Shopify Launches Ad Campaign To Steal Away Clients From Rival Lightspeed 🇨🇦

We're also covering Ant's new Mastercard 🇨🇳, Moniepoint launching remittances 🇳🇬, Marshmallow's $2B immigrant-focused insurtech 🇬🇧 & a fintech heiress raising 39M to build a Stripe in LatAm 🇨🇱

Before moving on to the most interesting stuff that happened in fintech this week, I wanted to invite you to watch my latest vertical video, which is about how David Vélez turned Nubank into the world's most valuable neobank. If you like what you see, follow me on YouTube!

🇨🇦 Shopify Launches Ad Campaign To Steal Away Clients From Rival Lightspeed

Shopify has launched an aggressive marketing campaign on Instagram and Facebook targeting Lightspeed customers. The campaign features an on-demand webinar with experts explaining why many retailers are transitioning from Lightspeed to the Shopify ecosystem.

Founded just a year apart, Lightspeed in Montreal (2005) and Shopify in Ottawa (2006), the two Canadian e-commerce and POS platforms have followed divergent trajectories. While both companies now offer similar product suites including an ecommerce website builder, a inventory management systems, a Point of Sale (POS) system and a payment solution, their growth strategies have differed dramatically. Lightspeed started with its POS offering and expanded through acquisitions, notably purchasing ecommerce platform Ecwid for $500 million in 2021. In contrast, Shopify started with its e-commerce offering, but built internally most of its other products.

The market has clearly favoured Shopify's approach, which now boasts a $114 billion market cap compared to Lightspeed's modest $1.4 billion. Recent performance reflects this disparity, with Lightspeed’s stock dropping 37% over the past six months while Shopify gained 5%. Lightspeed have been struggling with stagnant growth, maintaining around 160,000 customer locations for several quarters.

During the webinar, Zak Lokosius, Shopify's Retail Solution Engineer, emphasized Shopify’s unified commerce capabilities: "Total cost of ownership increases when businesses use multiple systems," noting that Lightspeed's acquisition-based platform often requires more extensive integration work. Sebastien Rankin, Product Marketing Lead at Shopify, reinforced this, stating: "At Shopify, POS and ecommerce are built on the same platform. One system of truth for all your channels."

Jason Sidana, Chief Growth Officer at Shopify partner agency Maxburst, highlighted specific operational challenges with Lightspeed's cobbled-together system, particularly around omnichannel fulfillment: "Look at buy online, pick up in store... When that customer places an order online [with a retailer using Lightspeed], when they come to pick it up, you'll have to cancel that order, bring it up at the register, give a refund and charge it again."

Source: Global Fintech Insider

🇺🇸 USDC Issuer Circle Launches New Cross-Border Payment Network

Circle, the company behind the $60 billion USDC stablecoin, is unveiling a new payments and cross-border remittance network on Tuesday. "Circle is launching a payments network that is initially targeting remittances, but is ultimately aiming to rival Mastercard and Visa," a source familiar with the plans told CoinDesk. The launch event targets banks, fintechs, payment service providers, remittance companies, and USDC strategic partners.

This development comes as stablecoins are seen as the future of cross-border payments by major fintech such as Stripe, which spent 1.1 billion to acuire stablecoin payment processor Bridge last year, and MoonPay, who forked an undisclosed amount to buy a similar firm in March.

The announcement coincides with Coinbase's upcoming expansion into business payments. Siddharth Coelho-Prabhu, Senior Director of Product Management at Coinbase, revealed in a X post on April 14: "We've been heads down building something new for startups and SMBs," highlighting features including global payments and earning rewards on USDC balances. While we don’t know if Coinbase’s new business offering will use Circle’s new payment network, what we know is that the relationship between Circle and Coinbase runs deep, with recent SEC filings revealing that Coinbase receives half of Circle's residual revenue from USDC reserves.

