Arrested Development’s Will Arnett Stars In RBC Ad Dismissing Fintechs As a Trend 🇨🇦

We're also covering Monzo CEO ousted over listing fight 🇬🇧, Coinbase boss manipulating markets for fun 🇺🇸, Pakistani stablecoin kiosks 🇵🇰 & Dutch neobank Bunq entering the US 🇳🇱

🇨🇦 Arrested Development’s Will Arnett Stars In RBC Ad Dismissing Fintechs As a Trend

RBC, Canada’s largest bank, released a one-minute ad featuring Netflix’s Arrested Development star Will Arnett that dismisses digital banks as mere trends. In the commercial, the Canadian actor walks past a street vendor wearing a sandwich board for “Kule Bank” who tries to hand him promotional material, to which the actor responds “Nah, I’m good.” The ad concludes with Arnett pointing to the RBC logo inside a branch, declaring “track record, not a trend.”

The ad sparked immediate pushback from two Canadian neobank founders. Neo Financial co-founder Jeff Adamson responded with humour in a LinkedIn post: “I’m super flattered that RBC is thinking of Neo Financial and other ‘trends’, so this year for Halloween, I’m going as ‘Kule Bank.’” KOHO founder and CEO Daniel Eberhard corrected the bank’s spelling: “It’s pronounced KOHO, not KULE.” Michael Fox, Chief Risk Officer at KOHO, added that “Fintechs like us will take the extra publicity here. Thanks to RBC for creating extra awareness.”

Source: Global Fintech Insider

🇬🇧 Monzo Replaces CEO After Board Clash Over London vs NYC Listing

UK neobank Monzo is replacing CEO TS Anil with former Google executive Diana Layfield in a surprise shake-up. Layfield spent nine years at Google as general manager of search, international, and growth.

Anil, who led Monzo for nearly six years, will step down in February after clashing with the board over where to list as the company weighs a stock market float. The board favours London while Anil pushed for New York, according to the Financial Times.

In a LinkedIn post, Anil called the move “bittersweet,” saying he and the board had initially searched for a UK chief executive to report to him. But during the process, they decided Layfield should replace him entirely.

Under Anil’s leadership, Monzo grew from a startup to a major player, reaching 13 million customers and posting over £1 billion ($1.3 billion) in annual revenue for the first time in March 2025.

Source: Financial Times

🇺🇸 Need a Chief Risk Officer but Can’t Justify the Full-Time Hire? Matthew Komos Has the Solution

SPONSORED - When risk oversight starts stretching your bandwidth, OGMA Risk & Analytics steps in. Founded by Matthew Komos, former VP at TransUnion and 25-year risk management and analytic veteran, OGMA delivers fractional CRO expertise to fintechs and financial institutions.

Their Fractional Chief Risk Officer and Risk Department On Demand programs give immediate access to top-tier risk leadership, analytics, and compliance expertise without the full-time cost. Whether you’re scaling, facing regulatory scrutiny, or building your governance framework, OGMA embeds seamlessly with your team to bring structure, clarity, and control.

Because in a fast-moving market, managing risk shouldn’t slow your growth: it should drive it.

🇺🇸 Coinbase CEO Brian Armstrong Manipulates Prediction Markets Live On Earnings Call

