Payroll Startup Shor Launches With a Bubble-Bath Ad Mocking Deel & Rippling 🇺🇸

We're covering N26 founders under investor fire 🇩🇪, 80+ fintech CEOs fighting open banking fees 🇺🇸, Stori eyeing a 2027 IPO, Wealthsimple hitting $61B AUM 🇨🇦 & F1's $500M fintech frenzy 🇬🇧

🇺🇸 Payroll Startup Shor Launches With a Bubble-Bath Ad Mocking Deel & Rippling

Shor, a new Y Combinator-backed payroll platform, decided to make its debut in an ad from a bubble bath. The US-based startup, hired influencer and financial analyst Max Zavidow (pictured above) to star in a tongue-in-cheek ad where he skewers traditional “employer of record” services. Filmed mid-soak, Zavidow jokes about rivals that pile on onboarding fees, lock clients into contracts and even hold funds for up to a week. “And while they are charging for every little thing, they are also busy with other extracurricular activities. I will let you Google that one yourself,” he says, a jab at the ongoing Deel–Rippling corporate espionage drama.

Shor, founded by Daivik Goel (left) and Avi Konduru (right), positions itself as a simpler and cheaper alternative. The platform automates up to 90% of HR tasks, integrates with tools such as Slack, and generates contracts instantly with salaries paid in local currency within 24 hours. Pricing is set at $99 per full-time employee plus a flat 2% FX fee.

Source: Global Fintech Insider

🇩🇪 N26 Founders Face Investor Revolt Amid Pressure from German Regulator

Founders and co-CEOs of German neobank N26, Valentin Stalf (right) and Maximilian Tayenthal (left), are under pressure to resign as investors move to replace them following renewed scrutiny from financial regulator BaFin, according to the Financial Times. A proposed deal would see Stalf step down by September 1 and Tayenthal by December 31, with both giving up special voting rights in exchange for some investors accepting reduced returns. Supervisory board chair Marcus Mosen is tipped to take over as interim co-CEO. Mosen has previously held senior roles at several fintech firms, such as Ingenico, Mastercard, and Roland Berger, including a two-year-plus stint as CEO of German payment service provider Concardis.

BaFin’s latest audit flagged “weaknesses in internal controls and organisation” at N26 and proposed new sanctions, adding to years of compliance troubles that saw the bank fined and temporarily capped on new customer growth. Restrictions on customer onboarding imposed in 2021 were only lifted last year. N26, which has raised over $1.8bn and serves more than 5 million customers, denied that its founders are being forced out, insisting its talks with regulators remain “confidential” and part of a “comprehensive improvement plan” due by March 2026.

Sources: Financial Times, Sifted & PYMNTS

🇺🇸 Open Banking: Over 80 Fintech CEOs Call on Trump to Block Bank Account Access Fees

More than 80 CEOs and fintech leaders, including executives from Coinbase, Stripe, Plaid, Chime, Klarna, Robinhood, Gemini and Kraken, have signed an open letter urging US President Donald Trump (pictured above) to block new “account access” fees planned by America’s biggest banks. The letter, published by the Financial Technology Association (FTA) and dated August 2025, warned that the fees, set to take effect in September, would prevent consumers from linking bank accounts to third-party apps, undermining competition and consumer choice in digital finance. “Large banks are taking aggressive action to preserve their market position by imposing exorbitant new ‘account access’ fees that would prevent consumers from connecting their accounts to better financial products of their choice,” said the letter. They cautioned that the policy would cripple innovation in three fast-growing areas: secure banking on-ramps for cryptocurrency, authorised AI financial assistants, and low-cost digital payments.

The pushback follows news from Bloomberg that JPMorgan Chase, the country’s largest bank, has already circulated pricing sheets to data aggregators like Plaid and MX. These fees would hit companies such as Venmo, Coinbase and Robinhood that rely on free access to customer banking data, striking at the heart of the open banking model. The move comes as the Trump administration’s scaled-back Consumer Financial Protection Bureau (CFPB) asks a federal judge to vacate the open banking rule, passed in October 2024, which would have required banks to share customer data for free.

