Toss Wants To Expand Its Pay by Face Technology to 1M Stores By 2026 🇰🇷

We're also covering PayPal's Chrome-killer browser deal 🇺🇸, Klarna's $14B IPO drop 🇸🇪, JPMorgan invading Germany 🇩🇪, an AI negotiator saving $1K per car 🇺🇸 & Mexico's new fintech unicorn 🇲🇽

🇰🇷 Toss Wants To Expand Its Pay by Face Technology to 1M Stores By 2026

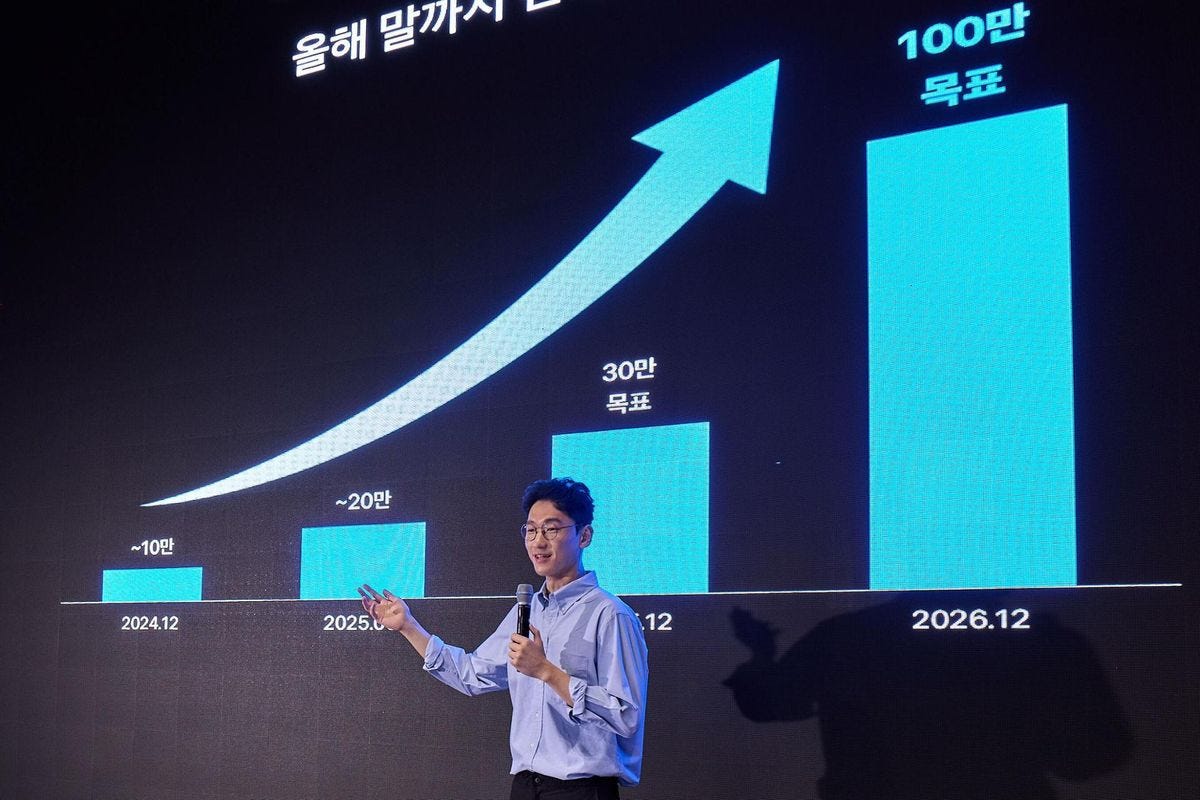

South Korea’s all-in-one finance app Toss plans to expand its Face Pay service to more than 1 million stores and 1 million active users by 2026. Face Pay lets users complete transactions by simply looking at a terminal after registering their face and payment method in the Toss app.

