Wise CEO Says London Cannot Match Wall Street's Deep Capital Markets, Plans to Move Listing to the US 🇬🇧

We're also covering a military drone billionaire's fintech play 🇺🇸, Evolve robbing Peter to pay Mercury 🇺🇸, Airwallex CEO's crypto clash 🇸🇬, Revolut's first ATMs 🇪🇸 & Ant's AI fintech bet 🇨🇳

🇬🇧 Wise CEO Says London Cannot Match Wall Street's Deep Capital Markets, Plans to Move Listing to the US

UK fintech giant Wise plans to ditch London for a New York primary listing, delivering another blow to struggling British capital markets. The £12.5 billion ($16.9 billion) money transfer company said the move would bring "substantial strategic and capital market benefits", while CEO Kristo Käärmann admitted it was about accessing "the world's deepest capital markets." Despite strong results showing 21% customer growth to 15.5 million users and £1.2 billion ($1.62 billion) revenue, Wise joins an exodus including Flutter, and Deliveroo abandoning London.

The move also follows Revolut CEO Nik Storonsky calling a London listing "not rational", bluntly asking: "If you look at trading in the UK, you always pay a stamp duty tax which is 0.5 per cent. I just don't understand how the product which is being provided by the UK can compete with the product provided by the US."

Sources: Financial Times & Global Fintech Insider

🇺🇸 Military drone billionaire Palmer Luckey leads $2B valuation round for stealth stablecoin neobank Atticus

Military drone billionaire Palmer Luckey is leading a funding round that values stealth stablecoin neobank Atticus between $1.5-2 billion, according to Axios. The fintech was founded by Owen Rapaport, who previously launched digital asset compliance firm Aer Compliance, and Jacob Hirschman, Circle's former special counsel who now advises the stablecoin giant. Luckey, who has a $2.5 billion net worth and founded Oculus VR before selling it to Facebook and launching Anduril Industries, is backing the startup alongside existing investor Haun Ventures, whose partner Diogo Monica founded Anchorage Digital, dubbed America's first federally chartered crypto-native bank.

Source: Axios & Global Fintech Insider

🇳🇬 PalmPay, The African Fintech That Grew Thanks To Chinese Phones, About To Raise $100M

PalmPay is in talks to raise between $50-100 million in Series B funding at a valuation that remains undisclosed but could approach $1 billion, marking a major milestone for the now-profitable Nigerian fintech. The company has grown to 35 million registered users processing 15 million daily transactions by pre-installing its app on smartphones made by their strategic investor Transsion, a Chinese phone manufacturer which gained over 40% of Africa's smartphone market by offering mid-level Android devices featuring dual SIM functionality, long battery life, and camera calibration for darker skin tones. Founded in 2019 by Chika Nwosu (pictured above), PalmPay has expanded beyond Nigeria to Tanzania and Bangladesh, and plans to use the new funding to accelerate growth across Africa and Asia while deepening its presence in its home market.

Sources: TechCrunch & Global Fintech Insider

🇺🇸 Winklevoss Twins' Gemini Files Confidentially for IPO Following Circle's Market Debut Success

The billionaire Winklevoss twins known for their portrayal in The Social Network movie are betting on crypto's public market momentum. Cameron and Tyler Winklevoss, who received $65 million from Facebook's Mark Zuckerberg after claiming he stole their social network idea, have filed confidentially for an IPO of their cryptocurrency exchange Gemini, timing their move after Circle's spectacular debut that saw shares open at $69, more than double its $31 IPO price this week. Founded in 2014, Gemini named former Affirm executive Dan Chen as CFO in March specifically to prepare for going public, following regulatory wins including the SEC wrapping up its investigation without enforcement action in February and a $5 million CFTC settlement in January

