JPMorgan Wants To Charge Fintechs For Open Banking Data That Was Supposed to Be Free 🇺🇸

Canadian PM's fintech portfolio exposed 🇨🇦, Mastercard exec tricks AI spammer 🇬🇧, Nuvei faces lawsuit 🇦🇺🇨🇦, X CEO quits before fintech launch 🇺🇸 & a new multilingual AI debt collector 🇪🇸

Hello Global Fintechers!

Just wanted to let you know that I'm going to take some vacation and will pause this newsletter for the next month! As a result, the next issue of Global Fintech Insider will hit your inbox on August 18! In the meantime, if you happen to live in the Northern hemisphere, I hope you'll do like me and enjoy long, sunny bicycle rides! And for those in the southern hemisphere, I'm sorry! Your favourite newsletter will be back shortly!

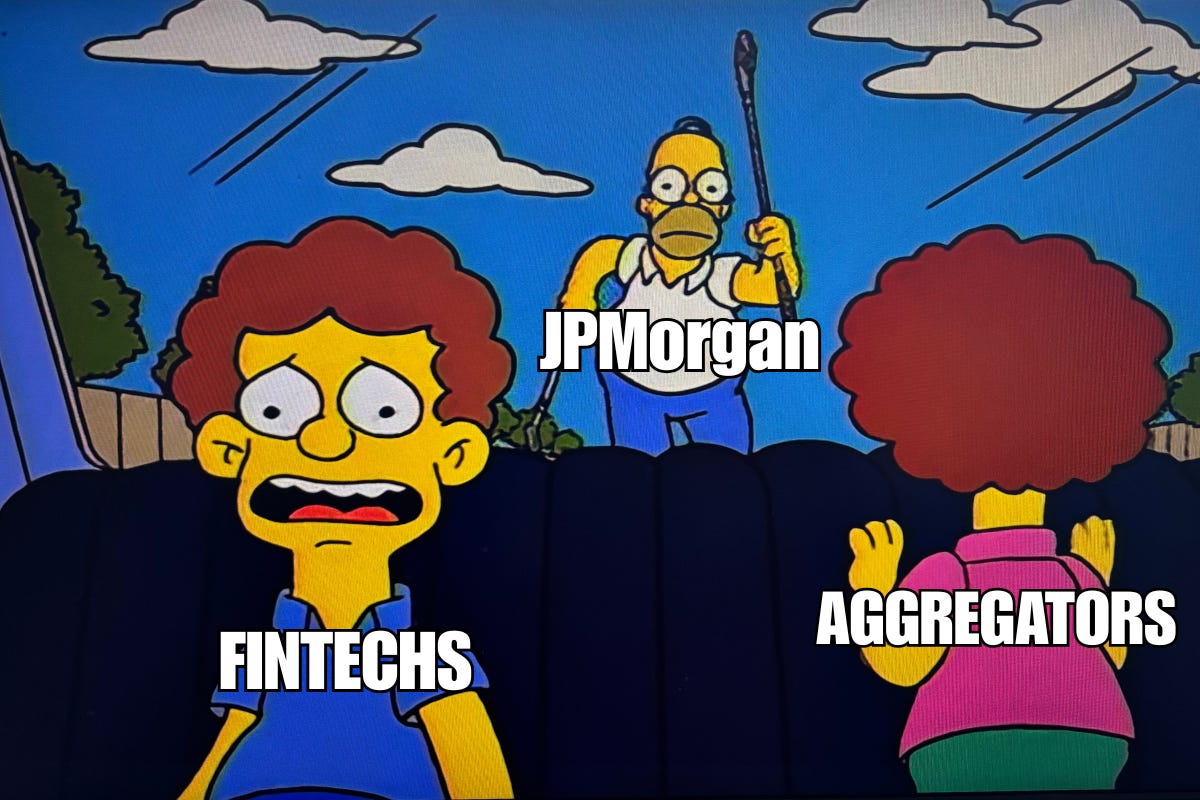

🇺🇸 JPMorgan Wants To Charge Fintechs For Open Banking Data That Was Supposed to Be Free

The last nail in the coffin of open banking in the US might just have been hammered last week when JPMorgan Chase sent pricing sheets to data aggregators such as Plaid and MX outlining new charges for accessing customer bank account information. The fees, expected to take effect later this year depending on regulatory developments, would impact companies like PayPal's Venmo, Coinbase, and Robinhood that rely on free access to customer banking data for their core services.

