🇬🇧 Monzo First to Offer Credit Scores from All 3 Bureaus; Is This the End for Credit Monitoring Apps?

We're also covering Lightspeed's potential buyers 🇨🇦, Revolut's Robinhood rival 🇬🇧, iPhone creator Tony Fadell's fintech investment 🇬🇧, US politicians’ trading activities 🇺🇸, and more.

🇬🇧 Monzo First to Offer Credit Scores from All 3 Bureaus; Is This the End for Credit Monitoring Apps?

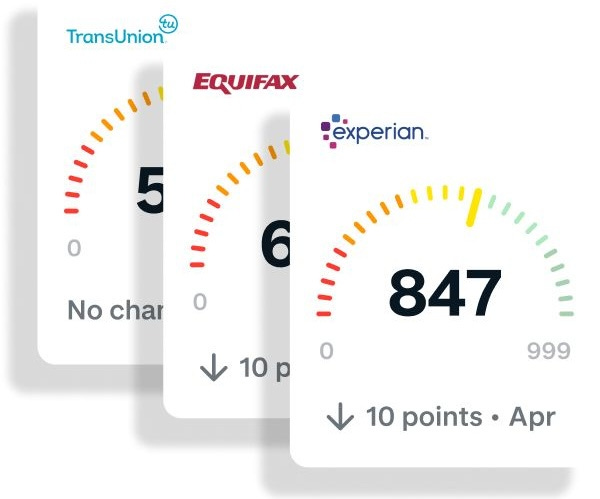

Monzo has made a significant leap, becoming the first mobile banking app in the UK to allow users to monitor their credit scores from all three major credit bureaus—Equifax, TransUnion, and Experian. In a LinkedIn post, Monzo’s Director of Software Engineering for Borrowing shared his excitement, stating in a Linkedin post that the Monzo app now allows its users to “get the 360 view of how credit agencies see you”.

This development could spell trouble for dedicated credit monitoring apps like Credit Karma (TransUnion), ClearScore (Equifax), and MoneySuperMarket’s Credit Monitor (TransUnion), which only provide scores from one bureau. Users often had to rely on multiple apps to get a full view of their credit standing. With major UK banks like NatWest and Royal Bank of Scotland also offering credit monitoring as part of their banking product, the competition for standalone apps is heating up.

Globally, this trend is catching on. In Canada, popular credit monitoring apps like Credit Karma, ClearScore, and Borrowell face similar challenges, as four of the five largest banks already offer free credit score monitoring directly in their banking portals. In the U.S., Credit Karma’s home market, the main banks and credit card issuers, including American Express, Discovery, Bank of America, Wells Fargo, Capital One, and Chase, provide similar services. With more financial institutions integrating credit score monitoring and even leapfrogging dedicated apps, the future of standalone apps looks uncertain.

Source: Global Fintech Insider

🇨🇦 Canadian POS Giant Lightspeed to be Sold Off: Here Are the Potential Buyers

Montreal-based Lightspeed Commerce, a point-of-sale (POS) and e-commerce software provider, has hired JP Morgan Chase & Co. to sell itself. Although it’s much smaller than its Canadian rival Shopify, Lightspeed, whose market cap stands at 2.5 billion USD, processes over 90 billion USD annually in gross transaction volume.

According to The Globe and Mail, Lightspeed has already signed non-disclosure agreements with multiple potential buyers. Analysts interviewed by the Globe have identified several key contenders:

Block Inc. (formerly Square) – Block, known for targeting solo entrepreneurs and small retailers with its POS solution, Square, could leverage Lightspeed to expand its offerings to mid-sized retailers, which are Lightspeed’s primary target market.

Shopify – Shopify’s acquisition of Lightspeed would enhance its dominance in both online and physical retail by leveraging Lightspeed’s powerful POS system and likely migrating Lightspeed-powered e-commerce stores to its platform.

PayPal – Acquiring Lightspeed would allow PayPal to broaden its merchant services and offer a more comprehensive solution for retail businesses.

Fiserv’s Clover – Integrating Lightspeed could strengthen Clover’s presence in the POS market, providing access to a wider retail and hospitality customer base.

NCR Voyix – As a major player in POS and payment technologies, acquiring Lightspeed could provide NCR Voyix with additional market share and more diverse product offerings across retail and restaurant industries.