Source: Global Fintech Insider & CoinDesk

🇺🇸 Global Payments Spends $24B To Buy Worldpay To Compete Against Stripe and Adyen

Global Payments has agreed to buy rival Worldpay from FIS and private equity firm GTCR for $24.25 billion, creating a payments giant that will process approximately 94 billion transactions annually across more than 175 countries for over six million customers. The acquisition combines Worldpay's enterprise-level merchant services with Global Payments' SMB expertise. In a LinkedIn post, industry expert Geoffrey Barraclough described the deal as "a defensive move that indicates that both businesses were running out of growth," noting that "today's 8.5x EBITDA multiple shows how Worldpay has struggled against Adyen, Stripe and others." As part of the deal, Global Payments will sell its struggling issuing segment to FIS.

Source: Payments Journal & Global Fintech Insider

🇨🇳 Ant Group Challenges Airwallex & Brex With New Cross Border Mastercard

Ant International's WorldFirst has introduced the World Card, a virtual Mastercard-enabled payment solution for SMBs conducting international business on April 17, followed by the launch of a cross-border trade operation center in Guangzhou on April 21. The new card enables payments in over 150 currencies across more than 210 countries where Mastercard is accepted, with foreign exchange fees waived on payments from WorldFirst account balances in 15 major currencies including USD, EUR, GBP, and JPY.

The card's features include user-set spending limits, with plans for multiple virtual cards and centralized spending tracking. Support for Apple Pay and Google Pay is expected in the coming months, with a physical card version planned for 2025.

The newly opened operation center in Guangzhou represent Ant Group's push to strengthen its cross-border payment infrastructure in the Guangdong-Hong Kong-Macao Greater Bay Area. WorldFirst is using these centers to increase its presence in the Chinese market while helping local exporters expand globally. As of 2024, WorldFirst has served over one million micro-multinational enterprises globally with transaction volumes exceeding $300 billion.