With the Trump administration's stripped-back CFPB asking a federal judge to vacate the open banking rule that would have required banks to share customer data for free, JPMorgan is positioning itself to monetize what was supposed to become a free service. The October rule, which enabled consumers to demand and transfer their financial data while requiring banks to share it with other providers at no cost, now hangs in the balance.

JPMorgan CEO Jamie Dimon defended the move in his annual shareholder letter, arguing that "third parties want full access to banks' customer data so they can exploit it for their own purposes and profits."

Industry voices are split on the implications. Tom Noyes, a fintech advisory partner and former bank executive, supported the measure on X, declaring "PAY BY BANK IS DEAD IN US" and noting that "the banks will have a solid case by demonstrating the real costs involved in supporting this service." However, Alex Johnson from The Fintech Take newsletter revealed in his latest newsletter the stark economics of the proposed fees: "the highest-volume aggregators would end up paying the bank approximately 10x what they make in revenue from JPMC customer data."

The implications extend beyond just higher costs. This threatens account aggregators, potentially forcing them to revert to less reliable screen scraping methods. While online lenders using cashflow analysis for subprime loans might absorb higher costs, low-revenue businesses like budgeting apps and free accounting tools face existential threats. Steve Boms from the Financial Data and Technology Association called it "a blatant effort to curtail innovation and undermine a stronger American financial system."

According to Bloomberg, JPMorgan's proposed fees could eclipse certain companies' per-transaction revenue by as much as 1000%, potentially eliminating pay-by-bank services entirely.

Sources : Global Fintech Insider & Bloomberg

🇨🇦 Disclosure Reveals Canadian Prime Minister Hold Many Fintech Stocks Including Adyen, Stripe, Paypal, Nu Holdings, Robinhood & Coinbase

Canadian Prime Minister Mark Carney's ethics disclosure reveals extensive fintech holdings. The disclosure shows the former Bank of England governor transferred over 500 stocks to a blind trust, including positions in payment processors PayPal, Stripe, Block, and Adyen, online brokerages Robinhood, Interactive Brokers, and Charles Schwab, credit card companies American Express and Capital One, credit bureaus Experian and TransUnion, cryptocurrency exchange Coinbase and Brazilian neobank Nu Holdings.

The disclosures also revealed that Carney must recuse himself from any government decisions involving Stripe, where he previously served on the board of directors, as well as Brookfield Asset Management where he was chairman, and 103 other companies owned or controlled by them as part of an extensive conflict-of-interest screen. This raises questions about Carney's ability to influence Canada's long-promised open banking framework, which the Liberals have pledged to implement after years of delays.

Source: Global Fintech Insider

🇬🇧 Mastercard Exec Tricked LinkedIn Spammer Into Sending Him Rhyming Sales AI Garbage

London-based Mastercard’s AI governance lead, Richard Boorman, successfully tricked an AI assistant into following hidden instructions embedded in his LinkedIn profile, exposing critical vulnerabilities in how language models process text. Boorman embedded a "prompt injection”, a hidden instruction designed to manipulate AI behaviour, into his LinkedIn profile. "Within days, it had tricked someone's AI assistant that was scraping profiles to generate personalized messages," he wrote in a LinkedIn post. The incident points to a fundamental flaw in LLM-based systems, which can’t tell the difference between the user’s intentional prompt and other instructions that could be hidden in the content submitted. Since they treat all text the same, attackers can slip in prompts that secretly control the AI’s behaviour, said Boorman. He then recommends two ways to protect yourself against such prompt injections: using an input screening tools that check for suspicious instructions that could be fed to AI, and structuring internal AI tools in such a way that submitted content is separated from prompt instructions.

Source: Global Fintech Insider

🇨🇦 Australian Court Clears Path for Massive Lawsuit Against Canadian Payments Giant Nuvei

The New South Wales Supreme Court granted investors access to Till's financial records in a decision rendered on July 2. This is a major setback for Canadian payments processor Nuvei, since the decision could be setting the stage for a major lawsuit over its 2024 acquisition of Australian fintech Till Global Payment Solutions. Investors Silva Fortune and NGP Investments, who lost 43 million AUD (28 million USD) after investing 77.6 million AUD (51 million USD) in Till across multiple funding rounds, are considering legal action against both Nuvei and Till founder Shadi Haddad for alleged misleading and deceptive conduct during capital raisings between 2020 and 2023. The case centers on Till's being valued at $500 million before ultimately being sold to Nuvei for just $47 million. Justice Elisabeth Peden rejected Nuvei's legal team's arguments that the discovery request amounted to a "fishing expedition," ruling that plaintiffs had legitimate grounds to examine internal documents to determine if there's basis for allegations of "intentional, and effectively fraudulent, statutory misleading or deceptive conduct."

