Robinhood Acquires Kevin O’Leary Backed WonderFi, Canada's Largest Crypto Exchange Operator 🇨🇦

We're also covering an ADHD founder's viral AI budgeting app 🇸🇬, Revolut's $1B+ French investment 🇫🇷, Walmart's AI shopping assistant 🇺🇸, Buffett dumping $416M Nubank stake 🇧🇷 & more.

🇨🇦 Robinhood Acquires Kevin O’Leary Backed WonderFi, Canada's Largest Crypto Exchange Operator

US trading platform Robinhood has agreed to acquire WonderFi, Canada's largest crypto exchange operator, for CAD $250 million (approximately $179 million USD) in an all-cash deal. The crypto company's name was inspired by Kevin O'Leary's "Mr. Wonderful" nickname from the hit show Shark Tank. O'Leary, an early investor in WonderFi, confirmed the naming connection: "We kind of ripped off Richard Branson with that Wonder thing. He does Virgin, I do Wonder, and it worked," O'Leary explained in a recent NYSE TV interview, adding that Robinhood valued the fact that Wonderfi had all the necessary licenses to operate in Canada.

O'Leary sees practical advantages in the deal beyond market share and regulatory approval. "I'm pretty excited about it because there's a few things that I don't think people have thought through very much," he stated. He emphasized the efficiency of cross-border transfers: "If I had an account at Robinhood Canada and one at Robinhood US, I'll just transfer USDC in one second at practically no cost. And that to me is a huge win."

The acquisition gives Robinhood an immediate regulated presence across all Canadian provinces through WonderFi's platforms Bitbuy and Coinsquare. Johann Kerbrat, Robinhood's senior vice-president and general manager of crypto, told the Globe and Mail that WonderFi was appealing precisely because "it's regulated, owns two recognized brands – Coinsquare and BitBuy – and has more than $2.1-billion in client assets."

Source: Global Fintech Insider & The Globe and Mail

🇸🇬 ADHD Founder Sherry Jiang Built An AI Budgeting App To Solve Her Own Shortcomings, And It's Spreading Like Wildfire

Sherry Jiang never saw her ADHD as an advantage. "ADHD wasn't my 'superpower' it was survival mode. I had to hack my brain just to function," she revealed on X. This necessity driven approach to managing her own finances has now blossomed into Peek Money, a new fintech based in Singapore that's making waves in the personal finance management (PFM) space.

In an industry graveyard filled with failed PFM apps that now include its biggest success Mint, Peek Money is defying expectations. Within just 30 days of launch, the app hit #1 on Product Hunt, reached 5,000 users with zero ad spend, and tripled both onboarding completion and retention rates.

What makes Peek's early traction even more remarkable is Jiang's unconventional development approach. "Full disclosure: 95% of Peek is vibe coded with AI," she admitted in a LinkedIn post. "Vibe coding" refers to using AI tools like Cursor or ChatGPT to generate code based on desired functionality, allowing non technical founders to rapidly build and iterate.

The former Google marketer connected the app to users' financial accounts through Plaid. Peek Money is currently available only in the US with plans to expand to Canada, UK, Germany, and France. Co founder Jeff Min described Peek as "a vibe check for your money" rather than another cold, confusing dashboard. "Peek gives everyone access to their own personal CFO, thanks to advanced AI models,"explained Jiang.

Alongside running Peek, Jiang has launched the Code with AI bootcamp, teaching over 100 students to build fully functioning apps in just 48 hours through vibe coding techniques.

"A year ago, I could barely code," Jiang confessed. "Today, most of what you see in our app is written by AI tools."

Source: Global Fintech Insider

🇫🇷 Revolut Plans Over $1B Investment In France

Revolut is betting big on France. The British neobank has announced plans to invest €1 billion (over $1.08 billion) over three years to establish France as its new Western European hub, marking a strategic shift in its European operations. While Revolut will maintain its Lithuanian headquarters where it secured an EU banking license after Brexit, the company is now dividing its European governance with Eastern Europe managed from Lithuania and Western Europe from Paris. The fintech, which counts 5 million French customers (versus 11 million in the UK), plans to hire 200 additional employees beyond its current 300-person French team and open new offices in Paris. "France is the country with the strongest growth for us," said Antoine Le Nel (pictured above), Revolut's global chief marketing officer. Despite already having EU wide banking operations through its Lithuanian license, Revolut will apply for a separate French banking license to strengthen its institutional image and expand into regulated French financial products, including mortgage lending, planned for testing later this year.