Source: Global Fintech Insider & Bloomberg

🇮🇳 India’s Paytm Wins Regulator Nod Days After Chinese Giant Ant Group Exit

Indian payment giant Paytm has finally secured “in-principle” approval from the Reserve Bank of India (RBI) to operate as a payment aggregator for online merchants. This is a regulatory breakthrough that comes just a week after Chinese financial giant Ant Group sold its remaining 5.8% stake in the company for $454 million. An “in-principle” nod is essentially a conditional greenlight, provided the company must complete a full system and cybersecurity audit within six months or risk losing the licence. Paytm, headed by CEO Vijay Shekhar Sharma (pictured above), has seen its ownership structure shift notably in recent years. Back in 2023, Sharma boosted his holding in Paytm-parent One97 Communications to 19.42% after acquiring a 10.3% stake from Ant Group without paying any cash, cutting Ant’s stake to 13.5% at the time.

That deal, seen against the backdrop of India–China tensions and restrictions on Chinese firms, paved the way for Ant’s gradual exit, culminating in the recent divestment. The approval lets Paytm’s Payments Services arm resume onboarding online merchants, a privilege it lost in 2022 when its application was rejected over foreign investment compliance issues. Since then they were forced to rely on partner banks such as Axis, HDFC, SBI, and Yes Bank to keep transactions flowing. Paytm trails PhonePe and Google Pay in India’s Unified Payments Interface (UPI) market, handling just 6.9% of June’s 18.4 billion transactions worth ₹1.34 trillion ($15B).