Source: PayDay News

🇵🇰 Pakistan's e-commerce Platform Bazaar Nears Profit After Acquiring Fintech Keenu

Pakistani e-commerce platform Bazaar Technologies expects to hit profitability in the coming quarters after completing the acquisition of digital payments platform Keenu. Co-founder Hamza Jawaid (left), who launched Bazaar in 2020 with high school friend Saad Jangda (right), aims to build Pakistan’s version of Alibaba or MercadoLibre for the world’s fifth-most populous country. "Right now we have a very strong balance sheet, which is why we were able to make more inroads and make this acquisition," Jawaid said to Bloomberg. Backed by New York-based private equity firm Tiger Global Management, Bazaar has raised a record $100 million over two funding rounds, also backed by Defy Partners, Wavemaker Partners, and Dragoneer Investment Group. The startup began by helping merchants buy inventory and manage platforms before launching direct consumer sales in 2024. Keenu’s mobile wallet and payment services in over 150 cities will help Bazaar build an integrated shopping and payment platform, similar to Amazon and Alibaba.

Source: Bloomberg

🇮🇪 Patrick Collison Says Stripe Usage Billing Surges 145% as Companies Abandon Traditional Subscriptions

Irish-American multinational financial services giant Stripe's usage-based billing (UBB) platform has grown 145% year-to-date as SaaS and fintech companies accelerate their shift from traditional seat-based subscriptions to consumption-based pricing models. Stripe CEO Patrick Collison (pictured above) revealed the surge in a LinkedIn post, noting the transformation already underway across the digital economy. “I'm curious what the second-order effects of this change will be.” Market data from usage-based billing platform Metronome and Investment firm Greyhound Capital, released in January 2025, shows that 85% of surveyed SaaS companies now use some form of UBB, including 77% of the largest firms and 64% of Forbes' next billion-dollar startups.

Another 2023 survey done by SaaS researcher and pricing expert Kyle Poyar shows UBB adoption rose from 27% in 2018 to 41% in 2023, with projections suggesting it could exceed 80% in the coming years. Major platforms like Twilio, Zapier, and Stripe itself now use consumption pricing based on API calls, transaction volume, or automated tasks.

Source: Global Fintech Insider

🇺🇸 Stocktwits, The Social Media for Stock Traders, Launches AI-Powered Newsroom Driven by User Sentiment

Stocktwits has launched a news service that turns conversations from its 10 million users into market news articles, according to its project advisor Ted Merz, founder of Principals Media. The platform analyzes what users are saying about stocks and crypto to identify market trends, then creates human-written news articles based on that sentiment data. Merz, former Bloomberg Global Head of News Product, points to the trend of data companies building editorial operations "from Robinhood to PitchBook to CoStar Group", he wrote in a LinkedIn post. Merz also cited Stocktwits CEO Howard Lindzon (pictured above) in the post, who said the articles now appear in Google News, driving a 20X increase in clicks and impressions within months.

Source: Global Fintech Insider

🇳🇴 Two, the Stripe of B2B Invoicing, Just Raised $15M

Norwegian payment processor Two has raised €13 million ($15.2 million) in strategic funding to expand its Stripe-like platform for B2B transactions, bringing total funding to over €40 million ($46.7 million). Founded in 2021 by Andreas Mjelde (pictured above) and Kiran Thomas, Two enables sellers to get paid instantly while giving buyers more time to pay, while using AI to handle fraud checks and credit decisions in an instant. The company wants to power how businesses pay each other, aiming to become the main system behind the US$100 trillion B2B payments market. Two operates in 15 countries with over 200 merchants, including Allianz and Santander. Since launching in the US, the market now accounts for over 20% of its revenue, just three months in, according to Silicon Canals. Revenue and payment volume are also expected to grow by over 150% in 2025. New investor Investinor joins Sequoia Capital, Antler, Alliance Ventures, Arkwright, and Local Globe. Two also recently partnered with Visa, ABN AMRO, Qliro, and Avarda.

Source: Silicon Canals

🇺🇸 Linda Yaccarino Leaves X Before Fintech Features Were Set To Go Live & Offers No Explanation

X CEO Linda Yaccarino (pictured above) has quit Elon Musk's social media platform just months before its ambitious fintech features were set to launch, offering no explanation for her sudden departure. “I’ll be cheering you all on as you continue to change the world”, she concluded her farewell posts on X, which did not contain any clue as to why she was resigning after just two year. Her exit came just one day after xAI's chatbot Grok posted antisemitic content praising Adolf Hitler on the platform, though sources told the New York Times she had already discussed leaving with employees before the incident. While Musk thanked Yaccarino for her contributions, the gesture may have been mere face-saving given that she briefly lost her blue verification badge after resigning… before it was mysteriously restored. Yaccarino is departing just as X prepares to roll out money transfers, credit cards and stock trading features through its X Money platform later this year.