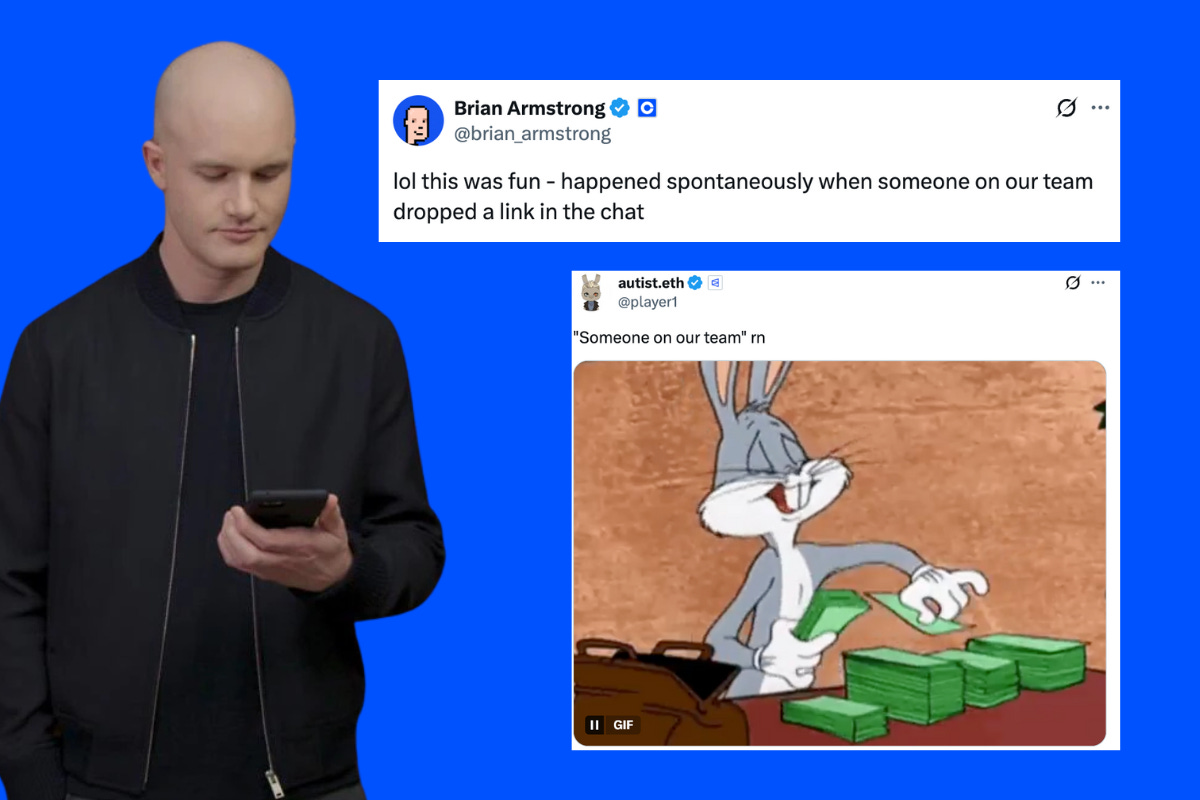

During Coinbase's quaterly earnings call last week, Coinbase CEO Brian Armstrong admitted he was “a little bit distracted” because he’d been tracking prediction markets about what words he would say during the call, then deliberately blurted out “Bitcoin, Ethereum, Blockchain, Staking, and Web3”.

By intentionally saying these words, Armstrong caused bettors who had wagered against him mentioning them to lose their positions. Brian Armstrong later explained on X that manipulating prediction markets while on a quarterly call was not something he prepared: “lol this was fun – happened spontaneously when someone on our team dropped a link in the chat.”

The response on X was harsh, with one bettor replying “Brian, I lost around $10,000 on all of these words. Do you still think this was fun?”. Others were wondering whether Armstrong’s employees benefited from his spontaneity: “Did you investigate if that team member had any positions open??”, one X user asked him.

Sources: Global Fintech Insider

🇲🇽 Jack Ma’s Ant Group Pumps Cash & AI Technology Into Mexican Startup R2

Chinese billionaire Jack Ma’s Ant International invested an undisclosed sum in Mexican embedded-lending startup R2, one year after raising $59 million from other investors. As part of the deal, Ant International will equip R2 with AI-powered tools to lower credit costs and improve underwriting accuracy. R2 allows its clients, like food delivery and ride-hailing platforms Rappi and InDrive, to offer loans to their gig workers, with repayments automatically deducted as a percentage of their earnings.