Source: Fintech Singapore & China Daily

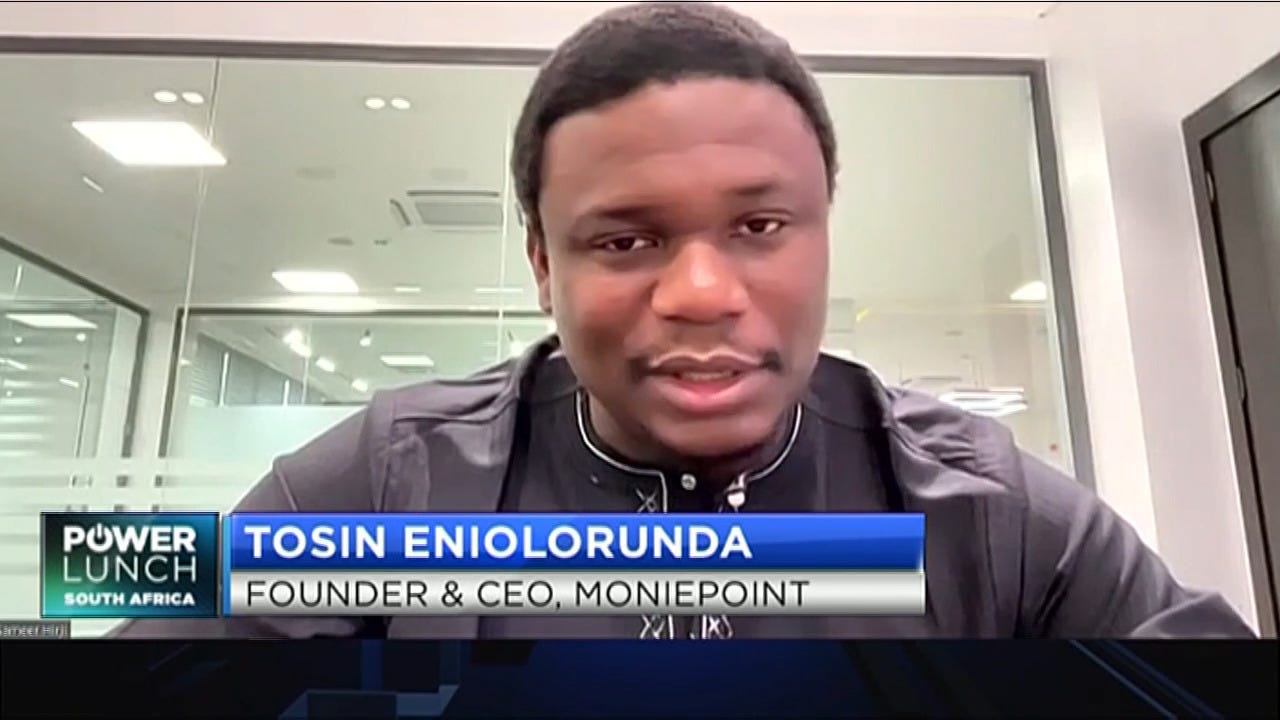

🇳🇬 Nigerian Fintech Unicorn Moniepoint Enters UK Remittance Market

Nigerian fintech unicorn Moniepoint has launched MonieWorld, a diaspora-focused financial service starting with the UK-Nigeria remittance corridor. The move comes months after securing an investment from Visa, which included integration with Visa Direct to unlock international payment rails for cross-border services. Despite entering a market dominated by established players like LemFi and Zepz, Moniepoint sees opportunity beyond simple remittances.

"With MonieWorld, Nigerians in the UK can now send money home in seconds with no transaction fees and at competitive rates," wrote CEO Tosin Eniolorunda, in a recent LinkedIn post. However, his vision extends further: "We're not trying to be a remittance app. We're building a proper immigrant banking platform."

Moniepoint plans to leverage its existing Nigeria infrastructure to offer a broader suite of financial tools for immigrants, including credit-building services similar to what Zolve provides in the US and Pillar offers in the UK. The fintech also plans to expand MonieWorld to serve other African diasporas in the UK, US, and Canada.

Source: TechCrunch & Global Fintech Insider

🇬🇧 Immigrant Focused Insurtech Marshmallow Raises 90M To Diversify Into Lending and Expand Internationally

Marshmallow has secured $90 million in a funding round that almost doubles its valuation to $2 billion. Founded in 2017 by twin brothers Oliver Kent-Braham and Alexander Kent-Braham (left and right) and David Goaté (middle), the car insurance fintech focuses on immigrants to the UK who typically face difficulties obtaining fairly priced coverage. "People who move country experience real hardship in finding good financial products," co-CEO Oliver Kent-Braham told Sifted. The round includes both debt and equity from investors including Portage Ventures, BlackRock, and Columbia Lake Partners. The company plans to launch its first lending product later this year while eyeing expansion into markets with high migration levels such as Germany, Canada, and the US. According to its 2023 annual results, Marshmallow achieved £184 million ($245 million) in annual turnover against just a £0.1 million ($133,000) pre-tax loss.

Source: Sifted

🇨🇱 Fintech Heiress Cristina Etcheberry Raises $39M To Build Stripe For Latin America

Toku has secured $39 million in new funding to revolutionize business-to-business payments across Latin America. Founded five years ago by Cristina Etcheberry in Santiago, Chile, the startup received its first investment from her father Javier Etcheberry, who previously founded payment processor Klap and twice led Chile's Internal Revenue Service. "My dad was the first one that challenged this monopoly. So I grew up learning about the problems in the current payments infrastructure," says Toku's 32-year-old CEO about her payments industry upbringing. The 170-person company has now reached a valuation of more than $175 million after fintech-focused venture capital firm Oak HC/FT led the latest investment round. Toku helps businesses with accepting consumer payments, sending payment reminders, and enabling auto-pay setups across Latin America's fragmented payment landscape, where 95% of businesses process payments through local banks and American fintechs like Stripe have little presence. With annualized revenue exceeding $10 million (doubling year-over-year) and 475 customers across Chile, Mexico and Brazil, Toku has achieved remarkable capital efficiency, spending just $11 million to reach its current scale.