According to Oh Kyu-in (pictured below), Toss’ Head of Payments, the technology has strong potential in Korea, where facial recognition is already common in daily life, such as office and apartment access. Toss says it places equal emphasis on security, using fraud monitoring, encrypted systems, and compensation for unauthorised transactions.

Piloted in March, the service quickly spread to 20,000 stores in Seoul within two months and has since attracted 400,000 users with a 60% monthly reuse rate. Toss expects to reach 300,000 stores by the end of 2025, tripling that figure the following year.

The push mirrors other biometric payment systems worldwide, from Alipay’s “Smile to Pay” across Asia to Amazon’s pay-by-palm in the U.S. and Apple Face ID for app purchases. Mastercard is also piloting face-based checkout with PopID and NEC in Brazil and the Asia-Pacific.

Sources: The Korea Times and CNBC

🇺🇸 PayPal And Venmo Users Get First Dibs On Perplexity’s Chrome Rival, Comet AI Browser

PayPal and Venmo users are gaining early access to Perplexity’s Comet, the AI-powered browser pitched as an alternative to Chrome. Users can access via a 12-month free trial of Perplexity Pro (normally $200 a year). The rollout plugs Comet directly into PayPal’s subscriptions hub, giving the Nvidia-backed startup exposure to 430 million PayPal accounts worldwide.

Perplexity CEO Aravind Srinivas (pictured above) said the partnership is just the beginning of what he calls “agentic commerce” on LinkedIn. On X, he wrote that Comet is now open to students as well, touting features like its AI assistant, flash cards, ad block, and study mode.

Alex Chriss, President and CEO of PayPal, also posted on LinkedIn that select customers would be able to “skip the waitlist” and activate the Comet trial a week before the public launch. He said the offer is among the first in PayPal’s new Subscriptions Hub, which lets customers manage recurring payments and unlock special deals.

Launched in July, Comet integrates Perplexity’s AI into web navigation, allowing users to summarise webpages, query personal data like emails and calendars, manage schedules, and even prepare for exams. Perplexity first partnered with PayPal in May this year to enable direct purchases inside its chat interface.

Source: Global Fintech Insider

🇸🇪 Klarna Reportedly Looking to Raise $1.27B Through Its Long Delayed US IPO

Klarna Group and its shareholders are seeking to raise up to $1.27 billion as the Swedish fintech revives a long-delayed New York IPO. The company and its backers plan to sell 34.3 million shares at $35–$37 each, valuing Klarna at about $14 billion at the top of the range, a steep drop from its $45 billion peak valuation in 2021. Klarna itself will sell 5.6 million shares, while holders, including executives, Heartland A/S, and Sequoia Capital will sell 28.8 million.

Founded in Stockholm and led by CEO Sebastian Siemiatkowski (pictured above), Klarna built its name on buy now, pay later (BNPL) but is now repositioning itself as a global digital bank. The firm boasts around 111 million active consumers and more than 790,000 merchants across 26 countries, while also expanding into debit cards and even mobile network services. For the six months to June 30, 2025, Klarna reported $1.52 billion in revenue and a $153 million net loss, widening from a $38 million loss on $1.33 billion revenue a year earlier. Klarna shares are set to trade on the NYSE under the ticker KLAR.

Sources: Bloomberg & TechCrunch

🇩🇪 JPMorgan Will Launch Chase In Germany To Compete With Deutsche Bank And N26

US banking giant JPMorgan will launch its digital bank Chase in Germany in the second quarter of 2026. This marks its biggest retail expansion in Europe since debuting in the UK in 2021. The rollout will begin with a savings account, chosen for Germany’s strong demand for deposit products, said Daniel Llano Manibardo (pictured above), JPMorgan’s head of German retail banking to the Financial Times.

The bank has already hired 100 staff in Berlin, where it plans to open a new headquarters by the end of 2025. Chase enters one of Europe’s most competitive markets, long dominated by Deutsche Bank and Commerzbank but now facing stiff competition from fintechs. Neobanks N26, with about 7 million global users and Trade Republic, serving 4 million mostly German customers, are both headquartered in Berlin. Spain’s BBVA also launched a digital service in Germany this year.

