Uzbekistan’s Digital Banking & Ecommerce Unicorn Uzum Is Taking Steps Toward an IPO 🇺🇿

We're also covering Rocket Money's open banking fees warning 🇺🇸, Wealthsimple's Bloomberg-killer acquisition 🇨🇦, Mexico's revenue per employee champion 🇲🇽, Forbes' next 4 fintech unicorns 🇺🇸

🇺🇿 Uzbekistan’s Digital Banking & Ecommerce Unicorn Uzum Is Taking Steps Toward an IPO

Uzum, Uzbekistan’s e-commerce and digital banking unicorn, is preparing to raise fresh capital to scale globally. Valued at $1.5 billion in a recent Tencent-led round, the company is planning a $300 million debut Eurobond as early as the first half of 2026, co-founder Nikolay Seleznev told Bloomberg.

The company is also laying the groundwork for a potential IPO in 2027, with Hong Kong, Abu Dhabi, and Nasdaq being considered as possible venues. Founded in 2022 by CEO Djasur Djumaev (pictured above), Seleznev and other partners, Uzum has grown into a platform serving 17 million users, spanning Uzum Bank for digital banking, Uzum Nasiya for BNPL and consumer lending, and Uzum Tezkor for food delivery.

Its rapid rise reflects Uzbekistan’s post-2016 economic liberalisation and the country’s youthful demographics, with more than half of its 38 million people under the age of 30. Though headquartered in Tashkent, Uzum is registered in Abu Dhabi, a move Djumaev said offers proximity to regional sovereign wealth funds

Source: Bloomberg

🇺🇸 Rocket Money CEO Says Users Will End Up Paying for JPMorgan’s Open Banking Data Fees

“Consumers are going to take the hit in the end. That’s just the way these things work,” said Haroon Mokhtarzada (pictured above), CEO of personal finance app Rocket Money, to Forbes, as JPMorgan Chase moves to impose new data access fees on fintechs using Plaid. Rocket Money, with four million paying subscribers, expects the costs will be passed down, possibly pushing its $8–$9 monthly plans higher and potentially forcing cuts to free spending-tracking features. Betterment CEO Sarah Levy also warned that higher costs would inevitably push her investment platform to raise prices for its one million customers. “If my costs go up, my pricing will need to go up,” though she expressed doubts that US regulators will ultimately allow JP Morgan’s plan. Betterment, which manages $63 billion in assets, also relies heavily on Plaid. Previously, JP Morgan CEO Jamie Dimon said data aggregators have cost the bank “a lot of money”.

Source: Forbes

🇨🇦 Wealthsimple Acquired Fey to Give Everyday Investors a Bloomberg-Like Tool

Wealthsimple, Canada’s most valuable fintech company, has acquired Fey, a Montreal-based investment analysis and research startup. The deal aims to fold Fey’s research features into Wealthsimple’s free stock trading platform by the end of the year. Fey mysterious co-founder Thiago Costa (pictured above) said the sale was driven by a shared mission to make sophisticated trading tools accessible to everyone. “That mattered, because while Fey had to be SaaS to survive, Wealthsimple could extend our vision to millions, changing how people relate to money, making it simpler, more enjoyable, and more beautiful. All without a monthly subscription,’’ he wrote on X. Fey’s toolkit includes earnings analysis, natural language stock screening, and a real-time personalised news feed, features designed to give retail traders the sophistication of a Bloomberg terminal without the complexity. Fey was co-founded in 2021 by Costa, Dennis Brotzky, and Thomas Russell. Wealthsimple, the Toronto-based wealth management firm and robo-adviser now serves three million Canadians and manages more than $80 billion in assets.

