Prediction Markets’ Right Call on Trump’s Win Could Help Them Become an Integral Part of Financial Markets 🇺🇸

We're also covering WonderFi's CEO kidnapping in Toronto 🇨🇦, Affirm & Cleo UK expansion 🇬🇧, a fintech newsletter writer launching a VC firm 🇨🇦, a new AI-managed mutual fund 🇨🇱 and much more!

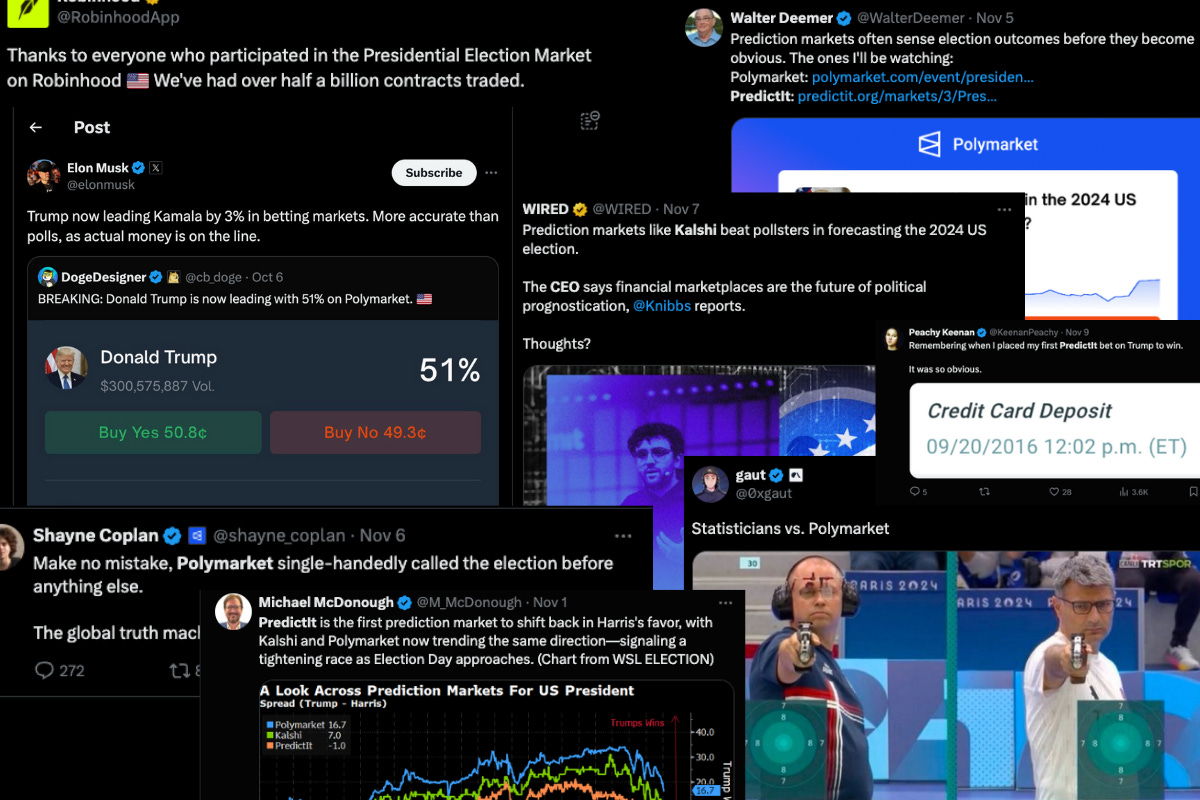

🇺🇸 Prediction Markets’ Right Call on Trump’s Win Could Help Them Become an Integral Part of Financial Markets

Platforms like Polymarket, Kalshi, PredictIt and Robinhood became go-to sources for many following the U.S. election closely. And unlike conventional polls, these markets predicted a Trump victory weeks before Election Day.

Stocks trading app Robinhood’s entry into the prediction market space just before the election, on October 28th, is part of a broader trend that Trump’s win should accelerate: prediction markets have become more mainstream and their movements are increasingly taken seriously.

Robinhood CEO Vlad Tenev told The Verge he believes prediction markets are here to stay and that he envisions users betting on outcomes beyond politics, like the performance of the companies. He attributes this newfound interest in prediction markets to a growing mistrust in traditional news sources. Tarek Mansour, CEO of Kalshi, another platform on which Americans could wager on election results, told the Washington Post that prediction markets have “done the very thing that they have been designed to do — aggregate information in real time and clear out all the noise.”

While prediction markets scored a big win in accurately predicting Trump’s victory, the jury is still out on whether they’re more like online gambling platforms such as sports betting sites or financial markets akin to stock exchanges.