In the UK, Chase has already attracted more than 2 million customers since 2021 and is on track to turn profitable this year. CEO Jamie Dimon sees Germany as the next step toward building a pan-European digital bank, leveraging JPMorgan’s $4 trillion US asset base.

Sources: Financial Times & PYMNTS

🇺🇸 CarEdge Launches AI Negotiators To Battle Dealers, Cutting Car Costs By $1,000

AI agents are giving car buyers leverage against dealerships, saving them an average of $1,000 per purchase, according to US based car buying platform CarEdge CEO Zach Shefska (left). The company’s new service lets AI negotiators bargain directly with dealerships on behalf of customers.

About 2,000 buyers have already used the tool since launch, Shefska said in an interview with NYSE. “Quite frankly, buying a car, customers do it every three to five years if you’re being kind of optimistic. But salespeople, sales managers, dealerships, they do it every single day. So I don’t think there’s another comparable transaction, maybe real estate, where the consumer is really that disadvantaged relative to who they’re going up to battle with. And it is a battle.” he said in the interview posted on his Linkedin.

CarEdge’s 2025 AI and Car Buying Survey shows 25% of consumers already use or plan to use AI in the car-buying process, a figure expected to hit 40%. Most rely on ChatGPT or Perplexity for research, with 88% using AI to compare makes and models, while a smaller but growing share turn to it for financing and negotiation. Still, Shefska cautioned against overreliance on AI : “Hallucinations are still a real thing. So even if your friendly buddy tells you you should get a $30,000 deal on that $70,000 Jeep Grand Cherokee, you know, double check, do your homework, talk to some friends and some peers.” Founded in 2019 by Shefska and his dad Ray (right), CarEdge provides US car buyers with pricing insights, financing tools, extended warranty services, and now AI-powered negotiation.

Source: Global Fintech Insider

🇺🇸 Walmart-Backed OnePay Rolls Out Mobile Plans, Rivalling Nubank And Klarna In “Super App” Push

Walmart-backed all-in-one finance app OnePay is rolling out its own branded mobile plan as part of a growing wave of fintech firms offering mobile phone plans. Similar to moves by Klarna and Nubank, OnePay Wireless will be embedded directly into its app, offering users unlimited 5G data, talk, and text for $35 a month on AT&T’s network. Powered by mobile virtual network operator Gigs, the plan requires no credit checks or activation fees and can be activated in a few clicks.

The app also wishes to positioned itself to the “American super app”, mirroring platforms like WeChat and Alipay in Asia. OnePays confirmed the launch, but declined to comment further to NBC. Gigs CEO Hermann Frank told CNBC that the embedded model helps cut AT&T’s customer acquisition costs, passing savings on to users. Created in 2021 by Walmart and venture firm Ribbit Capital, OnePay, headed by CEO Omer Ismail (pictured above) already offers credit and debit cards, high-yield savings accounts, buy now, pay later loans, and a peer-to-peer wallet.

Source: CNBC

🇲🇽 Mexico’s Kapital Hits $1.3B Valuation, Joins Unicorn Ranks as a Profitable Neobank

Mexico City–based neobank Kapital has become the country’s newest fintech unicorn, raising $100 million at a $1.3 billion valuation. The company has also already reported profitability, a rarity in the sector. The fresh funds will be used to expand its AI capabilities. The new funding puts Kapital in the same unicorn ranks as other Mexican fintech standouts such as Bitso (crypto exchange), Clip (payments), Konfio (SME credit), Clara (expense management), and Stori (digital credit). Regionally, it joins heavyweights like Brazil’s Nubank and Argentina’s Ualá. “Kapital is already profitable, and our growth continues to accelerate through the unique combination of a banking license and proprietary software,” said Kapital co-founder and CEO Rene Saul (left) in a statement to Bloomberg.