Source: Bloomberg

🇺🇸 Western Union Plans to Launch Stablecoin on Solana to Cut Global Transfer Costs

US-based money transfer giant Western Union is preparing to issue its own US dollar–backed stablecoin, dubbed the USDPT, on the Solana blockchain.

Western Union is partnering with San Francisco-based crypto bank Anchorage Digital, which will handle the stablecoin’s issuance, custody, settlement, and treasury operations.

In an interview with Bloomberg last July, Western Union CEO Devin McGranahan said stablecoins could solve two key challenges in emerging markets, which are currency conversion and value preservation.

“Converting stablecoin into fiat currencies, particularly in harder-to-convert markets, is an opportunity for us. For many of our customers, a stablecoin presents a store of value that’s tough to achieve in their country,’’ he said in the Bloomberg interview, adding that about 60% of Western Union’s business is outside the United States.

Sources: American Banker & Bloomberg

🇵🇰 A16z Backs $12.9M Round to Make Stablecoins Available on Every Pakistani Street Corner

Venture capital giant Andreessen Horowitz (a16z) is leading a new funding round for a Pakistani-based startup to make dollar-backed stablecoins as easy to access as mobile top-ups.

The firm is leading a $12.9 million funding round for ZAR, where the one-year-old startup plans to use local corner stores, kiosks, and money agents to let users swap cash for stablecoins stored in mobile wallets linked to Visa cards.

The model targets over 100 million unbanked adults in Pakistan, one of the world’s fastest-growing crypto markets. “Most people don’t need to understand blockchain to use stablecoins, they just need access,” co-founder Brandon Timinsky (left) said in an interview with Bloomberg.

Founded in 2024 by Timinsky and Sebastian Scholl (right), who previously sold their mobile wallet startup SadaPay to Turkey’s Papara, ZAR has now raised $20 million in total and plans to expand to Africa in 2026.

Source: Bloomberg

🇨🇦 WonderFi Sale to Robinhood Pushed to 2026 Over Regulatory, Tech Delays

Canada’s largest crypto-exchange WonderFi has announced that its sale to US trading platform Robinhood Markets has been delayed until the first half of 2026.

WonderFi attributed the delay to additional development work and regulatory approvals required for Robinhood to deploy its proprietary technology across WonderFi’s platforms.

The deal, first announced in May for $250 million CAD ($178 million) in cash, was initially expected to close in the second half of 2025. WonderFi, which trades on the Toronto Stock Exchange, has already secured shareholder and Competition Bureau approvals and received a final court order from the Supreme Court of British Columbia. WonderFi currently oversees $1.9 billion in client assets across regulated exchanges Bitbuy and Coinsquare.

Source: Betakit

🇺🇸 Startup Charter Space Wants to Break the Space Insurance Bottleneck with AI

San Francisco-based Charter Space is tackling a massive satellite insurance bottleneck with AI-powered underwriting that makes coverage faster and cheaper.

Founded in 2021 by former space lawyer Yuk Chi Chan, Charter connects satellite manufacturers’ engineering data directly to an underwriting platform linked with six major insurers. According to Chan, out of 13,000+ active satellites, fewer than 300 are insured due to complex and expensive risk assessments.

Source: TechCrunch

🇳🇱 Dutch Neobank Bunq Wins US Broker-Dealer License, Eyes American Expansion

Amsterdam-based neobank Bunq has successfully entered the US market after securing a broker-dealer license. The approval, granted by the Financial Industry Regulatory Authority (FINRA), allows Bunq to offer securities trading and investment services to American customers. The neobank first applied for the license in April.

Founded in 2012 by Ali Niknam, Bunq had previously sought a US banking license under the Biden administration in 2023 but withdrew the application. With the Trump administration’s fintech-friendly stance, the company is now expected to revisit those plans.

Source: Bloomberg

Upcoming Fintech Events

🇺🇸 NextGen Payments & RegTech Forum – USA will be held in Austin on November 13–14 ($785–$1,249), with la ist of speakers to be announced closer to the dates.

🚨 GFI Exclusive Offer: Enjoy a 10% discount on tickets using the qube10 promo code!