Global Payments – With its expertise in payment processing, Global Payments could see value in Lightspeed’s growing payments platform, which has been increasing average revenue per customer.

Shift4 – A publicly traded cloud software rival in online payments and POS systems, Shift4 could find strategic benefits in absorbing Lightspeed’s customer base.

Worldpay – Backed by Chicago-based private equity firm GCTR, Worldpay has the financial resources to pursue a deal. Lightspeed’s scale and expertise in POS systems would complement Worldpay’s payment processing offering.

Source: Globe & Mail

🇬🇧 Revolut Invest Launches to Rival Robinhood and eToro in Europe and the US

London-based neobank Revolut is launching a standalone retail brokerage app called Revolut Invest. Revolut was already offering trading in its core banking app in select market, with 3 millions out of its 45 million clients globally already investing through Revolut. However, launching a dedicated app will allow the fintech to compete more effectively with investing apps like eToro and Robinhood, which are on roll as a result of diminishing interest rates.

Revolut’s app will debut with nearly 5,000 assets, including US and European stocks, exchange-traded funds, commodities, bonds, and new products like contracts for difference. Currently in testing in Greece, Denmark, and the Czech Republic, the app is set to expand to other European Economic Area countries by the end of the year. Revolut has already secured licensing for future availability in the UK, US, Singapore, and Australia, but it’s not yet offered in the UK, as the company is currently focusing its effort in the UK on its recent transition to a full banking license, according to Bloomberg.

Source: Bloomberg

🇦🇺 eToro Lifts Off in Australia with $80 Million Spaceship Acquisition

eToro, the Israeli trading platform already operating in 76 countries, including Australia, has acquired the Australian investment platform Spaceship for up to $80 million. Founded in 2017, Spaceship has attracted 200,000 clients with $1.5 billion in funds under management, offering investment portfolios and a superannuation product, which is a government-mandated retirement savings plan in Australia. This acquisition will allow eToro to enhance its offerings in Australia, providing customers access to a broader range of products

Source: The Australian

🇺🇸 Stocktwits and Quiver Shine a Light on Political Pocketbooks

Stocktwits, a US-based social network dedicated to stock-picking discussions, has teamed up with Quiver Quantitative to introduce a Congressional Trade Tracker, allowing its users to easily monitor politicians’ trading activities directly from Stocktwits’ securities pages and feeds. Quiver, known for scraping alternative stock data, has been sharing insights from Congressional trading since 2020. The partnership promises to shed light on the often lucrative trading habits of U.S. politicians, many of whom have reportedly outperformed major indices like the S&P 500.

Source: Global Fintech Insider

🇦🇪 Dubai Forces Exchanges to Warn Investors They Could Lose It All in Crypto

Despite being known for friendly crypto regulations, with Binance and Bybit having one of their main offices in the city, Dubai has introduced new guidelines requiring crypto exchanges to include in their marketing a clear disclaimer warning investors about the risks of virtual assets, such as volatility and potential loss of value. The updated guidelines, effective October 1, 2024, also require approval for offering sign-up incentives from Dubai’s Virtual Assets Regulatory Authority (VARA), the city’s crypto regulator. These changes align with similar marketing guidelines adopted in countries like Belgium, Singapore and the UK.

Source: Bloomberg

🇱🇹 European Pay by Bank Pioneer kevin Declared Insolvent After Rapid Growth

Lithuanian payments fintech kevin, once one Eastern Europe's fastest-growing fintechs, has been declared insolvent by the Vilnius District Court. Kevin raised over $65 million from top investors like Accel and Eurazeo but is now unable to meet its financial obligations. The company, known for its innovative "pay by bank" solution, allowed merchants to bypass credit card fees by enabling customers to make direct payments from their bank accounts.

Source: Sifted

🇦🇺 Aussie Fintech InDebted Raises $40M as U.S. Growth Powers 70% of Revenue

Australian-founded fintech InDebted has secured a $40 million Series C funding round, valuing the company at over $250 million. InDebted employs AI and machine learning to personalize communication and payment options, helping businesses collect debts more effectively. The company now generates 70% of its revenue from the U.S. market, where growth surged by 195% last year. Nearly half of its 300 employees, including Founder and CEO Josh Foreman, are based in the U.S. following Foreman's relocation in 2023, and the company also has an office in Toronto. The funding round, led by Airtree, will support further expansion into Europe, South America, and new markets such as the UAE and Mexico. InDebted achieved profitability in February 2024.