Source: Fintech.ca

🇺🇸 Meet The Next Four Billion-Dollars Fintech Unicorns According to Forbes

Fintech infrastructure and a new wave of AI-driven financial tools stand out on this year’s Forbes “Next Billion-Dollar Startups” list. The annual ranking, which spotlights 25 venture-backed firms likely to hit unicorn status, features Lead Bank, Rogo, Basis and creator payments platform Stan as its top fintech picks. All four reported their latest revenues in 2024. Lead Bank, based in Kansas City and led by CEO Jacqueline Reses (pictured above), has raised $110 million and posted $170 million in revenue, the highest of any company featured on the list. It is an FDIC-insured bank rebuilt to serve fintech and crypto startups with payments and lending infrastructure. Reses, who ranked 30th on Forbes’ 2021 Richest Self-Made Women list with a $920 million fortune, briefly crossed into billionaire status due to her stake and stock options in Square. She now sits at 59th place with an estimated net worth of $550 million.

Rogo, based in New York, has raised $75 million and generates $2 million in revenue. It is an AI chatbot for junior bankers that automates pitch decks, number-crunching, and research, cutting into the long hours of investment banking. New York based Basis, has raised $37 million and only made $350,000 in 2024. It uses AI to handle accounting tasks like data entry from receipts, reducing manual work for firms. California-based Stan, has achieved a $25 million revenue on just $5 million raised. The platform helps influencers monetise through online storefronts linked directly to their social profiles.