Polymarket, the largest of such market, has implicitly been recognized as derivatives exchange by the US government, having been charged of «operating an illegal unregistered or non-designated facility for event-based binary options online trading contracts» by the Commodity Futures Trading Commission in 2022. Polymarket then settled the matter by paying a 1.4 million USD fine and withdrawing entirely from the U.S. market. Despite the ban, it was fairly easy for Americans to transact on the platform during the 2024 election.

Thanks to the enormous publicity generated by the US election (including from Trump super-supporter Elon Musk) and a 70 million USD cash injection back in May, Polymarket now plans to reenter the U.S. market. And with Trump now set for another term during which he is rumored to replace the current SEC chair by a Robinhood attorney, the regulatory environment might be more welcoming, at least in the US.

The outlook of Polymarket is less rosy in France, where L’Autorité nationale des jeux (ANJ), France’s gambling regulator, is currently investigating the platform. According to French newspaper Le Monde, the decision to ban Polymarket in France has already been made.

Ethereum co-founder Vitalik Buterin, himself a backer of Polymarket, sees an even broader future for prediction markets. In a recent blog post, Buterin explains these markets are just the first application of a broader set of use cases of what he calls “information finance”. According to the crypto billionaire, it could reshape Decentralized Autonomous Organizations (DAOs) by allowing stakeholders to vote with their money and even peer reviewed scientific papers, by creating a market where participants could bet on which experiment can be reproduced.

Source: Global Fintech Insider

🇨🇦 Canadian Substack Writer To Launch a Fintech VC Funds To Back Exited Fintech Founders

Tal Schwartz, author of the Canadian Fintech Newsletter on Substack, has announced in his latest newsletter the launch of Exit North Ventures, a $20 million VC fund dedicated to early-stage Canadian fintech startups. Transitioning from content creator to venture capitalist is an unusual move with few precedent. The only two other cases I can remember of are TechCrunch founder Michael Arrington with CrunchFund and Arrington Capital, and VC podcaster Harry Stebbings with 20VC. With a solid subscriber base of 11,000, Schwartz is well-positioned to tap into Canada’s fintech ecosystem. Partnering with industry veterans who have built and exited fintech companies, Exit North Ventures aims to back promising Canadian fintech founders through investments ranging from $250,000 to $1 million.

Source: Global Fintech Insider

🇧🇷 Tako Secures $13.2M From Andreessen Horowitz to Drive LLM Payroll Revolution in Brazil

Tako, a Brazilian fintech startup co-founded by Fernando Gadotti, has emerged from stealth with a $13.2 million seed round co-led by Andreessen Horowitz and Ribbit Capital. After experiencing firsthand the complexities of payroll management in Brazil due to changing laws and influential unions at his previous start-up DogHero, Gadotti launched Tako to automate employee lifecycle management, including onboarding and payroll. Tako's platform offers a centralized dashboard for transparency and uses a large language model (LLM) to stay updated with Brazil's frequently changing labour laws.

Source: TechCrunch

🇲🇽 Klar Plans to IPO in 2026 After Convincing Millions of Mexicans to Abandon Cash

Mexican fintech Klar has its eyes set on an IPO by the end of 2026. The company specialize in serving medium-income professionals and university students, offering savings accounts with returns up to 13.5% as well as credit cards. With 2 million active users, Klar is planning to expand to 10 million users in the next five years, fueled by a current growth rate of about 12% monthly. Cash is still the preferred payment method for over 70% of Mexican adults, and only about a third of them use formal credit. As a result, Klar is well positioned to cash in on Mexicans growing usage of digital banking.

Source: Bloomberg

🇬🇧 Affirm’s U.K. Debut Marks Its First Step Outside the U.S.

BNPL lender Affirm is launching in the U.K., its first steps outside the U.S. This move gives Affirm a head start in cultivating relationships with British consumers and regulators before expected regulations in 2026 bring BNPL companies under stricter financial oversight. Unlike Klarna, which started charging late fees in the U.K. in 2023, Affirm’s model stands out with a fixed interest fee based on the original loan amount and no late fees. Affirm, which already have hired 30 employees in the U.K., aims to build traction in the U.K. with partnerships with the likes of Alternative Airlines and Fexco.

Source: TechCrunch

🇬🇧 Cleo Plots U.K. Comeback With Its Sassy AI Sidekick

Cleo, a U.S.-focused fintech known for its chatbot-driven personal finance app, is planning a return to the U.K. after exiting it in 2018 to focus on the US. Founded in 2016 by Barney Hussey-Yeo, Cleo launched Facebook Messenger chatbot with a playful personality, including “Roast Mode” to nudge users away from bad spending habits. The chatbot syncs with its users’ bank accounts and offers budgeting advices. With over 7 million users in the U.S., Cleo makes money through premium subscriptions that unlock features such as credit-building cards and cash advances.