Sources: New York Times, Business Insider & Global Fintech Insider

🇪🇸 Meet Murphy, The Multilingual AI Debt Collector That Will Chase You Through Phone, SMS and WhatsApp

Spanish fintech Murphy has secured $15 million in funding to scale its AI-powered debt collection platform that automates communications with debtors across SMS, email, WhatsApp, and phone calls. The Barcelona-based startup, led by CEO Borja Solé Fauria (5th from the left), received $13 million in seed funding and $2 million in pre-seed funding in a round led by Northzone, with participation from ElevenLabs, Lakestar, and Seedcamp. Built on OpenAI's technology, Murphy's multilingual AI agents serve banks, telcos, utility companies, and debt collection agencies, charging fees based on successful recovery outcomes. "There's a huge potential for automating part of that flow," Solé explained, noting that the debt collection industry remains slow, fragmented, and highly analogue. The funding comes as AI agent startups have raised €1.9 billion ($2.22 billion) this year, with Murphy positioning itself to disrupt an industry that employs 114,000 people across Europe's collection agencies and credit bureaus.

Source: Sifted

🇨🇦 Canadian Crypto App Shakepay Unveils USD Accounts With 3% Annual Bitcoin Payout

Canadian cryptocurrency platform Shakepay has expanded its services with the launch of US dollar (USD) accounts offering 3% annual interest, paid weekly in bitcoin. In a July 9 post on X, CEO Jean Amiouny (pictured above) said the new feature lets users convert Canadian dollars to US dollars at a 1% fee. USD deposits are covered under the Canadian Investor Protection Fund insurance (the Canadian version of the Securities Investor Protection Corporation coverage in the US) for up to $1 million. The platform also integrated USDC stablecoin functionality with 1:1 conversion, allowing users to deposit USDC, which automatically converts to USD, though direct USD deposits and wire transfers aren't currently supported. Users can send USDC to external wallets or transfer USD to friends through Shakepay's peer-to-peer feature. Founded in Montreal in 2015, Shakepay generates revenue through a 0.5-2% spreads on crypto trades.

Source: Global Fintech Insider

🇺🇸 Substack Competitor Beehiiv Crosses $30M in Revenue, Thanks to Native Ad Network

Newsletter platform Beehiiv has surpassed $20 million in annual recurring revenue (ARR) just 3.5 years after launch, according to a post on LinkedIn by CEO Tyler Denk (pictured above). Denk added that Beehiiv’s Ad Network and Boosts products contributed another $10 million, pushing total revenue to around $30 million. Competing with other newsletter platforms like Substack, Beehiiv differentiates itself with a built-in ad network that connects newsletter creators directly with brands for sponsorships and ad placements, charging users based on a tiered subscription. The platform uses a tiered subscription model for its pricing. Substack, however, takes a standard 10% cut of subscription revenue from paid newsletters. Beehiiv has benefited from creator departures from Substack due to concerns about politically extreme content.

Sources: Global Fintech Insider & Digidays

🇺🇸 Robinhood’s Vlad Tenev Unveils Harmonic AI, a Math-Focused AI Startup

Math-focused AI startup Harmonic AI, co-founded by Robinhood CEO Vlad Tenev, raised $100 million at an $875 million valuation. Tenev also intentionally kept the valuation below the $1 billion unicorn threshold. “You never want to take the highest offer,’’ he said in an interview with Bloomberg. The Palo Alto startup focused on solving complex mathematical problems that often stump existing AI models and uses formal verification, a mathematical method used to guarantee an AI system functions correctly, to eliminate AI hallucinations. California-based Venture fund Kleiner Perkins led the round with participation from Sequoia Capital, Index Ventures, and Paradigm.

Founded in 2023 along with former autonomous driving company Helm.ai CEO Tudor Achim, who serves as CEO while Tenev acts as executive chairman, Harmonic plans to release its flagship AI model Aristotle later this year.