Source: CNBC & Global Fintech Insider

🇺🇸 Evolve Bank Accused of Running Ponzi Scheme Favoring Mercury Over Yotta Users

Fintech savings app Yotta has dramatically escalated its legal war against Evolve Bank, now accusing it of operating a Ponzi scheme that allegedly stole over $75 million in customer funds. The explosive amended complaint filed this week claims that when Evolve migrated corporate fintech Mercury off collapsed banking-as-a-service provider Synapse's platform in October 2023, the bank knowingly used funds from smaller customers to make Mercury whole despite being aware of account shortfalls. "This is a case about a bank that utterly failed in its most basic duties to its customers by misappropriating tens of millions of dollars in customer funds, lying in order to cover up its malfeasance, and running a Ponzi scheme," the complaint states. The fintech disaster, stemming from Synapse's April 2024 bankruptcy that left $65-95 million in customer funds missing, has devastated Yotta's business after bringing over 100,000 customers to Evolve and spending more than $20 million building its banking services.

Source: American Banker

🇸🇬 Airwallex CEO Jack Zhang Clashes With Fintech Brainfood’s Simon Taylor on X

Airwallex CEO Jack Zhang ignited a heated X exchange after questioning whether stablecoins can actually reduce foreign exchange fees, writing "if you send money from USD to EUR, and the receiving end still requires to receive EUR in their bank, I can't see any ways stablecoin can reduce fees." Zhang, whose Singapore-based payments company already moves money at less than 0.01% cost in real time, admitted "I still don't see a single use case yet on how crypto is helping anything in the last 15 years" and felt like "an idiot" for not grasping the hype. Simon Taylor, who publishes the Fintech Brainfood newsletter, pushed back, arguing on X that stablecoins are "cheaper for global South x global South" transactions and predicting upcoming US regulations would make stablecoins "the rail that rules them all." Zhang argued that being regulated in the U.S. does not allow a company to offer consumers stablecoins wallet in another country, noting that “global south countries doesn’t want their consumers to all hold USD” so it’s unlikely that it will be allowed. Taylor argued that "the dollarization of LATAM is something currency controls have failed to prevent" and is "accelerating” despite the regulations in place.

Source: Global Fintech Insider

🇪🇸 Revolut Launches Its First Ever ATMs in Barcelona and Madrid

British neobank Revolut is adding a physical layer to its operations with 50 sleek ATMs rolling out across Barcelona and Madrid this week. Revolut chose Spain as the testing ground for its inaugural ATM network, planning to reach 200 machines spanning Barcelona, Madrid, Valencia, and Malaga by 2026. The London-based neobank selected Spain partly because one in ten Spaniards holds a Revolut account, making it the company's second-largest continental European market with nearly 5 million users. Chief Growth and Marketing Officer Antonie le Nel explained the strategic move, telling press that while Revolut remains digital-first, "cash is still important" and the ATMs will help build "trust and the feeling of proximity" with customers. The machines offer fee-free withdrawals for Revolut users and allow non-customers to instantly obtain Revolut debit cards on-site, while providing the company's competitive exchange rates for international withdrawals.

Source: Catalan News

🇨🇦 Lisa Shields, Who Sold Her Previous Fintech To PayPal, Raises $30M For Banking Software Fispan

Lisa Shields, who sold her previous fintech Hyperwallet to PayPal for $400 million in 2018, has raised $30 million for Vancouver-based fintech Fispan, which helps banks embed their services directly into business software like QuickBooks and NetSuite. The company sells its software to 15 banks including BMO, TD, JPMorgan and Wells Fargo, enabling those banks to offer their services within the accounting platforms. The round was led by U.S. growth equity firm Canapi Ventures, whose managing partner Gene Ludwig previously served as chief banking regulator during the Clinton administration and whose funders include 75 financial institutions

Source: Globe and Mail

🇺🇸 Trading App Public.com Ditches Social Features In Favour Of AI

The "social investing app" just stopped being social altogether. Public announced it's sunsetting all social features on its platform, with co-CEO Leif Abraham (pictured above) stating on LinkedIn: "AI has cannibalized social. Today we are sunsetting the social features on Public." When Public launched, users could see other people's trades and insights in a social feed, which helped make it "not just a place to trade but a community." The company explained that over time, both the product and customers matured, with existing customers becoming more sophisticated and new customers arriving with extensive investing experience. Data from Public reveals the effectiveness behind this strategic shift: users who engage with their AI Alpha tool are nearly twice as likely to make a trade within 3 hours (25%) compared to those engaging with social posts (13%). The move is particularly intriguing given that competition in social trading is growing rapidly, with platforms like Dub and Autopilot expanding quickly, while eToro having recently completed a blockbuster IPO.