Source: Sifted

🇨🇦 The CEO of Canada’s Largest Regulated Crypto Exchange Kidnapped in Broad Day Light in Toronto

The CEO of TSX-listed cryptocurrency company WonderFi, Dean Skurka, was kidnapped in downtown Toronto on November 6, 2024, by unknown assailants who demanded a ransom. According to the CBC, he was later found unharmed in Etobicoke, after a $1 million ransom was paid electronically. Toronto police are investigating the incident, and WonderFi has assured that no client funds or data were compromised. Skurka, who joined WonderFi in 2022 after the company acquired his crypto exchange Bitbuy, leads Canada’s largest regulated crypto trading platform.

Source: CBC

🇳🇿 Bank of New Zealand Acquires Open Banking Pay-By-Bank Provider BlinkPay

The Bank of New Zealand (BNZ) has acquired BlinkPay, a New Zealand-based pay-by-bank provider that leverage open banking to process payment. Founded in 2015, BlinkPay’s payment method allows Kiwis to transact in English and Maori. BNZ plans to leverage BlinkPay’s capabilities to enhance its own open banking products while maintaining the fintech's payment product, with BlinkPay's co-founder Adrian Smith staying on as CEO.

Source: Fintech Futures

🇨🇱 Holdo Launches Chile’s First AI-Managed Mutual Fund

Holdo has launched Chile Smart Fund, the country’s first mutual fund fully managed by artificial intelligence and composed entirely of Chilean stocks. This innovative fund is built on the IPSA, Chile's main index, which posted a 22% return from January 2023 to July 2024. The AI-powered platform continuously adjusts the fund’s portfolio by analyzing over 120 market variables to optimize performance. Targeting moderate-to-high-risk investors, the fund democratizes access to AI-driven investing with a low entry point of 500,000 Chilean Pesos (511 USD).

Source: Emol

🇨🇦 Canadian Sharia-Compliant Fintech Manzil Expands to the U.S.

Toronto-based Manzil, a provider of sharia-compliant prepaid Visa cards, investment products and mortgages, will expand south of the border. It just announced its acquisition of US-based Aghaz Investments, a SEC-registered platform that will allow Manzil to introduce new investment products like ETFs to US retail investors. The move aligns with Manzil's mission to offer Shariah-compliant financial services, which exclude interest (riba) in accordance with Islamic law. Aghaz Investments CEO Khurram Agha will work alongside Manzil CEO Mohamad Sawwaf as Head of Manzil Invest USA.

Source: BetaKit

Upcoming Fintech Events

🇿🇦 The Africa Tech Festival will be held in Cape Town November 12-14 ($1,749), with speakers such as Kagiso Mothibi, CEO of MTN Fintech and Christian Kajeneri, director, payment systems at the National Bank of Rwanda.

🌐 The OpenFinity 2024 Expo will take place online on November 20-21 (free), with speakers such as Jane Barratt, Chief Advocacy Officer at MX and Roy Kao, board member at Open Finance Network Canada.

🇬🇧 Fintech Connect will be held in London on December 4-5 ($325), with speakers such as Zahra Gill, Financial Crime Strategy Lead at Starling Bank (!!!) and Anirudh Narla, Head of Product - Global Payments, Anti-Fraud & Wallet at Hopper.

🇺🇸 The Bank Automation Summit will be held in Austin on March 3-4, 2025 ($632.50), with speakers such as Michael Lehmbeck, CTO at BankUnited and Koren Picariello, head of generative AI strategy for Morgan Stanley Wealth Management.

Fintech’s Musical Chair

🇺🇸 Kristyn Leffler has been appointed Chief Product Officer at InDebted, leading global product strategy and enhancing the AI-powered collections capabilities of the company.

🇧🇷 Giulliano Carvalho has been appointed as Chief Technology Officer (CTO) of Astride, aiming to drive innovation and growth at the international accounting fintech.

🇧🇷 Eduardo Genton has joined fintech Kapitale as Chief Revenue Officer, tasked with developing commercial strategies and partnerships to boost innovation in the payments market.

🇬🇧 Chun Ong, former VP operations at WordRemit, has been named Chief Operating Officer (COO) of Scottish paytech BR-DGE, where he will scale operations.

🇳🇱 Martijn Hohmann has been appointed as the provisional CEO of Dutch payment processor Intersolve, focusing on product innovation and business development.

🇬🇧 Diptesh Mishra has joined Monument Technology as Chief Technology Officer (CTO), bringing extensive experience in digital banking to enhance their BPaaS platform.

🇬🇧 Nick Lawler has been appointed Chief Commercial Officer (CCO) of Monument Technology, responsible for commercial strategies in their composable banking platform.

Have some fintech news you think I should include in the Global Fintech Insider newsletter or heard some rumours you’d like me to look into? Drop me an email at: jrbrault@protonmail.com