Sources: TechCrunch & Bloomberg

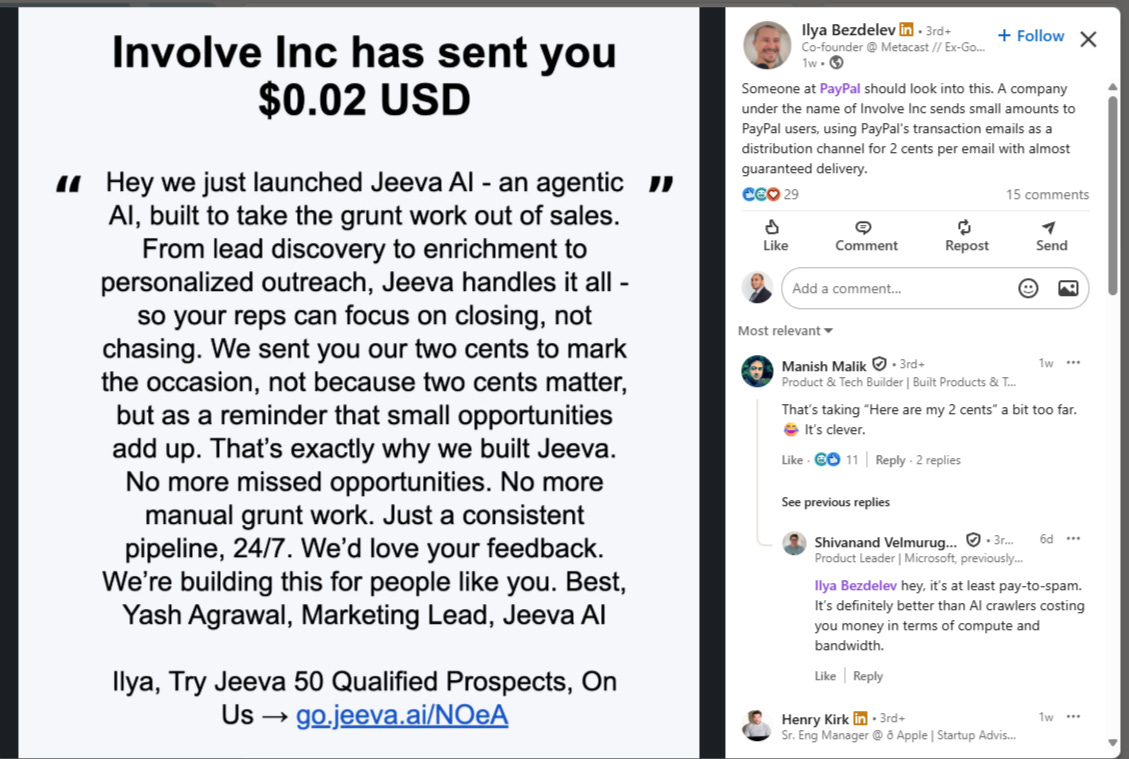

🇺🇸 Involve Sends 2¢ via PayPal to Slip Past Inbox Clutter

Involve, a web design firm that recently launched an AI prospection tool called Jeeva AI, has been spotted sending micro-payments of $0.02 through PayPal to trigger the platform’s transactional email alerts. This method makes sure their pitch gets read compared to the constant spam by emails and Gen AI marketing content flooding inboxes. The message ties into the launch of their AI tool pitched as taking the grunt work out of sales. The PayPal note reads: “ From lead discovery to enrichment to personalised outreach, Jeeva handles it all… We sent you our two cents to mark the occasion, not because two cents matter, but as a reminder that small opportunities add up.”

The stunt drew amused reactions on LinkedIn after Metacast co-founder Ilya Bezdelev flagged it and posted on Linkedin: “Someone at PayPal should look into this,” he said. “That’s taking ‘here are my 2 cents’ a bit too far,” joked Amazon’s Head of Product for Fire TV Apps, Subscriptions and Payments, Manish Malik. Microsoft’s Principal Product Manager Shivanand Velmurugan also quipped on the post, “Hey, it’s at least pay-to-spam. It’s definitely better than AI crawlers costing you money in terms of compute and bandwidth.”

Source: Global Fintech Insider

🇺🇸 Ex-Nubank and Stripe Employees Launch AI-Powered Market Analyst For Retail Investors

Former Nubank and Stripe employees have launched Gaus, offering ChatGPT-like insights, such as personalised market analysis, to retail investors. The Y Combinator-backed fintech is led by co-founders Bruno Koba (right) and Daniel Tulha Hochstetler (left), Brazilian fintech builders who’ve previously worked at Nubank, Stripe and Robinhood. Gaus tracks markets around the clock and alerts users when something important is happening, like a sudden price move or an early signal and explains why it matters. It also lets users test “what if” scenarios to see how an idea might play out before committing money.

Source: Global Fintech Insider

🇬🇧 Bleap Launches Global Send, a Faster Way to Move Money Worldwide

Bleap, a London-based crypto payments startup founded by former Revolut executives João Alves (right) and Guilherme Gomes (left), has launched Global Send, its new feature designed to make international money transfers as simple as sending a text message. With Global Send, users can send money from their Bleap wallet to anyone in the world using just a phone number or payment address. The system automatically picks the fastest and cheapest route, whether that’s blockchain, stablecoins, or local payment rails like SEPA Instant in Europe. Bleap has already rolled out euro support and plans to add Mexican pesos, Colombian pesos, Brazilian reals, Peruvian soles and Argentine pesos. Alongside transfers, the startup also offers a Mastercard-linked debit card that lets users spend stablecoins directly without conversion fees, as well as high-interest multi-currency accounts.

Source: Global Fintech Insider

🇨🇦 Canada’s Largest Fintech Wealthsimple Is Now Managing $60.7B in Assets

Wealthsimple, the Canadian digital wealth manager, has surged past 84 billion CAD (60.9 billion USD) in assets under management (AUM), up from 9 billion CAD (6.5 billion USD) in 2020. Taking to LinkedIn, its Chief Commercial Officer Paul Teshima (pictured above) wrote that Wealthsimple grew 94% since last year and 833% since he joined the Canadian robo-advisor in 2020. The milestone comes as Canadian asset manager, IGM Financial, raised the fair value of its investment in Wealthsimple to $1.48 billion CAD (1.1 billion USD) as of June 30, 2025, up from $1.22 billion CAD (885 million USD) at the end of 2024. Given that IGM owns 26.7% of Wealthsimple, it means that Wealthsimple’s valuation now reaches 5.54 billion CAD (4 billion USD). IGM Financial's parent company, Power Corporation of Canada, reports a combined equity interest of 54.3% in Wealthsimple through its subsidiaries.