Founded in 2020 by Saul, CFO Fernando Sandoval (right) and Managing Director Eder Echeverria (center), Kapital products span loans, credit cards, payroll, and employee benefits. The firm now serves 300,000 customers across Mexico, Colombia, and the US and manages a $3 billion balance sheet.

Sources: Global Fintech Insider & Bloomberg

Upcoming Fintech Events

🇿🇦 Seamless Africa will be held in Johannesburg on September 8–9, 2025 ($750), with speakers such as Ricki Allardice, CEO, Orange, Francis Dufay, Group CEO, Jumia Group, and Wole Ayodele, CEO, Fincra.

🚨 GFI Exclusive Offer: Enjoy a 30% discount on Seamless Africa premium networking pass with the GFI30 promo code!

🇮🇱 Money Tel Aviv will be held in Tel Aviv on September 11, 2025 (₪300–₪600), with speakers include Zack Levine, Head of North America, Checkout.com, Eyal Shimoni, CEO, Hyp, & Ido Shamash, Head of Commercial Partnerships, Wix.

🚨 GFI Exclusive Offer: Save ₪100 (US$26) using the GFI promo code!

🇨🇦 Fintech Sandbox Innovation Forum will be held in Boston on September 16–17, 2025 ($495), with speakers such as David Jegen Managing Partner, F-Prime & Co-Founder, Fintech Sandbox, Karan Kashyap, CEO & Co-Founde at Posh, and Mike Massaro, CEO at Flywire.

🚨 GFI Exclusive Offer: Enjoy a 20% discount on tickets using the BFTW25-NEW-FRONTIER promo code!

🇨🇦 The Customer Experience for Financial Services Summit will be held in Toronto on September 18–19, 2025 ($995), with speakers such as Amit Mondal, VP & Head of Digital Analytics & Experimentation at Amex & Angela Crapsi, AVP of Operations at Flexiti/Questrade.

🇨🇦 Canada Fintech Forum will be held in Montreal on September 22–23, 2025 (CA$460–CA$1,199), with speakers such as Shelby Austin, Co-Founder and CEO at Arteria AI, Hamed H. Arbabi, Founder and CEO at VoPay, and Daniel Eberhard, Founder and CEO at KOHO.

🚨 GFI Exclusive Offer: Enjoy a 15% discount on tickets using the GFI15 promo code!

🇬🇧 Buy AND Build: The Future of Capital Markets Technology will be held in London on October 2, 2025 (£360), with speakers such as David Marcos, CIO & Head of AI, IO Capital Group, Richard Bell, Head of Engineering at CoinShares, and Jon Butler, Co-Founder & CEO at Velox.

🚨 GFI Exclusive Offer: Enjoy a 15% discount on tickets using the GFI15 promo code!

🇩🇪 Sibos will take place in Frankfurt from Sept. 29 to October 2 ($1,180.90 for fintechs), with speakers such as Victoria Cleland, Director of Payments at the Bank of England & Sophie Gilder, Managing Director, Blockchain & Digital Assets at Commonwealth Bank.

Who Am I?

Hi, my name is Julien Brault.

From 2017 to 2024, I was the CEO of Hardbacon, a fintech I co-founded, which reached 400,000 unique visitors at its peak.

A Google update ultimately sealed the company’s fate, and I started this newsletter to keep myself busy in the aftermath.

Why share this?

Because my goal is to use my experience as an economic journalist, fintech entrepreneur and product manager to present the most essential fintech news from around the world through the eyes of an insider.

If you like what I do, feel free to share this newsletter and follow me on Linkedin, X, Reddit, YouTube & TikTok.

If you are raising for your fintech and would like to be featured in Global Fintech Insider for free, fill this form.

P.-S. : Once you refer a new subscriber to the newsletter using your unique share link, you'll receive a personalized social media shout-out from me to promote your work or professional profile. Just write to me at jrbrault@icloud.com once your referral is confirmed on our leaderboard and include your social media account(s) URL(s) and who you are.