Source: Bloomberg

🇺🇸 US Bank Wells Fargo Exits Reward’s Platform Bilt Credit Card Partnership After Losing $10M Monthly

US multinational financial service giant Wells Fargo is ending its credit card partnership with payment and rewards platform Bilt early after losing up to $10 million monthly on the rent rewards program, forcing the fintech to find a new issuer. The partnership, originally scheduled to end in 2029, became unsustainable as Wells absorbed transaction fees on rent payments, while expected interest income failed to materialize as most cardholders paid bills in full monthly. Wells initially viewed the program as a way to attract young customers for future mortgage business... Yet, Bilt just closed a 250 million funding round in which mortgage lender United Wholesale Mortgage took part, valuing Bilt at $10.8 billion.

According to Kleber Santos, CEO of consumer lending at Wells, the reason for the break up could be "reputational risk", given the money laundering risks involved in sending a large volume of payments to unvetted landlords. Bilt CEO Ankur Jain (pictured above), who now has an estimated net worth of $1.2 billion according to Forbes, announced that the company is now developing Bilt Card 2.0 in collaboration with credit card and loyalty platform Cardless. The new card will be launched in February 2026 and current Bilt cardholders will automatically get the new card.

Sources: Wall Street Journal & Bloomberg

🇺🇸 Upstart Insiders Dump $1.8M in Shares Sparking Investor Concern About the Subprime Lender’s Prospects

US-based AI lending platform Upstart Holdings is drawing investor concern after insiders sold $1.8 million in shares over three months, even as the company posted 67% revenue growth in Q1 2025. Chief Accounting Officer Natalia Mirgorodskaya sold 12,637 shares, reducing holdings by 13.97%, while Chief Legal Officer Scott Darling sold 26,115 shares under a prearranged plan. The sales represent 0.005% of outstanding shares from cashless stock option exercises. Upstart's AI underwriting faces Consumer Financial Protection Bureau (CFPB) scrutiny over algorithmic fairness, while rising interest rates squeeze personal loan demand. Upstart earned $213 million in Q1, with 92% of loans approved by AI, but expects a $10 million loss in Q2 due to ongoing investment in AI and regulatory compliance. Upstart, led by CEO Dave Girouard (pictured above), is currently valued at about 1.8 times its annual revenue and carries a relatively high level of debt.

Source: AInvest

Upcoming Fintech Events

🇺🇸 Fintech South will be held in Atlanta on August 19-20,2025 ($600), with speakers such as Joshua Silver, CEO of Rainforest & Kristin Slink, fintech strategist at FIS.

🇺🇸 FinovateFall will be held in New York on will be held on September 8-10, 2025 ($3,998), with speakers such as Norah Coelho, Managing Director, Embedded Finance at J.P.Morgan & Lindsey Downing, VP Interactive at TransUnion.

🇨🇦 The Customer Experience for Financial Services Summit will be held in Toronto on September 18–19, 2025 ($995), with speakers such as Amit Mondal, VP & Head of Digital Analytics & Experimentation at Amex & Angela Crapsi, AVP of Operations at Flexiti/Questrade.

🇩🇪 Sibos will take place in Frankfurt from Sept. 29 to October 2 ($1,180.90 for fintechs), with speakers such as Victoria Cleland, Director of Payments at the Bank of England & Sophie Gilder, Managing Director, Blockchain & Digital Assets at Commonwealth Bank.

🇺🇸 Money 20/20 USA will be held in Las Vegas on Oct. 26-29, 2025 ($3,849), with speakers such as May Zabaneh, VP of Digital Currencies at PayPal & Dietrich Kuhlman, CEO of Navy Federal Credit Union

Who Am I?

Hi, my name is Julien Brault.

From 2017 to 2024, I was the CEO of Hardbacon, a fintech I co-founded, which reached 400,000 unique visitors at its peak.

A Google update ultimately sealed the company’s faith and I started this newsletter to keep myself busy in the aftermath.

Why share this?

Because my goal is to use my experience as an economic journalist, fintech entrepreneur and product manager to present the most essential fintech news from around the world through the eyes of an insider.

If you like what I do, feel free to share this newsletter and follow me on Linkedin, X, Reddit, YouTube & TikTok.

If you are raising for your fintech and would like to be featured in Global Fintech Insider for free, fill this form.

P.-S. : Once you refer a new subscriber to the newsletter using your unique share link, you'll receive a personalized social media shout-out from me to promote your work or professional profile. Just write to me at jrbrault@icloud.com once your referral is confirmed on our leaderboard and include your social media account(s) URL(s) and who you are.

It's as if they knew that the CFPB was going to permit this, with its yet to be published ANPR (as of date JPMC made this info public) on its revisions to Final Rule 1033.

If you’re in and around the Atlanta area and want to attend Fintech South this year, I’ve got a code for $25 off - FTRewards25.

I’ll be covering the event, let me know if you’ll be there!