Source: Les Échos

🇮🇱 eToro's $620M IPO Opens Door For Other Fintechs To Go Public, Says Capital One Founder

Capital One founder Nigel Morris believes eToro's successful IPO marks a turning point for fintech unicorns. "Many fintechs waiting in the wings to go public are now at industrial-strength with real governance, real compliance functions and real economics—they're not fragile, fly-by-night companies," Morris wrote on LinkedIn. "The IPO window will continue to be open and the Klarnas, Chimes, Revoluts and Monzos of the world will eventually go public and they will be weighed in a way that makes sense." The Israel-based trading platform and its shareholders raised nearly $620 million in an upsized IPO priced at $52 per share, above the initially marketed range of $46-$50, giving the company a market value of approximately $4.3 billion and a fully diluted value of nearly $5 billion. The successful offering marks a significant achievement after eToro temporarily paused its listing plans amid tariff-related market volatility following President Trump's April announcements.

Sources: Global Fintech Insider & Bloomberg

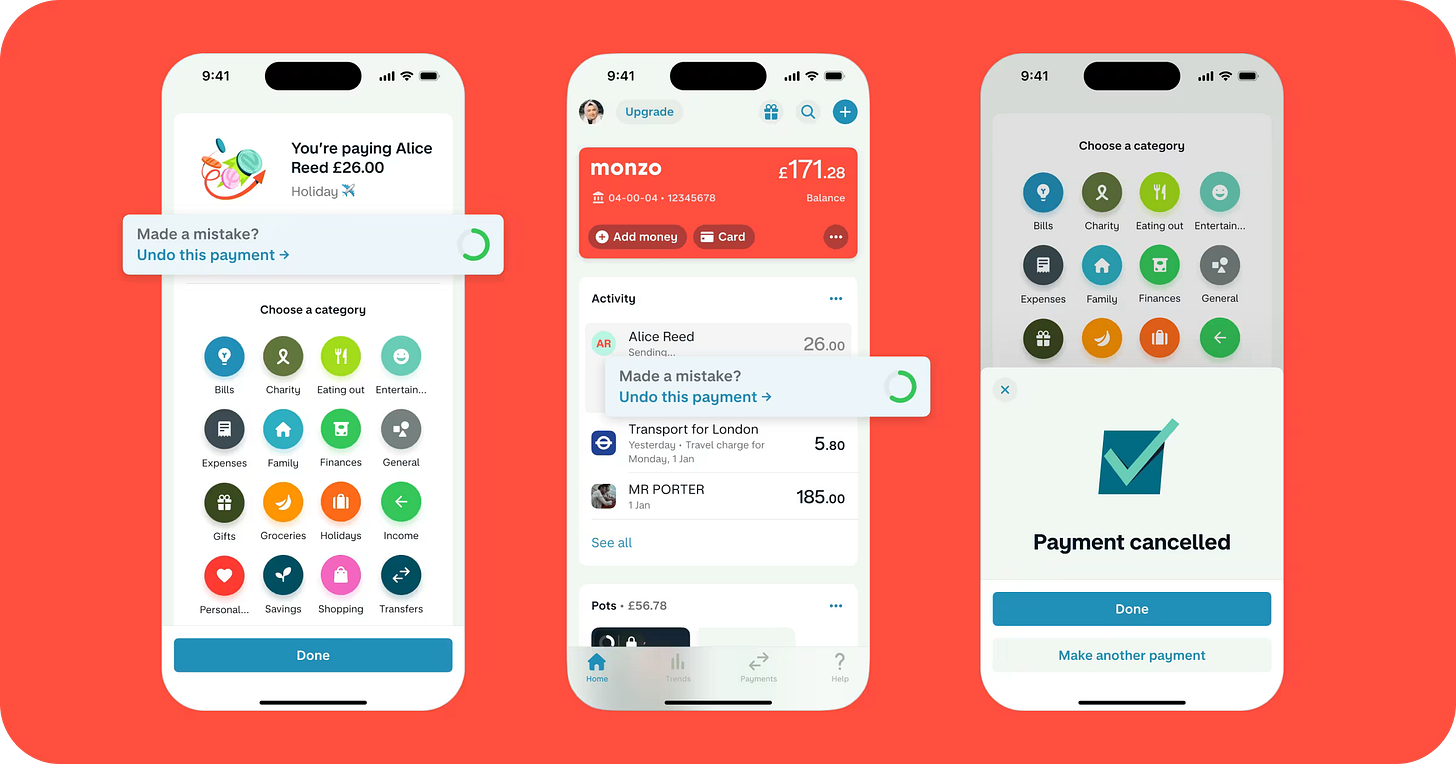

🇬🇧 UK Neobank Monzo Creates Banking Equivalent of Email Unsend Button

Monzo, a UK-based neobank, is rolling out an "undo payments" option that gives users a window of 10-60 seconds to cancel transfers. According to Moneyhub, 1 in 10 people in the UK have accidentally sent money to the wrong person. "If you can unsend email, then you should be able to undo payments," explained Xiayun Sun, Director of Engineering for Payments at Monzo, in a LinkedIn post. She revealed that the feature originated from a hackathon project and required significant backend changes, including implementing asynchronous multi-stage payment processing and building robust infrastructure monitoring systems. The feature is set to 15 seconds by default but can be adjusted or disabled entirely through the app's Privacy & Security settings.

Source: Global Fintech Insider

🇧🇷 Warren Buffett Sells His $416 Million Stake In Brazilian Neobank Nubank

