HBO Documentary Claims Bitcoin's Inventor Is Some Random Kid from Ontario, Canada 🇺🇸

We're also covering Stripe's crypto comeback 🇮🇪, a free Bloomberg killer 🇺🇸, Klarna's boardroom drama 🇸🇪, a crowdfunding site becoming an insurer 🇮🇩, Flinks founders' new venture 🇨🇦 & more

🇺🇸 HBO Documentary Claims Bitcoin's Inventor Is Some Random Kid from Ontario, Canada

The grand finale of HBO’s Money Electric: The Bitcoin Mystery, which was released on October 8, was a total joke. In the final scene, the director Cullen Hoback confronts Peter Todd (on the left), laying out his shaky theory that he is none other than the inventor of Bitcoin who hides behind the Satoshi Nakamoto pseudonym.

Listening to this nonsense, Todd cannot stop laughing, while Blockstream CEO Adam Back (on the right), whose claim to fame is being quoted in Nakamoto's seminal 2008 whitepaper, can’t help but display an increasingly amused smile. Last night, when watching the documentary for the first time, I was laughing too. (For those interested, it’s streaming on Crave in Canada, on Max in the US and on NOW TV in the UK.)

So here are the “evidences” laid out by the documentarist in favour of Peter Todd being Nakamoto:

The documentary claims Todd accidentally posted under his own name in a 2010 BitcoinTalk forum discussion, forgetting to switch back to Nakamoto’s account, based on a reply that does not sound like a reply: “Of course, to be specific, the inputs and outputs can't match exactly if the second transaction has a transaction fee,” he wrote.

Nakamoto’s spelling indicates that he might have been educated in Canada or the UK”, spelling words like “favour” or “neighbour” with a 'u'. Since Todd is Canadian, he fits the bill spelling-wise.

Todd once joked about being an expert in sacrificing bitcoins, which Hoback interpreted as a possible reference to Satoshi’s unspent 1 million BTC stash, which would be valued at almost 70 billion USD today.

The funny thing about this is that I did comment about losing some bitcoin (don’t worry, it was a tiny fraction of a Bitcoin) in the past and do spell “favour” with a 'u', so I guess I could be Nakamoto, too, based on Hoback’s arguments… except I never interacted with Nakamoto on BitcoinTalk :)

Despite its ridiculous finale, the movie was a good overview of the ups and downs of Bitcoin since inception and included some interesting footage of El Salvador’s self-proclaimed “world’s coolest dictator” making Bitcoin legal tender in his country, as well as multiple interviews with “bitcoin ambassador” Samson Mow, who is in the strange business of flying private around the world to convince world leaders to embrace Bitcoin. Unfortunately, Cullen Hoback never asked him how he makes money doing that.

Following the documentary’s release, Peter Todd denied being Nakamoto, and posted on X that the documentary’s conclusion was dangerous: “This nonsense is a genuine danger, as crazy people might try to get my non-existent fortune. But it's also hilarious.” Samson Mow, for his part, noted that “perhaps Peter is too clever for his own good”, referring to his tongue-in-cheek reactions to the documentarist’s allegations, where he kept saying stuff like “Sure, I am Satoshi Nakamoto” and “If I were Satoshi Nakamoto...”.