Source: Forbes

🇮🇪 Revolut Asked to Provide Transaction Evidence in Rippling-Deel Corporate Spy Drama

Revolut has been drawn into the corporate espionage battle between HR platforms Rippling and Deel through a court information request. According to court records, Rippling is seeking from Revolut the full name and address of the person who allegedly transferred $6,000 to a Rippling employee's account as payment for corporate espionage. This isn't a lawsuit against Revolut itself, but rather a legal request for information in Rippling's case against Deel. Rippling wants access to account opening documentation to confirm if the sender was indeed Alba Basha Westgarth, wife of Deel's COO Dan Westgarth. Revolut has responded by hiring a top lawyer in Ireland and sent what was described in court as a "helpful but complicated" letter to Rippling last week. The fintech told TechCrunch it would "always comply with any court order request for disclosure," though EU privacy laws make such disclosures difficult without a formal Irish court order.

Source: TechCrunch

🇺🇸 Ramp Leverages Peter Thiel’s Trump Ties In A Bid To Overtake A $700B US Government Program

Corporate expense management fintech Ramp is positioned to potentially secure a piece of the U.S. government's $700 billion SmartPay program. The startup, which sells corporate credit cards and AI-powered expense management software, has met at least four times with Trump appointees at the General Services Administration (GSA) within the administration's first three months. According to ProPublica, GSA officials are swiftly moving to award Ramp a charge card pilot program worth up to $25 million, despite the company having no previous federal contracts. Ramp's powerful investor base includes figures with close ties to the Trump administration, such as billionaire Trump supporter and PayPal co-founder Peter Thiel (pictured above), who has invested in 7 of Ramp’s 10 funding rounds. The six-year-old fintech has raised approximately $2 billion in venture capital and is now positioned to potentially disrupt a program that has traditionally been operated by banking giants U.S. Bank and Citibank, who have earned hundreds of millions in fees from the program.