Warren Buffett's Berkshire Hathaway has sold its entire $416 million stake in Nubank, Latin America's largest digital bank serving over 80 million customers with app-based banking services, credit cards, and loans. The divestment revealed in the latest SEC filing comes just days before the Brazilian fintech reported a 37% jump in adjusted profits that still fell short of analyst expectations at $606.5 million. Buffett initially invested $500 million in Nubank in 2021 when it was still private, just months before its NYSE debut. The legendary investor, who announced he will hand over CEO duties to Greg Abel by year-end while remaining as Chairman, appears to have lost confidence in the digital bank despite its growing loan portfolio of $24.1 billion and 19% revenue growth to $3.2 billion across Brazil, Colombia, and Mexico.

Source: CNN Brasil & Global Fintech Insider

🇺🇸 Coinbase CEO Refuses $20M Ransom After Breach, Offering a $20M Bounty Instead

Coinbase CEO Brian Armstrong has publicly refused to pay a $20 million Bitcoin ransom after cybercriminals bribed overseas support agents to steal customer data. In a video posted on X, Armstrong addressed the extortion attempt where attackers demanded payment to prevent the release of stolen information. "Our systems are designed to mitigate the impact of something like this, so less than one percent of our monthly transacting users had their records accessed, but this is still unacceptable," Armstrong stated. The compromised data included names, addresses, phone numbers, emails, masked bank account details, and account balances, though no passwords, private keys or funds were directly exposed. The incident could cost Coinbase up to $400 million to remediate according to an SEC filing. Rather than capitulating to the hackers, Armstrong announced a bold counter-strategy: "Instead of paying this $20 million ransom, we're turning it around. And we're putting out a $20 million award for any information leading to the arrest or conviction of these attackers."

Source: Global Fintech Insider & CNBC

🇺🇸 Stash Raises $146M After Co-Founders Return To Lead Company

Stash has secured a massive capital injection just months after its founding team reclaimed the helm. The US-based investing platform raised $146 million in Series H funding led by Goodwater Capital, with participation from existing investors including Union Square Ventures and T. Rowe Price. The funding comes after co-founders Brandon Krieg and Ed Robinson returned as co-CEOs in October 2024. Since then, the company has turned profitable for the first time in its 10-year history.