Source: Global Fintech Insider

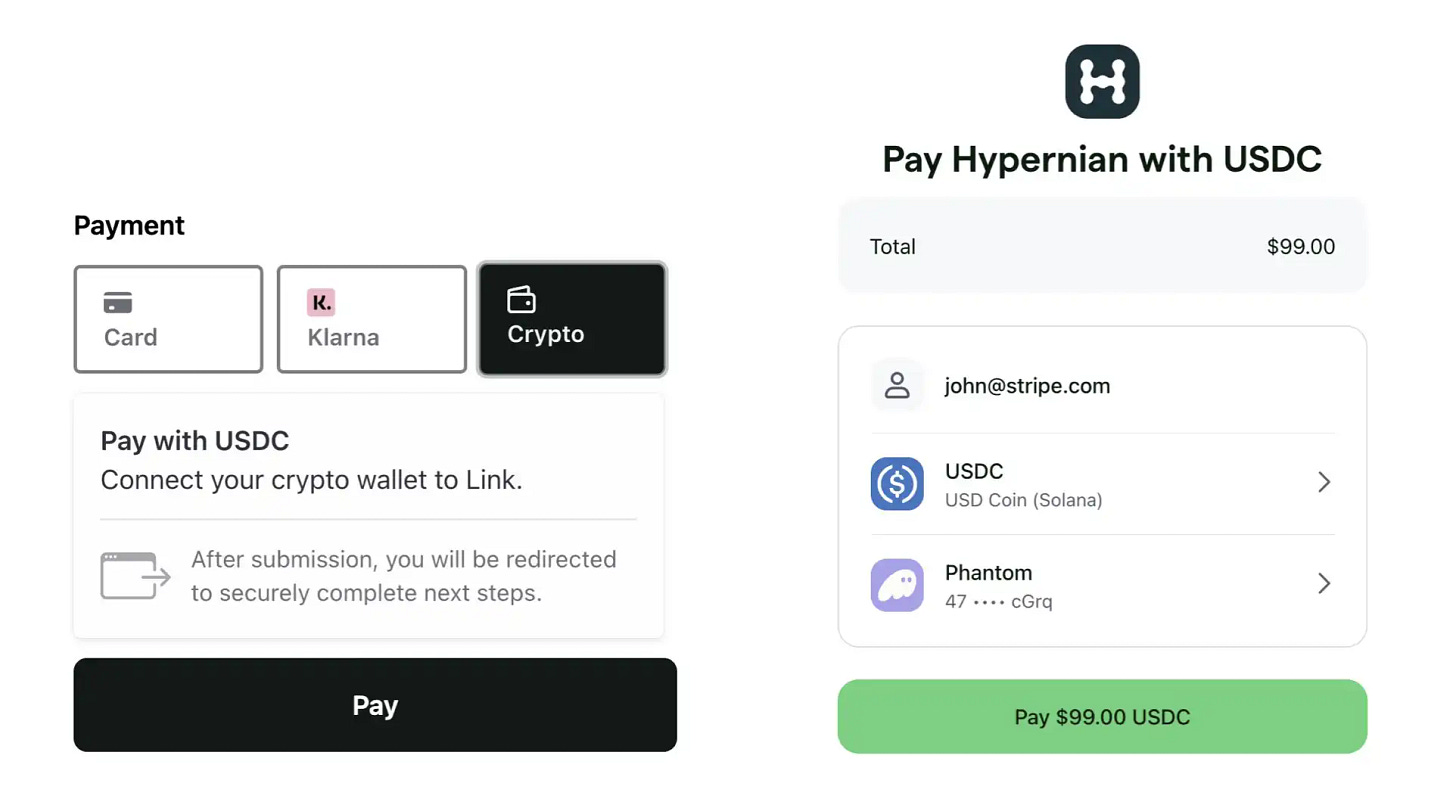

🇮🇪 Stripe Lets Merchants Accept Stablecoins in 150 Countries

Payment processor Stripe relaunched stablecoin payments on October 9. According to Bloomberg, within 24 hours of the relaunch, consumers from no less than 70 countries have made purchases in stablecoins. US merchants accepting USDC through Stripe receive payments in USD. This marks Stripe’s return to crypto after suspending Bitcoin payments in 2018 due to slow processing times. Product lead Jeff Weinstein noted on X that Stripe's crypto offerings allow businesses to "accept stablecoins from 150+ countries" and can be accepted at checkout and soon for subscriptions.

Stripe's move aligns with growing interest in stablecoins, as companies like Visa expand into the space. Jay Shah, Stripe’s head of product, said the feature helps lower costs for merchants, during a presentation in New York covered by Bloomberg. Stripe's president of product and business Will Gaybrick told Axios that “crypto protocols are faster and cheaper than existing payment protocols,” but noted the challenge of consumer adoption, describing it as a “chicken-and-egg” problem. However, he believes that increased adoption in developing countries could drive wider usage in the West.

🇳🇴 Ex-McKinsey Consultants Raise $2.8 Million to Automate Market Research

Norwegian startup Economic Mind, founded by former McKinsey and BCG consultants Jens Martin Dahlum, Aksel Reiten, Nikolai Bratsberg, and Gard Rystad, has raised 30 million NOK (2.8 million USD) to develop what they call a “digital twin of the global economy”. The platform, which already has 50 early users, aggregates companies' and market data to automate market analysis. Backed by investors like SNÖ Ventures and Rystad Energy, the founders plan to expand globally from their home base in Oslo, starting with London and New York. If you’d like to test this out, Economic Mind CEO Gard Rystad wrote on Linkedin that he’s down to demo the platform to anyone that reaches out.

Source: Finansavisen

🇺🇸 Bloomberg Killer Startup OpenBB Launches a Free Version

OpenBB has launched a new free version of its investment research platform that competes with the Bloomberg Terminal. The new free product, called OpenBB Terminal, is a web-based platform providing access to over 100 financial data sources and AI-powered tools, customizable for individual users. This free product, however, lacks some features offered to OpenBB’s Terminal Pro customers, such as pre-built database integrations, an Excel add-in, and enhanced security. With this free platform, OpenBB is pursuing a product-led strategy to attract users who may later upgrade to its enterprise offering.