Source : ProPublica

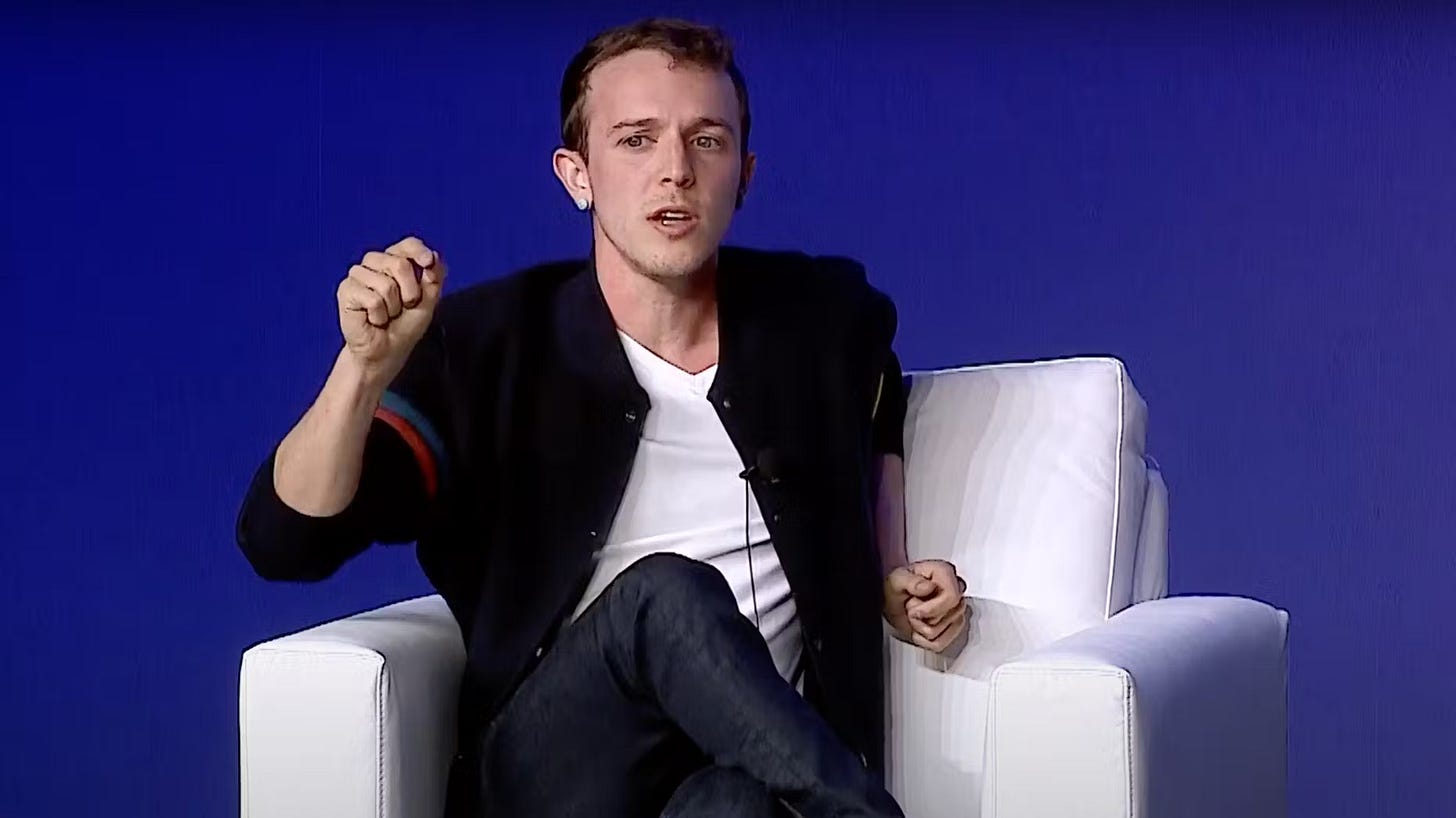

🇺🇸 Bolt Founder Ryan Breslow Launches New Superapp To Take On PayPal And Coinbase

Bolt's controversial founder Ryan Breslow, who returned as Bolt CEO in March, wants to turn the one-click checkout platform into a "superapp" that combines crypto and everyday payments. The app, built in just six months, aims to serve as "a centralized and personalized hub for financial services" by competing simultaneously with crypto exchange Coinbase, peer payment platform Zelle, and PayPal. "I founded Bolt 11 years ago to build the easiest app to buy, sell, and send crypto. I believe this still hasn't been done well in the marketplace. Today marks a significant day: the return of that original vision," Breslow told TechCrunch. The superapp allows users to process peer payments "with just a single click," offers a debit card with up to 3% cash back on eligible purchases, and provides real-time order tracking. Since stepping down as CEO in January 2022, Breslow has faced multiple investor lawsuits and allegations of misleading investors. While Bolt's ARR stood at just $28 million with $7 million in gross profit as of March 2024, Breslow hopes to monetize the company's claimed network of 80 million shoppers through interchange fees and crypto transaction fees.

Source: TechCrunch

🇨🇦 Deck Raises $12M To Turn Any Password Protected Account Into An API

Deck has secured $12 million in Series A funding to build what it calls "the Plaid for the rest of the internet." The Montreal-based startup, founded in January 2024, uses AI agents to unlock data from password-protected accounts through browser-based automation and convert it into structured, usable data with full user permission. "Just like Plaid gave developers an easy, secure way to access bank account data with user permission, Deck does the same for the 95% of platforms that don't offer APIs such as utility portals, e-commerce backends, payroll systems and government services," CEO Yves-Gabriel Leboeuf (pictured above in the middle) told TechCrunch. The company operates specifically in areas where users' valuable data is locked behind login credentials and session-based portals with no easy way to share it securely. Leboeuf and president Frédérick Lavoie (pictured, left) previously co-founded Flinks, dubbed the "Plaid for Canada". Deck co-founder and CTO Bruno Lambert (pictured above, right) was part of the engineering team at Flinks.