🇺🇸 Banking Transformation Summit will be held in Charlotte on November 17–18, 2025 ($2,280), with speakers such as Darius Wise (President & CEO, Red Rocks Credit Union), Priya Singh (Lead Data Scientist, Mastercard), and Rene Schuurman (Director – CashPro Product Manager, Bank of America).

🚨 GFI Exclusive Offer: Enjoy a 20% discount on tickets using the GFI20 promo code!

🇲🇾 Digital Finance Asia Summit – Malaysia will be held in Kuala Lumpur on November 18, 2025 (Price TBC), with speakers such as Sam Majid (CEO, National AI Office Malaysia), Nic Ngoo (CTO, Ryt Bank), and Farhan Ahmad (Group CEO, Payments Network Malaysia – PayNet).

🚨 GFI Exclusive Offer: Enjoy a 20% discount on tickets using the #GlobalFinDFA promo code!

🇩🇪 Banking 4.0 and Banking Innovation Conference will be held in Berlin on November 20–21, 2025 (€1,299–€4,999), with speakers such as Kamini Belday (Head of Global Payments & Transformation Executive, IBM), Sonja Marjanovic Vucic (Chief Data Officer, NLB Banka a.d. Banja Luka), and Nicole Onuta (AI Business Transformation Strategist, ING).

🚨 Save €100 on tickets using the promo code RQM8TEFV!

🇺🇸 RegTech Summit NYC will be held in New York City on November 20, 2025 ($995.50), with speakers such as Kenneth Lamar (Principal Partner, Lamar Associates LLC), Kristi Kunworee Baishya (AVP – Data and AI Product Management, Nomura Holding America), and Sepehr Irandoost (Head of Global Surveillance Calibration and Effectiveness, Bank of America).

🚨 GFI Exclusive Offer: Enjoy a 15% discount on tickets using the GFI15 promo code!

🇬🇧 Fintech Connect will be held in London on December 2–3, 2025 (£299), with speakers such as Aleksi Grym (Head of Fintech, Bank of Finland), Apoorv Kashyap (Head of AI, Santander UK), and Ben Brophy (Head of Institutional Growth, Europe, Solana).

🚨 GFI Exclusive Offer: Enjoy a 20% discount on tickets using the AAA-PTN20 promo code!

🇨🇳 Insurtech Insights Asia will be held in Hong Kong on December 3–4, 2025 ($299–$1,999), with speakers such as Huynh Thanh Phong (Group CEO, FWD), Edward Moncreiffe (CEO, Insurance, HSBC Life), and Masashi Namatame (Group Chief Digital Officer, Tokio Marine).

🚨 GFI Exclusive Offer: Enjoy a 25% discount on tickets using the GFI25 promo code!

Who Am I?

Hi, my name is Julien Brault.

From 2017 to 2024, I was the CEO of Hardbacon, a fintech I co-founded, which reached 400,000 unique visitors at its peak.

A Google update ultimately sealed the company’s fate, and I started this newsletter to keep myself busy in the aftermath.

I then launched an another fintech affiliate site called MooseMoney, but I still find the time to publish this newsletter weekly.

Why share this?

Because my goal is to use my experience as an economic journalist, fintech entrepreneur and product manager to present the most essential fintech news from around the world through the eyes of an insider.

If you like what I do, feel free to share this newsletter and follow me on LinkedIn, X, Reddit, YouTube & TikTok.

If you would like me to accompany you on your fintech entrepreneurship journey and provide you with ongoing feedback, feel free to hire me as coach on MentorCruise.

If all you need is to pick my brain on specific topic in the field of fintech marketing, product or strategy, feel free to book a one hour consulting call with me instead.

P.S : Once you refer a new subscriber to the newsletter using your unique share link, you'll receive a personalized social media shout-out from me to promote your work or professional profile. Just write to me at jrbrault@icloud.com once your referral is confirmed on our leaderboard and include your social media account(s) URL(s) and who you are.