Source: Forbes

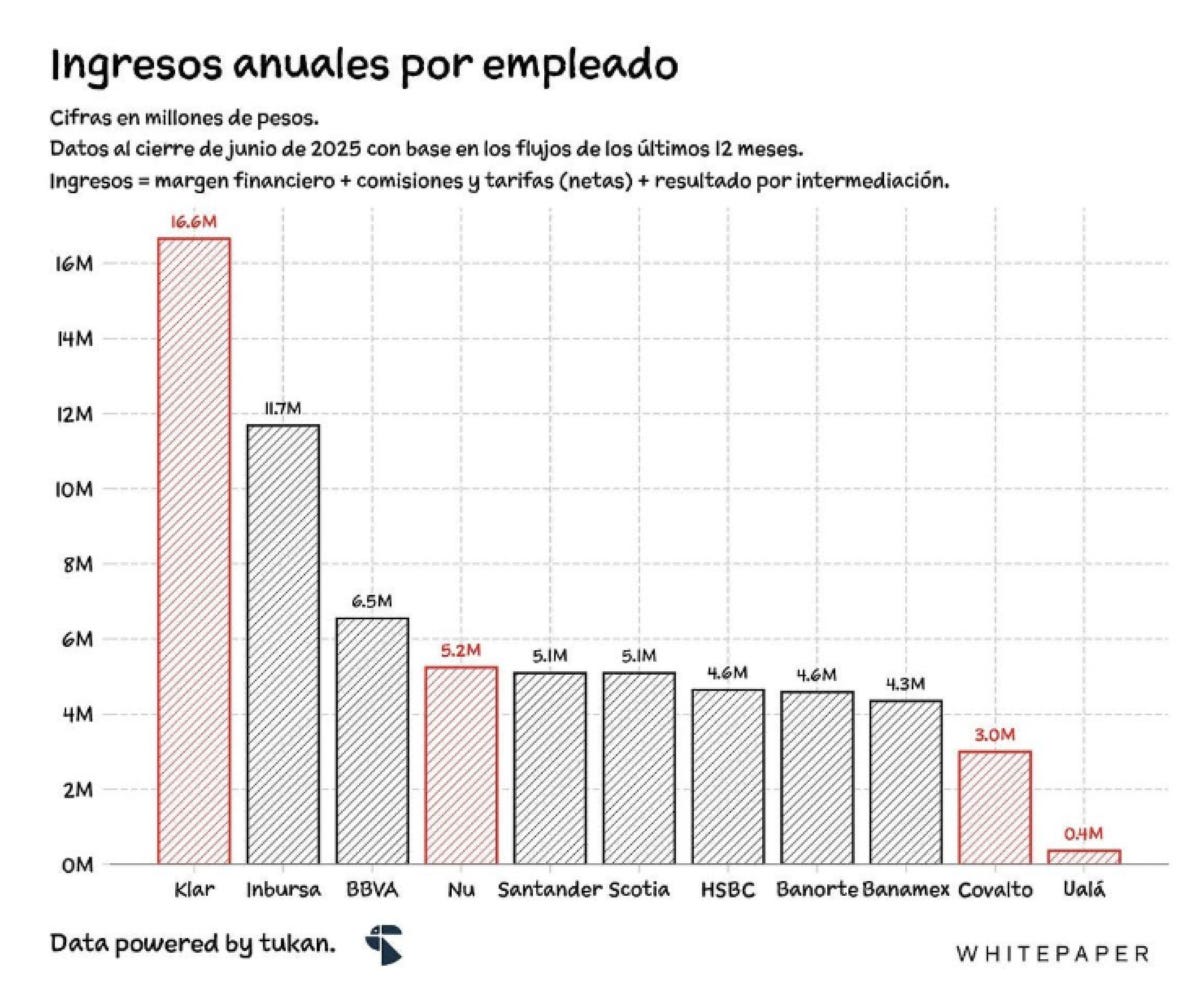

🇲🇽 Klar Tops Sales Per Employee, Outpacing BBVA, Santander And Nubank In Mexico

Mexican neobank Klar has outperformed both traditional banks and fintech competitors in Mexico on annual revenue per employee, according to recent data shared by CEO and founder Stefan Moller. The data, measured as of June 2025, shows Klar generating MX$16.6 million ($890,000) per employee, far outpacing both traditional banks and other fintech rivals. Moller credited Klar’s team for the performance, writing that this milestone was “100% because of Klar team’s quality and grit, nothing else.” he wrote on LinkedIn. By contrast, Argentine fintech Ualá posted just MX$0.4 million ($21,436) per employee. Traditional players sat in the middle with Banamex (MX$4.3 million or $230,465), Banorte (MX$ 4.6 million or $246,529), HSBC (MX$4.6 million or $246,529), Santander (MX$5.1 million or $273,326), Scotiabank (MX$5.1 million or $273,326), and BBVA (MX$6.5 million or $348,375). Among fintech peers, Covalto recorded MX$3 million ($160,789) and Nu (Nubank) MX$5.2 million ($278,689), while Inbursa stood out with MX$11.7 million ($627,050), second only to Klar. This comes after Klar raised US$190 million in a Series C round last month led by US private equity firm General Atlantic, valuing the neobank at more than US$800 million.

Sources: Global Fintech Insider & Fintech Futures

🇺🇸 Kikoff Unveils ChatGPT-Inspired AI Tool To Fix Credit Reports

San Francisco–based personal finance platform Kikoff has launched an AI-powered credit dispute tool that lets users spot and correct errors on their credit reports directly in the app. Live since August 13, the feature even allows users to send dispute letters to US credit reporting agency. CEO and co-founder Cynthia Chen (pictured above) told Fox Business the tool was used more than 70,000 times in its first week. Kikoff’s subscription plans start at $5 a month, giving users affordable credit-building services. Chen said AI can automate what was once a slow and confusing process: “Traditionally expensive services and products that are heavy with manual procedures can definitely be automated, making them more accurate and predictable.” Founded in 2019, Kikoff targets underserved consumers seeking accessible ways to build credit.

Source: Fox Business

🇵🇭 Philippines E-wallet Brings NFC Tap-To-Pay To 150 Million Mastercard Locations

GCash, the Philippines’ all-in-one finance app, has launched Tap to Pay, letting users make contactless payments at over 150 million Mastercard locations worldwide. The feature brings GCash in line with other leading Asian e-wallets such as GrabPay (Singapore, Malaysia), GoPay and OVO (Indonesia), and Touch ’n Go (Malaysia), which are adopting NFC technology similar to Apple Pay to complement QR code payments. GCash CEO Ren-Ren Reyes (pictured above) said the service is a “globally competitive solution that is locally relevant and universally accessible.” With 94 million registered users in a country of 112 million, GCash commands nearly 89% of the Philippine mobile wallet market. GCash also offers digital payments, money transfers, savings, loans, insurance, and investments. The new feature is powered by Alipay+ and Mastercard and operated by Mynt.

