur and product manager to present the most essential fintech news from around the world through the eyes of an insider.

If you like what I do, feel free to share this newsletter and follow me on LinkedIn, X, Reddit, YouTube & TikTok.

If you are raising funds for your fintech and would like to be featured in Global Fintech Insider for free, fill out this form.

P.S : Once you refer a new subscriber to the newsletter using your unique share link, you'll receive a personalised social media shout-out from me to promote your work or professional profile. Just write to me at jrbrault@icloud.com once your referral is confirmed on our leaderboard and include your social media account(s) URL(s) and who you are.

Good for them!