Source: TechCrunch

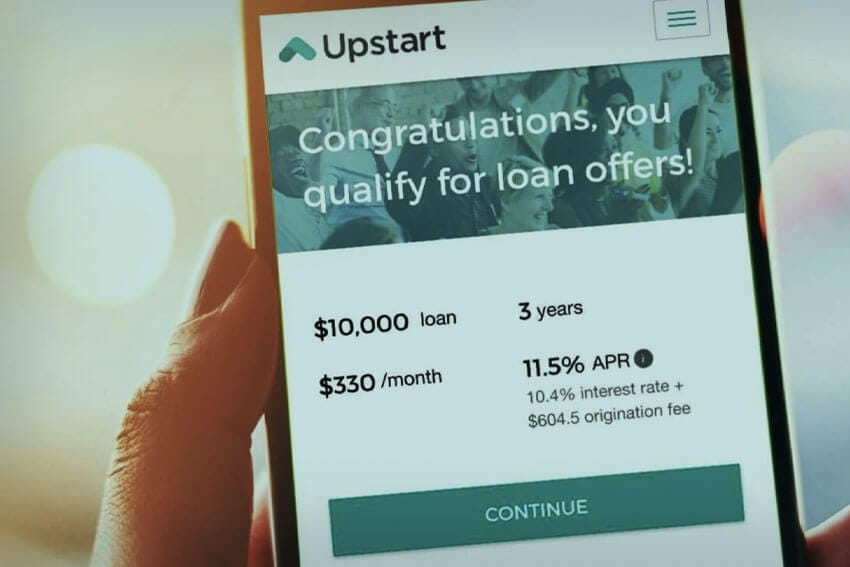

🇺🇸 Digital Lender Upstart Offloads $1.7 Billion in Future Consumer Loans

Digital lender Upstart has entered into an agreement with Blue Owl Capital, committing to sell up to $2 billion in consumer installment loans. This deal includes $290 million in personal loans that have already been issued and will be completed over the next 18 months through a forward-flow agreement. This shift marks a departure from Upstart's previous strategy of selling loans to banks, which have recently shown a decreased appetite for such assets. Instead, private equity firms are stepping in to acquire these loans. Alongside Blue Owl, Upstart has also engaged with other private credit partners, including Castlelake LP, Eltura Capital Management, Centerbridge Partners, and Ares Management.

Source: Bloomberg

🇫🇷 Insurtech Qantev Raises $33M For Its AI-Powered Health & Life Claims Platform

Paris-based insurtech Qantev has raised €30 million (33 million USD) in a funding round led by Blossom Capital, with participation from Elaia, Omnes, and Raise Venture. Founded in 2019 by current CEO Tarik Dadi, Qantev’s AI-driven platform automates medical claims processing for health and life insurers, helping reduce costs and improve services. The company plans to use the funds to enhance its platform, expand its team, and drive global growth. Currently, Qantev serves clients in 12 countries, including the US, Mexico, and across Asia, with teams based in Paris, Hong Kong, and the UK.

Source: Tech.eu

🇨🇦 Canadian Open Banking Millionaires Are Launching Deck, a Global Platform to Fetch Any Customer Data

Flinks co-founders Frédérick Lavoie and Yves-Gabriel Leboeuf, along with Flinks alumni Bruno Lambert and Julien Bélisle, have launched a new start-up called Deck. Flinks, a provider of bank account data similar to Plaid, but focused on the Canadian market, was sold to National Bank of Canada for 150 million CAD in 2021. Deck just raised 4.5 million USD from a handful of VCs and previous Flinks investors including Golden Ventures, Better Tomorrow Ventures and Luge Capital. Like Flinks, Deck use screen scraping to access customer data, but will go beyond banking to include utilities like electricity, telecom, and gas accounts. In a LinkedIn post, CEO Frédérick Lavoie explained Deck's mission: "We’re building the global infrastructure for user-permissioned data, unlocking a new era of personalized, secure, and innovative applications."

Source: Global Fintech Insider

🇮🇩 An Indonesian Crowdfunding Platform Reinvents Itself as a Sharia-Compliant Digital Insurer

Kitabisa, a donation-focused Indonesian crowdfunding platform similar to GoFundMe in the West, has launched Kitabisa Insurance, a sharia-compliant subsidiary aimed at tackling Indonesia’s low life insurance penetration, which stands at just 1.4%, significantly below neighboring countries like Singapore (12.5%) and Malaysia (3.8%). The company's first product, SalingJaga Keluarga, offers affordable sharia life insurance with premiums starting at 5,000 rupiah ($0.32) per month, providing coverage up to 2 billion rupiah ($127,844).