The fresh capital will boost Stash's AI capabilities, particularly Money Coach AI, which has already recorded over 2.2 million interactions. Currently, Stash has 1.3 million paying subscribers and manages $4.3 billion in assets. "Since Brandon Krieg and I returned to lead Stash late last year, we've turned profitable, enhanced our subscription service, and made major advances in our AI tools," noted Ed Robinson in a Linkedin post announcing the round.

Source: Global Fintech Insider & Global Data

🇺🇸 Walmart Is Developing Its Own AI Shopping Assistant to Compete in Agentic Commerce

Walmart is building AI shopping agents that will let customers reorder weekly groceries and fill shopping baskets through conversational prompts like planning themed parties. The retail giant's move comes as major payment providers race to dominate the emerging "agentic commerce" space, with Perplexity recently partnering with PayPal for in-chat shopping and payment giants Visa and Mastercard launching their own agentic commerce initiatives. According to Gartner analyst Robert Hetu, the shift to AI agents will force retailers to rethink product descriptions and pricing strategies since AI bots aren't influenced by emotional visuals designed for humans. While AI shopping agents have the potential to transform retail, Hetu notes the transformation will take time as over 80% of shopping still happens in physical stores.

Source: Wall Street Journal & Global Fintech Insider

🇧🇷 Brazilian DoorDash iFood Offers Credit Card To 175K Restaurants Rejected By Banks

Brazilian food delivery giant iFood is launching a credit card for restaurant partners through its fintech arm iFood Pago announced Thais Redondo, head of payments at iFood, at the StartSe Fintechs & Insurance 2025 event. The new card fills a critical gap as 70% of credit provided through the platform was previously denied by traditional banks. iFood's financial division already serves 175,000 restaurants, using alternative analysis models that assess sales patterns, seasonality, and delivery performance rather than conventional credit scores. Restaurants using iFood Pago credit grow 20% faster on average than non-users. Since acquiring embedded finance startup Zoop last year, the company has expanded its financial infrastructure, including its payment solution, processing R$80 million (14M USD) monthly and helping increase restaurant sales by up to 40%. The fintech now serves 400,000 restaurants and processes over 120 million orders.

Source: Finsiders Brasil

🇺🇸 Samaya AI Raises $43.5M From AI Godfather Yann LeCun & Others To Replace Financial Analysts

Samaya AI, a startup that creates financial analysis AI models, has secured $43.5 million in new venture capital financing led by New Enterprise Associates (NEA), with backing from tech and finance heavyweights including former Google CEO Eric Schmidt, Meta's chief AI scientist Yann LeCun, Two Sigma co-founder David Siegel, and former Goldman Sachs executive Martin Chavez.

Founded in 2022 by AI researchers from Google Brain, Meta, AWS, and other leading labs, Samaya has developed tools that conduct financial research and analysis by examining SEC filings and other high-quality data sources. "We deeply believed back then that expert intelligence emerges from specialization," said CEO Maithra Raghu (pictured above), whose company has already deployed its technology at Morgan Stanley's Institutional Securities Group and several hedge funds. Beyond its core research product, Samaya has also unveiled Causal World Models, a new AI agent that excels at modeling economic systems and has been used by customers to assess the impact of Trump's proposed tariffs on different sectors.

Source: Fortune

🇮🇪 An Obscure Dublin Fintech With Spanish Royal Connection Tied to a $880M Cocaine Bust

Two directors of a shadowy Irish company named ET Fintech Europe are under investigation for alleged links to Spain's biggest cocaine trafficking operation that yielded a record 13-tonne seizure worth €783 million (880 million USD). While director Juan Angel Cervera Munoz was arrested in Dubai and fellow director Angel Luis Cano Riofrio appeared before Spain's highest criminal court as suspects, the company's other two directors remain uninvolved in the probe, including Francisco de Borbon, a distant cousin of the king of Spain. ET Fintech Europe, founded in 2023, has no website and lists itself as involved in "other financial service activities". Given what we know about those two directors and the other companies managed by Munoz that were allegedly used to launder money, it seems likely that those other financial service activities include money laundering.