Source: TechCrunch

🇺🇸 A Mushroom Gummies Peddler From Florida Is Raising $100M To Become The MicroStrategy Of Solana

Following the playbook of Strategy (formerly MicroStrategy), an analytics software firm that transformed into a Bitcoin investment vehicle, Tampa-based mushroom gummies peddler Upexi is raising $100 million to speculate on the Solana cryptocurrency. The micro-cap company, which had just a $3 million market capitalization last week, has secured agreements with investors including GSR and White Star Capital to purchase approximately 43.9 million shares at $2.28 per share in a private placement closing April 24. While $5.3 million will go toward working capital and debt reduction, the majority will establish Solana treasury operations, sending Upexi's stock surging over 330% since last week.

Source: Bloomberg & Global Fintech Insider

🇺🇸 PayPal Brings Back Will Ferrell To Showcase Online And In-Store Payment Options

PayPal has launched a new ad spot featuring comedian Will Ferrell singing a modified version of the song "Go Your Own Way" to "Pay Your Own Way" to highlight the multiple payment options offered by PayPal, including debit cards and BNPL loans. "This was a brand that people knew existed, but it had become this dormant brand. It just sat there. It didn't have a personality," explained Geoff Seeley, PayPal's chief marketing officer, to ADWEEK. The first iteration campaign featuring Will Ferrell, initially launched 7 months ago, is showing strong results, as PayPal added 3 million new debit card users since then. In a LinkedIn post about the new ad, Seeley highlighted the campaign's purpose: "It's another milestone as we transform the way shoppers think of our brand and drive them to choose PayPal for every purchase, every time."

Source: ADWEEK & Global Fintech Insider

Upcoming Fintech Events

🇬🇧 The Innovate Finance Global Summit will be held in London on April 29, 2025 (450 USD), with speakers such as Justin Basini, co-founder & CEO of ClearScore & Diana Avila, Global Head of Banking and Expansion at Wise.

🇨🇦 The AI Agent Montreal meetup will be held in Montreal on May 1, from 6:00 PM to 8:00 PM, with speakers such as Deck co-founder and president Frédérick Lavoie.

🇺🇸 FinovateSpring will be held in San Diego on May 7-9, 2025 (1,299 USD), with speakers such as Vishal Garg, founder & CEO at Better.com & Lauren McCollom, Head of Embedded Finance at Grasshopper Bank.

🇦🇪 Dubai FinTech Summit will take place in Dubai on May 12-13, 2025 (899 USD), with speakers such as Arik Shtilman, co-founder and CEO of Rapyd & John Caplan, CEO of Payoneer.

🇺🇸 Stablecon will take place in New York on May 29, 2025 (1,295 USD), with speakers such as Cuy Sheffield, Head of Crypto at Visa and Edward Woodford, CEO & co-founder of Zero Hash.

🇳🇱 Money20/20 Europe will be held in Amsterdam on June 3-5, 2025 (3,395 USD), with speakers such as Steven van Rijswijk, CEO of ING & Yoni Assia, CEO of eToro.

Who Am I?

Hi, my name is Julien Brault.

From 2017 to 2024, I was the CEO of Hardbacon, a fintech I co-founded, which reached 400,000 unique visitors at its peak.

A Google update ultimately sealed the company’s faith and I started this newsletter to keep myself busy in the aftermath.

Why share this?

Because my goal is to use my experience as an economic journalist, fintech entrepreneur and product manager to present the most essential fintech news from around the world through the eyes of an insider.

If you like what I do, feel free to share this newsletter and follow me on Linkedin, YouTube, TikTok, Instagram & X.

P.-S. : Once you refer a new subscriber to the newsletter using your unique share link, you'll receive a personalized social media shout-out from me to promote your work or professional profile. Just write to me at jrbrault@icloud.com once your referral is confirmed on our leaderboard and include your social media account(s) URL(s) and who you are.