The Play Date Is Over For Danish Spending Card For Kids MyMonii 🇩🇰

We'll also cover PayPal's new cashback offering 🇺🇸, Saudi Arabia's bold plan to become a fintech Mecca 🇸🇦, Thailand's super-wallet scheme changes 🇹🇭 + other news from 🇦🇪, 🇬🇭 & 🇨🇳.

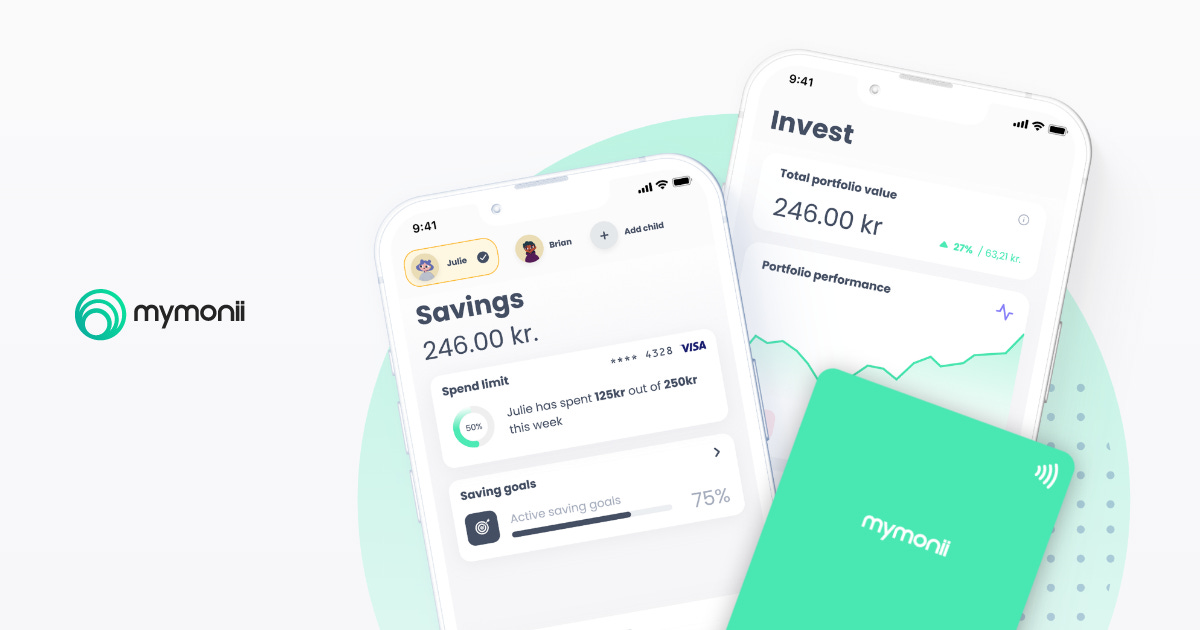

🇩🇰 The Play Date Is Over For Danish Spending Card For Kids MyMonii

MyMonii, a Danish fintech targeting families with kids aged 7-18, offered a parental-controlled Visa credit card and an app for setting savings goals. Despite eight years in business, the company struggled with scaling due to poor unit economics. Founder Louise Ferslev revealed that while MyMonii could break even, it lacked the resources to grow. The company's business model, which focused on collecting interchange fees from children's spending, made it hard grow without more funding. Meanwhile, its much bigger rival GoHenry, a UK-based fintech acquired by US-based Acorns in 2023, is already established in the US as well as in multiple European markets including the United-Kingdom, France, Italy and Spain.

Source: Finextra

🇺🇸 PayPal Now Offering Cash Back on In-Store Transactions

PayPal is stepping up its game with the launch of "PayPal Everywhere" in the United-States, introducing a 5% cash back rewards program on user-selected categories like groceries or clothing. This move is likely aimed at competing with credit cards that offer similar perks. The initiative also allows users to integrate their PayPal debit cards with Apple Wallet for in-store payments, expanding PayPal’s footprint beyond e-commerce. New features like auto-reload, which automatically tops up the debit card balance when it drops below a set threshold, are designed to make PayPal more convenient for everyday use.

Source: PYMNTS

🇸🇦 Saudi Arabia Aims to Become a Fintech Mecca with 525 Firms by 2030

Saudi Arabia is targeting 525 fintech companies by 2030, Finance Minister Mohammed bin Abdullah Al-Jadaan announced at the 24 Fintech conference on September 3, 2024. This goal, first set in 2023, highlights the kingdom’s push for digital transformation. Al-Jadaan noted that Saudi Arabia now has 224 fintech firms, surpassing its mid-2024 target of 168. He emphasized the role of open banking, alongside the kingdom’s advanced payments infrastructure and strong banking sector, in supporting this growth.