Source: Deal Street Asia

🇸🇪 Klarna CEO's $35 Billion Bonus Sparks Intense Boardroom Drama

The drama continue at Stockholm-based global BNPL provider Klarna. One of its board member, Mikael Walther, claims he was ousted due to his opposition to a controversial bonus plan that could potentially award CEO Sebastian Siemiatkowski up to $35 billion over the next years. In a letter to shareholders, Walther urged investors to vote against his removal at the upcoming Oct. 24 meeting, asserting that the bonus could cost Klarna $2 billion in direct cost. The conflict reflects ongoing tensions between co-founders Sebastian Siemiatkowski and Victor Jacobsson in the context of an upcoming initial public offering.

Source: Fortune

🇸🇬 Singapore Bank Introduces No Interest Credit Card for Clients with Bad Credit

Singapore-based digital bank GXS Bank has launched the GXS FlexiCard, a credit card that charges flat fees on outstanding balances instead of traditional compounding interest, targeting consumers with limited credit histories. Available to Singaporean citizens and permanent residents aged 21 to 55, the card offers a credit limit of S$500 with no income requirements for application. Cardholders can choose to pay their balance in full or make a minimum payment with a flat S$5 (3.83 USD) extension fee, while a late fee of S$50 (38 USD) that applies if the minimum payment is missed. The GXS FlexiCard also provides instant cashback on eligible transactions and waives foreign transaction fees.

Source: Fintech Singapore

Upcoming Fintech Events

🇬🇧 The Globalization of Open Banking conference will be held in London on Oct. 14th (free), with speakers such as Don Cardinal, CEO of Financial Data Exchange and Henk Van Hulle, CEO of UK’s Open Banking Ltd.

🇺🇸 Boston Fintech Week will be held in Boston Oct. 14th to 18th ($395), with speakers such as Chris Behling, Head of Risk Product Sales & Underwriting at Northwestern Mutual and Matt Harris, partner at Bain Capital Ventures.

🇺🇸 Money 20/20 will be held in Las Vegas Oct. 27th to 30th ($3999), with speakers such as Chris Britt, CEO of Chime and Daniela Amodei, president of Anthropic.

🇸🇬 The Singapore Fintech Festival will take place Nov. 6th to 8th, with speakers such as Kfir Godrich, Chief Innovation Officer at BlackRock and Richard Teng, CEO of Binance.

🇿🇦 The Africa Tech Festival will be held in Cape Town November 12-14 ($1,749), with speakers such as Kagiso Mothibi, CEO of MTN Fintech and Christian Kajeneri, director, payment systems at the National Bank of Rwanda.

🇬🇧 Fintech Connect will be held in London on December 4-5 ($325), with speakers such as Zahra Gill, Financial Crime Strategy Lead at Starling Bank (!!!) and Anirudh Narla, Head of Product - Global Payments, Anti-Fraud & Wallet at Hopper.

Fintech’s Musical Chair

🇫🇷 Natalia Williams, former Chief Product Officer at Hootsuite, has been appointed Chief Product Officer at Qonto, an European neobank for SMBs.

🇺🇸 Eric Noll, former CEO of Stone Ridge Capital Partners, has been named CEO and President of FusionIQ, a cloud-based wealth management platform.

🇰🇷 Gyubin Kim, former product manager at eBay, has been appointed CEO of Toss Securities, the U.S. securities trading platform owned by Viva Republica.

🇳🇿 David Leach, former CEO of the inventory management software company Cin7, has been appointed CEO of JAVLN, an insurtech providing white label software to insurance companies.

🇬🇧 Bruce Carnegie-Brown, chairman of Lloyd’s of London, has been appointed chairman of the board of directors at Ebury, a UK-based payments group backed by Banco Santander.

🇺🇸 Nancy Gail Daniels, former Chief Revenue Officer, has been promoted to COO at Hyosung Americas, a B2B fintech software provider.

🇸🇬 Karthik Shenoy, former global head of financing & wealth technology at Credit Suisse, has been appointed head of platforms and transformation at Bank of Singapore.

🇸🇬 Ben Wong, who has been with Adyen since 2016, has been appointed General Manager for Southeast Asia and Hong Kong at the global payments platform.

Have some fintech news you think I should include in the Global Fintech Insider newsletter or heard some rumours you’d like me to look into? Drop me an email at: jrbrault@protonmail.com