Source: Global Fintech Insider

🇺🇸 Ryan Breslow's Bolt Teams Up With Alex Karp’s Palantir For AI Powered Checkout

Ryan Breslow's one-click checkout platform Bolt has partnered with Alex Karp's Palantir Technologies to offer AI-enhanced personalized checkout experiences using the defense contractor's data analytics capabilities. The collaboration will leverage Bolt's trove of shopper data fed into specialized models created with Palantir's software to present consumers with preferred payment methods, remember shopping preferences, and suggest additional purchases. Breslow qualified this new personalized checkout the “world’s first smart checkout” in a Linkedin post accompanied by pictures of him and Palantir CEO Alex Karp inking the deal. The partnership raises eyebrows given that Palantir, although it was co-founded by Peter Thiel, is primarily known for its intelligence and defense tools used by militaries and counter-terrorism analysts.

Sources: Bloomberg & Global Fintech Insider

🇬🇧 Revolut Adds Wero Money Transfers To Its App As It Joins The European Payments Initiative

Revolut has joined the European Payments Initiative to integrate its Wero Wallet, giving millions of customers access to account-to-account payments that bypass traditional card schemes. The move brings Revolut into a network that already has 40 million users across its initial markets and enables instant transfers within 10 seconds using phone numbers, email addresses, or QR codes through SEPA Instant Credit Transfer protocols. Revolut customers in France, Belgium, and Germany will initially access Wero's peer-to-peer transfer features directly within their app, with e-commerce payments planned for the second half of 2025 and in-store payments, subscription management, and loyalty services from 2026. David Tirado, VP of global business at Revolut, stated : "Facilitating seamless access to free and instant payments is no longer a nice to have, it's a must." The partnership reflects growing European concerns about payment sovereignty amid trade tensions, with European Central Bank President Christine Lagarde recently advocating for Europe to stop relying on US payment networks.

Source: Finextra

🇪🇸 Payflow, A Wage Access Provider Used by Five Guys, Claims It Reduce Employee Turnover By 21%

Barcelona-based fintech Payflow has closed a €10 million ($11.4 million) funding round led entirely by German fund Cusp Capital. The Y Combinator-backed fintech, which provides earned wage access solutions allowing employees to receive their salary on demand, claims its wage access loans reduce employee turnover by 21% on average. Payflow operates across Spain, Portugal, Colombia, and Peru, serving over 1,000 companies including Lidl, Mango, Decathlon, and Five Guys. The company generates €6 million ($6.9 million) in annual revenue with fewer than 50 employees. In a Linkedin post, co-founder Avinash Sukhwani (left) revealed that the company was growing 70% per year, while maintaining a negative margin of -10%.

Source: CincoDias & Global Fintech Insider

🇨🇳 Alibaba's Payment Arm Wants To Help Fintechs Leverage AI For Fraud Detection, Customer Service & More

Alibaba's fintech arm Ant Group has rolled out the Alipay+ GenAI Cockpit, an AI-as-a-Service platform designed to help fintech companies build autonomous AI systems for payments and compliance. The Singapore-based international division describes applying AI to finance as the "holy grail of the current AI revolution," with Chief Innovation Officer Jiangming Yang stating "the FinAI sector is at its big-bang moment. We are eager to work with the industry to evolve and expand the toolbox as well as this ecosystem to help financial businesses scale their growth faster and better." The platform supports over 20 leading AI models, including Ant's proprietary Falcon Time-Series Transformer FX, and focuses on combating deepfakes and AI-generated payment fraud through its AI Shield framework. Ant claims its fraud loss rate is just 5% of the industry average, while the platform offers built-in AI agents for customer service, curated advertisements, and AI-assisted coding. The tool will be rolled out across Southeast Asia and South Asia this month as part of Ant's broader Alipay+ cross-border mobile payments ecosystem.