Source: Big News Network

🇹🇭 Thailand's New Government Adjusts Digital Wallet Plan to Include Cash Payments

Thailand’s new Prime Minister, Paetongtarn Shinawatra, is revising the 450 billion baht (US$13.1 billion) digital wallet initiative by adding cash payments to the original plan. Initially, 10,000 baht was to be distributed digitally through a "super app," but access concerns - particularly for those without smartphones or internet - led to the inclusion of cash for vulnerable groups. The app, developed by the Ministry of Digital Economy, will allow anyone to transact digitally, even those without a bank account. While this initiative could enable Thailand to leapfrog Western countries in digital payments, it remains to be seen if the government-backed app, which has been criticized for being buggy by local media, will become a fixture in Thai daily life.

Source: The Diplomat

🇺🇸 Mastercard Want Online Stores to Stop Asking for Credit Card Numbers

Mastercard is expanding its efforts to eliminate credit card numbers in online shopping as part of a broader push to combat payment fraud. The company is building on its decade-old token technology, which replaces card numbers with secure tokens, now processing 1 billion such transactions weekly. As online payment fraud is projected to exceed $91 billion by 2028, Mastercard is introducing new measures, including the use of biometric data like fingerprints and face scans instead of passwords.

Source: Bloomberg

🇬🇭 Fido Raised $30 Million to Lend Money to the Unbanked Population of Africa

Ghanaian fintech Fido has secured $30 million in Series B funding, with $20 million coming from impact investors BlueOrchard and FMO, aiming to expand its services across East and Southern Africa. Fido, which operates in Ghana and Uganda, provides digital lending solutions to underbanked individuals and microenterprises, offering loans between $20 and $500 with interest rates of 7% to 12%. The company uses mobile technology and alternative data, such as mobile money transactions, to serve populations often excluded from traditional banking. Along with credit, Fido also offers savings, bill payments, and smartphone financing, helping many unbanked individuals access financial services for the first time.

Source: Financial Afrik

🇦🇪 Ziina Secures $22M To Grow Its All-in-One Platform for SMBs

Ziina, the Dubai-based fintech, just secured $22 million in Series A funding, proving that even in a global funding slowdown, there’s room for winners. What sets Ziina apart? By evolving from a simple peer-to-peer payment app to an all-in-one financial platform for SMBs, the fintech tapped into the UAE’s booming small business market, a segment often underserved by traditional banks. With seamless payment solutions like gateways, POS systems, and social media payments, all wrapped in a user-friendly platform, Ziina removed the usual headaches of setup time, hidden fees, and complexity for business owners. Their product-led growth strategy - building irresistible features rather than relying on sales- fueled their rapid expansion to 50,000 customers, showing how fintechs can thrive by solving real pain points for SMBs.

Source: TechCrunch

🇨🇳 WeChat Pay Integration with Alibaba Sparks New Payment Era in China

Alibaba's Taobao and Tmall platforms will soon accept WeChat Pay, breaking down China's longstanding "walled garden" approach in e-commerce. This integration marks a significant shift in the payment landscape, allowing Tencent's WeChat Pay to rival Alibaba's Alipay on its own platforms. While the rollout timing remains unclear, this move could position WeChat, already a "super app," as a dominant force in the payment space. With JD.com and Pinduoduo already offering WeChat Pay, Alibaba’s adoption may enhance competition and reshape China's digital payments ecosystem.

Source: Reuters

Upcoming Fintech Events

🇺🇸 FinovateFall will be held in New York from Sept. 11th to 13th. ($999 to $3,998) with speakers such as Jazz Samra, head of strategic partnership at Wells Fargo.

🇨🇦 Canada Forum Fintech will be held in Montreal on Sept. 10th &11th. ($450 to $800) with speakers such as Shopify president Harley Finkelstein & New Jersey Governor Phil Murphy.

🇸🇬 Token2049 Singapore will be held on Sept. 18 & 19 ($999 to $4,999) with speakers such as Solana co-founder Anatoly Yakovenko & Binance CEO Richard Teng.

🇪🇸 The European Blockchain Convention will be held in Barcelona on Sept. 25th & 26th (€719 to €1899) with speakers such as Polygon co-founder Jordi Baylina and Kraken COO Gilles BianRosa.

Have some fintech news you think I should include in the Global Fintech Insider newsletter or heard some rumours you’d like me to look into? Drop me an email at: jrbrault@protonmail.com