Fun fact: The company's VP Finance, Channel St-Pierre, CPA, is actually from my hometown Montreal!

Source: Intelligent CIO

🇬🇧 Tony Fadell, Co-Creator of the iPhone, Invests in Apron's $30 Million Round

London fintech Apron has secured $30 million in Series B funding, with notable participation from Tony Fadell, the co-creator of the iPhone. Founded in 2021 by former Revolut product lead Bogdan Uzbekov, Apron aims to streamline payment management for small businesses by gathering all receivables in one place. The funding round was led by Zinal Growth, alongside existing investors like Index Ventures and Bessemer Venture Partners. Fadell, who designed a crypto wallet in 2022, invest mainly in deep tech start-up through is fund Build Collective. However, he seemed to be interested in the fintech space as well.

Source: City AM

Upcoming Fintech Events

🇺🇸 G2E will be held in Last Vegas Oct. 7th to 10th ($309 to $1999), with speakers such as Greg Kirstein, GM, iGaming North America at Paysafe and Sarah Stapp, Head of Strategic Initiatives at Aeropay.

🇺🇸 Boston Fintech Week will be held in Boston Oct. 14th to 18th ($395), with speakers such as Chris Behling, Head of Risk Product Sales & Underwriting at Northwestern Mutual and Matt Harris, partner at Bain Capital Ventures.

🇺🇸 Money 20/20 will be held in Las Vegas Oct. 27th to 30th ($3999), with speakers such as Chris Britt, CEO of Chime and Daniela Amodei, president of Anthropic.

🇸🇬 The Singapore Fintech Festival will take place Nov. 6th to 8th, with speakers such as Kfir Godrich, Chief Innovation Officer at BlackRock and Richard Teng, CEO of Binance.

🇿🇦 The Africa Tech Festival will be held in Cape Town November 12-14 ($1,749), with speakers such as Kagiso Mothibi, CEO of MTN Fintech and Christian Kajeneri, director, payment systems at the National Bank of Rwanda.

Fintech’s Musical Chair

🇬🇧 Andy Mielczarek, co-founder and CEO of UK challenger bank Chetwood Financial, will step down at the end of September, with Paul Noble, former JN Bank CEO, announced as his successor.

🇨🇦 Ha Duong, former VP of Finance at growth fund Georgian, has been appointed VP of Finance and Operations at Luge Capital, a Canada-based early-stage fintech VC fund.

🇺🇸 Robin Benoit, who has served as interim Chief People Officer at US-based insurtech Acrisure since March 2024, has been appointed to the role permanently and will report to Chairman and CEO Greg Williams.

🇺🇸 Jody Guetter, former EVP of market innovation, has been appointed CMO at Nymbus, a cloud-based fintech provider of core banking softwares to banks and credit unions.

🇮🇳 Nitin Pulyani, a former director of product management at PhonePe, has been appointed Head of Product and SVP at Indian paytech startup Cashfree.

🇮🇱 Itamar Bar-Tur, former Product Group Director at Fiverr, has been appointed Vice President of Product at fintech company Finq, where he will lead the development of AI-powered investment platforms as the company expands in the U.S. and Israeli markets.

🇸🇬 Axel Frändén, former Chief Marketing Officer at Lendela, a Singapore-based digital lender with operations in Singapore, Hong Kong, and Australia, has been promoted to Deputy CEO of the company.

🇬🇧 Samir Desai, co-founder and former CEO of UK-based small business lender Funding Circle, will step down from the company’s board on October 25th, concluding his three-year term as a non-executive director.

🇬🇧 Andrew Bateman has been appointed as Executive Vice President of Lending at Finastra, a London-based provider of banking and lending softwares.

🇫🇷 Vanessa Rodrigues, former Director of Partnerships at Novaxia, has been appointed Partner and Director of Partnerships at Darwin, a Paris-based fintech providing investment and savings products that enable retail investors in Europe to invest in real estate.

Have some fintech news you think I should include in the Global Fintech Insider newsletter or heard some rumours you’d like me to look into? Drop me an email at: jrbrault@protonmail.com