Source: South China Morning Post

🇸🇬 Cross Border Payment Company Thunes Expands To Denmark, Norway & US

Singapore-based cross-border payments company Thunes has rolled out direct Pay-to-Bank services across Denmark, Norway, and Sweden got its payments licenses in the US following its recent $150 million Series D funding. The expansion allows Thunes network members to access the Nordic region's $600 billion in export volumes and over $5.4 billion in inbound remittances through direct corridors supporting Danish krone, Norwegian krone, and Swedish krona payouts. The company has also secured money transfer licenses across all 50 US states, with final approvals pending. Co-founder and Deputy Chairman Peter De Caluwe (pictured above) described the milestone on LinkedIn as "a major step forward in the journey we started years ago: building a global network that connects every wallet, every account and every user." President and COO Chloé Mayenobe wrote on LinkedIn: "With our U.S. licenses in hand, we can now directly serve American businesses with real-time Pay and Accept solutions."

Source: The Paypers & Global Fintech Insider

🇮🇪 SoftBank Takes Strategic Stake In Irish Fintech Nomupay To Strengthen Payment Business

SoftBank is doubling down on cross-border payments with a strategic $40 million investment in Irish fintech Nomupay at a $290 million valuation. The funding comes from SB Payment Service, SoftBank's payment subsidiary, marking a clear strategic play to expand the Japanese giant's existing payment capabilities rather than a typical venture investment. Nomupay CEO Peter Burridge (pictured on the left) told TechCrunch the partnership will immediately unlock Japanese alternative payment methods for global merchants, stating "starting immediately, we will be adding Japan APMs to our platform, enabling the rest of world merchants to plug into us and get access to Japanese consumers without having to have an entity in Japan." The deal mirrors Tencent's strategic investment in Airwallex to enhance WeChat Pay's capabilities, with SoftBank likely leveraging its strong Asia presence to help Nomupay expand across the region. The Dublin-based startup, which serves over 2,000 merchants globally and expects to exceed $45 million in gross annualized revenue by end-2025, has raised roughly $120 million total and is preparing to launch coverage in Singapore, Indonesia, and Vietnam.