Sources: Global Fintech Insider

Upcoming Fintech Events

🇿🇦 Seamless Africa will be held in Johannesburg on September 8–9, 2025 ($750), with speakers such as Ricki Allardice, CEO, Orange, Francis Dufay, Group CEO, Jumia Group, and Wole Ayodele, CEO, Fincra.

🚨 GFI Exclusive Offer: Enjoy a 30% discount on Seamless Africa premium networking pass with the GFI30 promo code!

🇮🇱 Money Tel Aviv will be held in Tel Aviv on September 11, 2025 (₪300–₪600), with speakers include Zack Levine, Head of North America, Checkout.com, Eyal Shimoni, CEO, Hyp, & Ido Shamash, Head of Commercial Partnerships, Wix.

🚨 GFI Exclusive Offer: Save ₪100 (US$26) using the GFI promo code!

🇨🇦 Fintech Sandbox Innovation Forum will be held in Boston on September 16–17, 2025 ($495), with speakers such as David Jegen Managing Partner, F-Prime & Co-Founder, Fintech Sandbox, Karan Kashyap, CEO & Co-Founde at Posh, and Mike Massaro, CEO at Flywire.

🚨 GFI Exclusive Offer: Enjoy a 20% discount on tickets using the BFTW25-NEW-FRONTIER promo code!

🇨🇦 The Customer Experience for Financial Services Summit will be held in Toronto on September 18–19, 2025 ($995), with speakers such as Amit Mondal, VP & Head of Digital Analytics & Experimentation at Amex & Angela Crapsi, AVP of Operations at Flexiti/Questrade.

🇨🇦 Canada Fintech Forum will be held in Montreal on September 22–23, 2025 (CA$460–CA$1,199), with speakers such as Shelby Austin, Co-Founder and CEO at Arteria AI, Hamed H. Arbabi, Founder and CEO at VoPay, and Daniel Eberhard, Founder and CEO at KOHO.

🚨 GFI Exclusive Offer: Enjoy a 15% discount on tickets using the GFI15 promo code!

🇬🇧 Buy AND Build: The Future of Capital Markets Technology will be held in London on October 2, 2025 (£360), with speakers such as David Marcos, CIO & Head of AI, IO Capital Group, Richard Bell, Head of Engineering at CoinShares, and Jon Butler, Co-Founder & CEO at Velox.

🚨 GFI Exclusive Offer: Enjoy a 15% discount on tickets using the GFI15 promo code!

🇩🇪 Sibos will take place in Frankfurt from Sept. 29 to October 2 ($1,180.90 for fintechs), with speakers such as Victoria Cleland, Director of Payments at the Bank of England & Sophie Gilder, Managing Director, Blockchain & Digital Assets at Commonwealth Bank.

Who Am I?

Hi, my name is Julien Brault.

From 2017 to 2024, I was the CEO of Hardbacon, a fintech I co-founded, which reached 400,000 unique visitors at its peak.

A Google update ultimately sealed the company’s fate, and I started this newsletter to keep myself busy in the aftermath.

Why share this?

Because my goal is to use my experience as an economic journalist, fintech entrepreneur and product manager to present the most essential fintech news from around the world through the eyes of an insider.

If you like what I do, feel free to share this newsletter and follow me on Linkedin, X, Reddit, YouTube & TikTok.

If you are raising for your fintech and would like to be featured in Global Fintech Insider for free, fill this form.

P.-S. : Once you refer a new subscriber to the newsletter using your unique share link, you'll receive a personalized social media shout-out from me to promote your work or professional profile. Just write to me at jrbrault@icloud.com once your referral is confirmed on our leaderboard and include your social media account(s) URL(s) and who you are.