Sources: Global Fintech Insider & Private Capital Journal

🇪🇺 Nato Nations Set Up Defence, Security and Resilience Bank with Backing From JPMorgan, ING and RBC

Nato nations are pressing ahead with the creation of the Defence, Security and Resilience Bank (DSRB), a new international lender to finance defence spending. The bank will be led by Rob Murray (pictured above), CEO of its incubator, the DSRB Development Group and former head of innovation at Nato. “The banks stepping up today understand that deterrence demands financial support, and this new institution is being built to deliver it,” he said in a statement to financial news outlets. Modelled on the World Bank, DSRB is expected to launch with around 40 shareholder nations and begin operating by late 2026. Founding banking partners include JPMorgan Chase, ING, Commerzbank, Landesbank Baden-Württemberg and Royal Bank of Canada. The DSRB will hold its first meeting in September to decide on its headquarters and leadership. Shareholders are expected to commit US$65–70 billion, securing a triple-A credit rating before the bank taps bond markets to expand lending.

Source: Finextra & Financial Post

🇨🇦 Nuvei Uses Stablecoins to Speed Up Global Payouts

Canadian payments processor Nuvei has begun using stablecoins, digital tokens tied to real currencies like the US dollar, to make cross-border transfers faster and cheaper. The service targets emerging markets, where traditional settlement systems such as SWIFT can take days and charge steep fees. “With this extension, we’re giving our customers the ability to move fiat account to account, across borders, faster and more cost-effectively than ever before,” Phil Fayer (pictured above), Nuvei’s CEO, told Fintech News Singapore. Businesses can fund local virtual accounts in their own country, with transfers settled the same day or the next day instead of several days later. Nuvei joins other fintechs exploring stablecoin rails such as Stripe and Airwallex.

Source: Fintech News Singapore

🇲🇽 Mexico’s Neobank Stori Eyes IPO by 2027 as Profits Emerge

Mexican neobank unicorn Stori CEO Bin Chen (pictured above) said the company is eyeing an initial public offering within the next two years. Operating profits are also expected later this year. “It’s not easy. You have to figure out how to serve customers, give them a great product while managing, compared to our industry segment, lower non-performing loans,” Chen said to Bloomberg. Stori, which offers credit cards, loans and deposit accounts to underbanked consumers, posted net income of 21.4 million pesos ($1.1 million) in the first half, with annualised revenue up 80% to $300 million. While 23% of loans were delinquent in June, Chen said risk-adjusted returns remain stronger. Founded in 2018, Stori has grown to 3.7 million users in Mexico with a 99% approval rate on its credit card. Its main competitors in the space include MercadoLibre and Nubank. If successful, the IPO would be one of Latin America’s first major startup listings since Nubank’s 2021 debut. Stori was last valued at $1.2 billion in 2021.

Source: Bloomberg

🇸🇦 Alaan Raises $48M to Double Down on Saudi Expansion

Dubai-based spend management startup Alaan has raised $48 million to accelerate its push into Saudi Arabia, where transaction volumes have doubled month-on-month for the past six months. Founded by ex-McKinsey consultants Parthi Duraisamy (right) and Karun Kurien (left), Alaan turns corporate expense headaches into AI-powered expense automation. “It was constant pain. I’d spend my weekends uploading receipts, reconciling every expense manually,” Duraisamy told TechCrunch, recalling the inspiration behind the company. Since launch, Alaan has processed over 2.5 million transactions for more than 1,500 firms, reached profitability by spending $5M to generate $10M in revenue, and was one of the first spend management fintech to allow its clients to add their cards to Apple Pay in the Middle East. Its AI tools streamline receipt matching, reconciliation, and VAT extraction, saving finance teams time in a region with complex tax rules. The round, led by Peak XV Partners (formerly Sequoia India & SEA) with backing from Y Combinator, 468 Capital, Pioneer Fund, and the founders of Careem and Tabby, is among the largest Series A deals for a fintech in the Middle East and North Africa region.