Source: TechCrunch & Global Fintech Insider

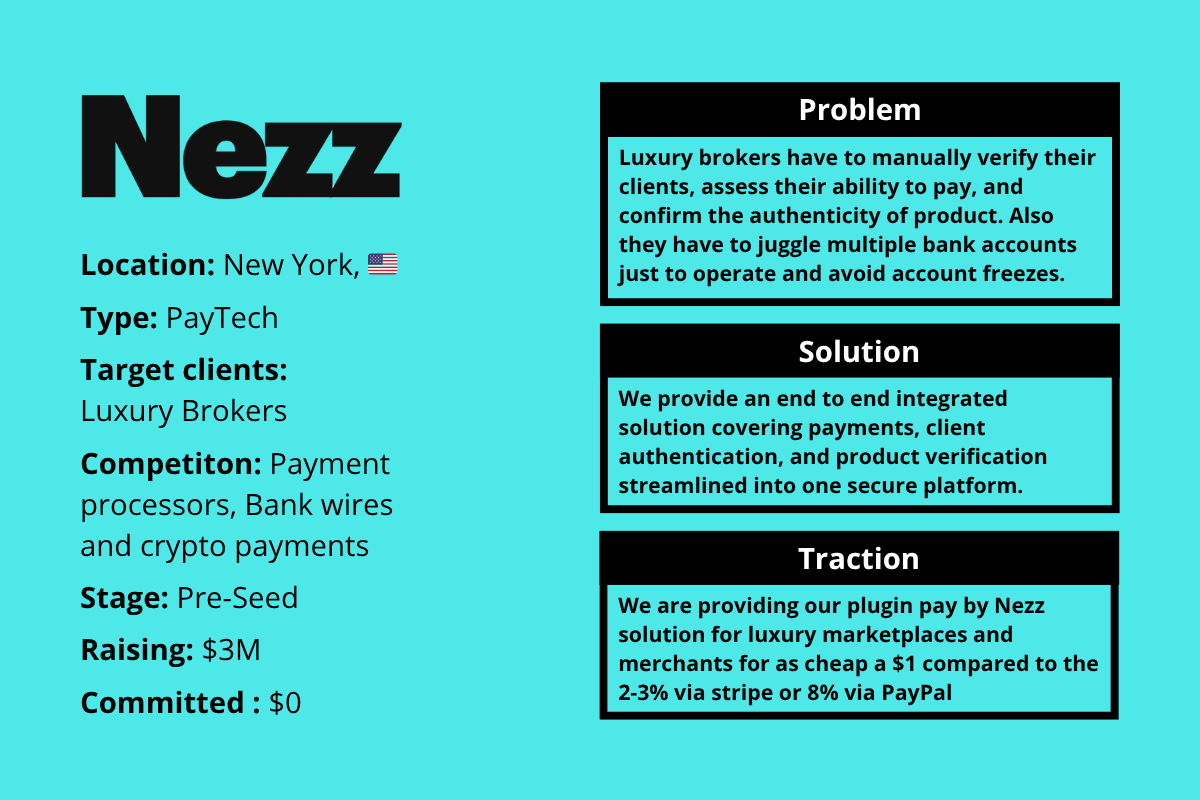

Fintech Currently Fundraising

If you are interested learning more about Nezz, feel free to reach out to Lopsii Olagoke at : lolagoke@nezzapp.com

PS: Keep in mind the fintech I feature here are not deals I’m actually recommending doing, but fintechs that I think are worth a look based on the very limited information they submitted through this form. If you are currently raising for your fintech, feel free to fill it, too.

Upcoming Fintech Events

🇳🇱 Money20/20 Europe will be held in Amsterdam on June 3-5, 2025 (3,395 USD), with speakers such as Steven van Rijswijk, CEO of ING & Yoni Assia, CEO of eToro.

🇬🇧 The Future of FinTech Conference 2025 will be held in London on June 12, 2025 (527 USD), with speakers such as Kirsty Rutter, Strategic Investment Director at Lloyds Banking Group & Chris Waring, Head of Digital Customer Journeys at NatWest.

🇮🇱 Money Tel Aviv will be held in Tel Aviv on June 18-19, 2025 ($83), with speakers such as Ido Shamash, head of payments at Wix & Ran Cohen, CEO at BridgerPay.

🇺🇸 Fintech South will be held in Atlanta on August 19-20,2025 ($600), with speakers such as Joshua Silver, CEO of Rainforest & Kristin Slink, fintech strategist at FIS.

🇨🇦 The Customer Experience for Financial Services Summit will be held in Toronto on September 18–19, 2025 ($995), with speakers such as Amit Mondal, VP & Head of Digital Analytics & Experimentation at Amex & Angela Crapsi, AVP of Operations at Flexiti/Questrade.

🇺🇸 Money 20/20 USA will be held in Las Vegas on Oct. 26-29, 2025 ($3,849), with speakers such as May Zabaneh, VP of Digital Currencies at PayPal & Dietrich Kuhlman, CEO of Navy Federal Credit Union

Who Am I?

Hi, my name is Julien Brault.

From 2017 to 2024, I was the CEO of Hardbacon, a fintech I co-founded, which reached 400,000 unique visitors at its peak.

A Google update ultimately sealed the company’s faith and I started this newsletter to keep myself busy in the aftermath.

Why share this?

Because my goal is to use my experience as an economic journalist, fintech entrepreneur and product manager to present the most essential fintech news from around the world through the eyes of an insider.

If you like what I do, feel free to share this newsletter and follow me on Linkedin, X, Reddit, YouTube, TikTok & Instagram, .

P.-S. : Once you refer a new subscriber to the newsletter using your unique share link, you'll receive a personalized social media shout-out from me to promote your work or professional profile. Just write to me at jrbrault@icloud.com once your referral is confirmed on our leaderboard and include your social media account(s) URL(s) and who you are.