Source: Irish Independent & El Correo del Golfo

🇸🇬 CrediLinq Raises $8.5M From Citi To Expand Embedded Lending To US, UK & Australia

Singapore-based AI-powered embedded finance platform CrediLinq has secured $8.5 million in Series A funding led by OM/VC and MS&AD Ventures, with participation from Citi North America, to fuel its international expansion into the US, UK, and Australia and enhance its AI credit models. Co-founded by Deep Singh (left) and Vikram Kotibhaskar (right), the fintech enables B2B platforms to offer financing solutions to SMBs through API integration, leveraging real-time alternative data from partners like Amazon, Lazada, and TikTok Shop for credit decisions.

Source: Global Fintech Insider

🇨🇦 Nuvei Partners With European Payments Initiative to Integrate Wero

Canadian payment processor Nuvei has joined the European Payments Initiative (EPI) to bring the Wero payment network to online merchants, with pilots starting this month and general availability expected by September. Launched in late 2024, Wero has already attracted 40 million users across Germany, France and Belgium with its instant account-to-account transfer capabilities, and plans to expand to the Netherlands and Luxembourg while adding BNPL features. The partnership supports Europe's push toward financial sovereignty, echoing European Central Bank President Christine Lagarde's recent call to reduce Europe's dependence on American and Chinese payment networks.

Source: PYMNTS

Fintech Battle of the Week: Substack vs Onlyfans

They couldn't look more different on the surface: one platform synonymous with adult content, the other with intellectual newsletters. Yet OnlyFans and Substack are essentially using the same playbook to build a massive recurring subscription business. Both companies created a unified platform making it easy for anyone to distribute their content… while relying on creators’ existing audience to bring in the customers and take a cut of the subscriptions in the process.

Upcoming Fintech Events

🇺🇸 Stablecon will take place in New York on May 29, 2025 (1,295 USD), with speakers such as Cuy Sheffield, Head of Crypto at Visa and Edward Woodford, CEO & co-founder of Zero Hash.

🇳🇱 Money20/20 Europe will be held in Amsterdam on June 3-5, 2025 (3,395 USD), with speakers such as Steven van Rijswijk, CEO of ING & Yoni Assia, CEO of eToro.

🇬🇧 The Future of FinTech Conference 2025 will be held in London on June 12, 2025 (527 USD), with speakers such as Kirsty Rutter, Strategic Investment Director at Lloyds Banking Group & Chris Waring, Head of Digital Customer Journeys at NatWest.

🇮🇱 Money Tel Aviv will be held in Tel Aviv on June 18-19, 2025 ($83), with speakers such as Ido Shamash, head of payments at Wix & Ran Cohen, CEO at BridgerPay.

🇺🇸 Fintech South will be held in Atlanta on August 19-20,2025 ($600), with speakers such as Joshua Silver, CEO of Rainforest & Kristin Slink, fintech strategist at FIS.

🇨🇦 The Customer Experience for Financial Services Summit will be held in Toronto on September 18–19, 2025 ($995), with speakers such as Amit Mondal, VP & Head of Digital Analytics & Experimentation at Amex & Angela Crapsi, AVP of Operations at Flexiti/Questrade.

Who Am I?

Hi, my name is Julien Brault.

From 2017 to 2024, I was the CEO of Hardbacon, a fintech I co-founded, which reached 400,000 unique visitors at its peak.

A Google update ultimately sealed the company’s faith and I started this newsletter to keep myself busy in the aftermath.

Why share this?

Because my goal is to use my experience as an economic journalist, fintech entrepreneur and product manager to present the most essential fintech news from around the world through the eyes of an insider.

If you like what I do, feel free to share this newsletter and follow me on Linkedin, YouTube, TikTok, Instagram & X.

P.-S. : Once you refer a new subscriber to the newsletter using your unique share link, you'll receive a personalized social media shout-out from me to promote your work or professional profile. Just write to me at jrbrault@icloud.com once your referral is confirmed on our leaderboard and include your social media account(s) URL(s) and who you are.