Source: TechCrunch

🇬🇧 Revolut, Airwallex and OKX pump $500M into F1 as fintechs go full throttle on sports

Fintech giants including Revolut, Airwallex and OKX have poured over $500 million into Formula 1 sponsorships for the 2025 season. Revolut, the UK-based neobank led by CEO Nik Storonsky (pictured above), has also signed a title deal with Audi’s F1 team that will take effect from the 2026 FIA Formula One Championship. As part of the partnership, Revolut Business will be integrated into the team’s financial operations, according to a statement released on their website.

Airwallex, the Australian global payments platform, has partnered with McLaren, while crypto exchange OKX has splashed its branding across McLaren’s gear. The average F1 sponsorship deal now tops $6 million, nearly double 2019 levels, according to SponsorUnited. Beyond motorsport, UK-based payment solution provider Sokin has struck sponsorship agreements with Manchester United, Nottingham Forest and the British & Irish Lions to be their official global payments partner. No figures were made available on the Sokin deal.

Sources: Marketing Week & City Am

🇨🇦 Canadian Banking Giants RBC & BMO Weigh Sale of $2B Payments Venture Moneris

Royal Bank of Canada (RBC) and Bank of Montreal (BMO) are exploring the sale of their Canadian payments joint venture Moneris, in a deal that could value the business at up to $2 billion, according to an exclusive report by Reuters. Currently, Moneris has been led by President and CEO James Hicks (pictured above) since 2023. Quoting sources, the report stated that the owners are in the early stages of discussions, with PJT Partners, RBC Capital Markets and BMO Capital Markets advising on the process. Moneris generates nearly $700 million in annual revenue, which sources said could support a valuation close to $2 billion. A sale, however, is not guaranteed, and the banks could still choose to keep part or all of the business. Founded in 2000, Moneris is one of Canada’s largest payment processors, handling one in every three business transactions nationwide and serving about 325,000 merchants.

Source: Reuters

Upcoming Fintech Events

🇺🇸 Fintech South will be held in Atlanta on August 19-20,2025 ($600), with speakers such as Joshua Silver, CEO of Rainforest & Kristin Slink, fintech strategist at FIS.

🇺🇸 FinovateFall will be held in New York on will be held on September 8-10, 2025 ($3,998), with speakers such as Norah Coelho, Managing Director, Embedded Finance at J.P.Morgan & Lindsey Downing, VP Interactive at TransUnion.

🇨🇦 The Customer Experience for Financial Services Summit will be held in Toronto on September 18–19, 2025 ($995), with speakers such as Amit Mondal, VP & Head of Digital Analytics & Experimentation at Amex & Angela Crapsi, AVP of Operations at Flexiti/Questrade.

🇩🇪 Sibos will take place in Frankfurt from Sept. 29 to October 2 ($1,180.90 for fintechs), with speakers such as Victoria Cleland, Director of Payments at the Bank of England & Sophie Gilder, Managing Director, Blockchain & Digital Assets at Commonwealth Bank.

🇺🇸 Money 20/20 USA will be held in Las Vegas on Oct. 26-29, 2025 ($3,849), with speakers such as May Zabaneh, VP of Digital Currencies at PayPal & Dietrich Kuhlman, CEO of Navy Federal Credit Union

Who Am I?

Hi, my name is Julien Brault.

From 2017 to 2024, I was the CEO of Hardbacon, a fintech I co-founded, which reached 400,000 unique visitors at its peak.

A Google update ultimately sealed the company’s faith and I started this newsletter to keep myself busy in the aftermath.

Why share this?

Because my goal is to use my experience as an economic journalist, fintech entrepreneur and product manager to present the most essential fintech news from around the world through the eyes of an insider.

If you like what I do, feel free to share this newsletter and follow me on Linkedin, X, Reddit, YouTube & TikTok.

If you are raising for your fintech and would like to be featured in Global Fintech Insider for free, fill this form.

P.-S. : Once you refer a new subscriber to the newsletter using your unique share link, you'll receive a personalized social media shout-out from me to promote your work or professional profile. Just write to me at jrbrault@icloud.com once your referral is confirmed on our leaderboard and include your social media account(s) URL(s) and who you are.